After a quiet decade for deals, mergers and acquisitions (M&A) activity in the resources sector has boomed in 2023.

Livent’s proposed merger with Allkem (lithium), Newmont’s takeover bid for Newcrest Mining (gold), and BHP’s takeover of OZ Minerals (copper, completed in April 2023) are just three prominent examples. Resources companies are increasingly looking externally for growth and synergies.

To put it into perspective, the value of M&A involving ASX-listed commodities companies in the first five months of 2023 has already eclipsed US$23 billion. The average value of M&A over the ten years previous was less than US$5 billion per year.

We expect the deals to keep coming. Australian small resources companies with attractive assets in key sectors will entice takeover interest at premium valuations. This will present fantastic opportunities for Australian small companies investors.

In this piece, we discuss:

- Why the current environment is set up for heightened M&A activity in 2023 and beyond;

- Why Australian small cap miners are highly attractive targets relative to global peers;

- Where the opportunities lay for Australian small cap investors.

The curtains have opened for resources M&A

In the decade prior to 2023, resources companies turned their focus inward. Rather than M&A, the key objectives were free cashflow generation from existing assets and managing through COVID.

But a range of factors have now led to a rush to snap up attractive assets. For many commodities, the medium-term outlook has improved because of limited supply growth and increased demand.

Energy transition will create significant demand. The energy transition is creating a huge demand uplift for minerals such as lithium, copper and nickel. These minerals are crucial components for electric vehicles, wind turbines, electricity grids and other decarbonisation use cases. The world is expected to need ~3.9x current lithium production and ~1.3x current copper production by 20301. The transition is also boosting the medium-term demand outlook for resources such as natural gas as a replacement for coal power generation.

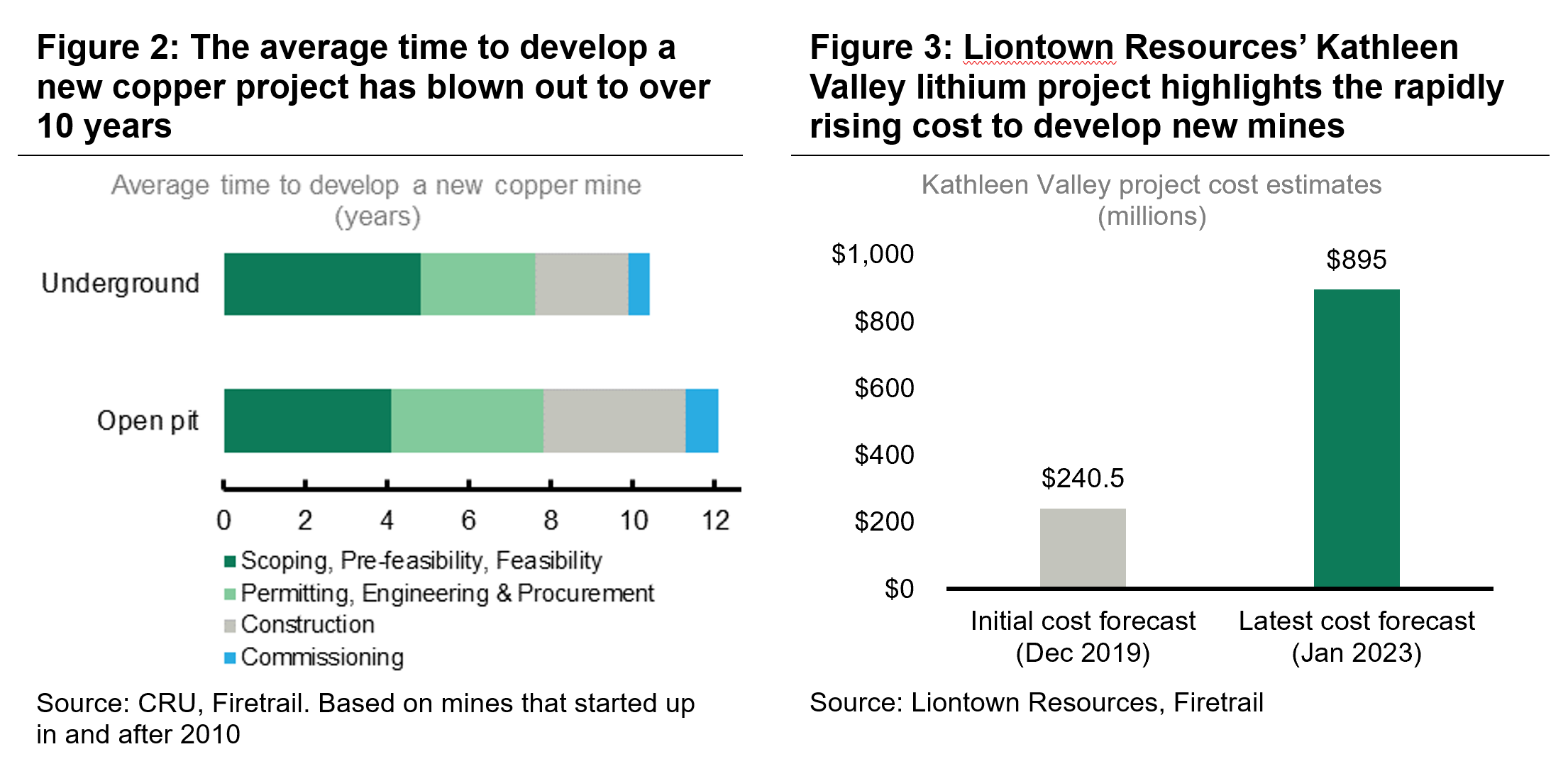

Cheaper (and faster) to buy than build. At the same time, the time and cost to build new resources projects has increased significantly in the last two years, in many cases by as much as 50%. Companies without operational cashflows are facing a higher cost of capital. Rising interest rates have driven debt costs sharply higher and investors are reluctant to support large scale projects.

Soaring energy, labour and raw material costs have compounded the issue. Most management teams we speak to agree it is cheaper to buy than build at the moment, particularly considering lengthening permitting timelines.

Acquisitions are the logical path. With a strong demand outlook and limited new supply coming online, companies are looking to acquisitions to drive growth. Rising costs are also driving miners to seek synergies through consolidation with nearby projects. For example, Genesis Minerals is looking to consolidate the highly gold-rich Leonora Province of Western Australia by merging with St Barbara.

Australian mines are at the top of acquirers’ wish lists

Australia has long been blessed with an abundance of the natural resources that the world wants. In the past, iron ore, coal and natural gas exports have been the pillars of Australian economic growth. Now the world is turning to a new set of minerals in the race to decarbonise and electrify. Australia’s vibrant mining sector is well-placed to benefit with large deposits of lithium, nickel, rare earths, copper and uranium.

Western supply has a geopolitical premium. The Russia-Ukraine war and heightened US-China tensions have reinforced the fact that the presence of minerals is not enough. Security of supply is just as important. Governments need to ensure their suppliers of critical minerals won’t turn off the taps in the event of conflict.

Resources concentrated in risky places. Unstable jurisdictions also create risks for mining companies and investors. A large proportion of the world’s decarbonisation resources fall in developing countries such as Africa and Latin America. Just in late May 2023, the Namibian government threatened the nationalisation of its uranium mines. Shares in the miners who operate those mines fell by up to 20% on the day. Additionally, operators in Argentina have had issues taking money out of the country due to the country’s capital controls.

In contrast, Australia is a developed country with a stable government, a strong rule of law, and no capital controls. This makes Australia’s vibrant resources sector highly attractive to global mining companies and investors looking for future-facing projects to invest in.

Exciting times for Australian small cap investors

Australian small cap investors are in the box seat to watch this M&A action unfold, and to cash in on the often material premiums offered by acquirers. While we won’t invest in a company solely on M&A potential, it can provide attractive upside risk to the thesis.

Too many companies, not enough capital. There are far too many sub-scale resources companies listed on the ASX. Many have corporate costs and capital hurdles disproportionate to the size of their business and are reliant on regular shareholder funding to remain going concerns. The most compelling opportunities exist when value uplift can be realised from 1) corporate cost duplication 2) industrial logic, and 3) funding synergies, i.e. funding capex projects from free cashflow rather than dilutive equity.

Where should investors look? The shopping list is extensive.

The Cobar Basin in central New South Wales is a particularly compelling region for consolidation. Cobar Basin is rich in gold, copper, silver, zinc and other metals. It is home to several operators such as Peel Mining, Aurelia Metals, Manuka Resources, and US-based Metals Acquisition Corp.

Even before considering the substantial operating and capital cost synergies available, we estimate consolidation would result in a valuation uplift of ~15% of the combined entities simply by rationalising corporate administration and technical functions.

But it is important to be selective. Not every resource company is an attractive target, and not every management team has the incentive to extract maximum value for shareholders.

The cash flow gap. Companies who are not generating current free cash flow have struggled to garner investor attention. However, acquirers have a longer-term focus than listed investors. They focus on what’s in the ground, rather than this year’s cash flow. Opportunities await investors who can identify Australian small cap miners who have compelling assets in the ground but are fundamentally mispriced.

Self-interest will win at the end of the day. Finally, management incentives are also an important determinant of whether investors will get the most out of M&A deals. In the twists and turns of M&A, investors are reliant on management teams and boards to act strategically and in the best interest of shareholders. Management teams with skin in the game and a well-defined strategy are in the best position to extract maximum value from the bidder to the benefit of shareholders.

Conclusion

Resources M&A activity is back in 2023, driven by improved demand outlooks across commodities and underinvestment in new supply. With an abundance of key minerals in the ground in a tier one jurisdiction, Australia’s vibrant small cap resources sector has been and will continue to be a major beneficiary.

Firetrail Australian Small Companies Fund is finding fantastic in opportunities in resources companies with strong fundamentals and significant upside potential as a result of M&A.

1Barrenjoey estimates