By Matthew Fist

Portfolio Manager

After two years of underperformance, consensus is starting to shift in favour of small companies.

The ASX Small Ordinaries Index underperformed the ASX 100 by over 20% over the last two years, which is typical in a period of rising interest rates and slowing economic growth. However, with worst fears of further interest rate hikes and economic meltdown now alleviating, investors are turning their attention back to small caps. The ASX Small Ords rose 14.8% in the last two months of 2023, compared with the ASX 100 return of 12.4%.

Looking forward, we believe 2024 could be a breakout year for Aussie small caps. Small caps deliver their best absolute and relative returns (versus large caps) coming out of slowdowns in economic growth. We don’t claim to have a crystal ball, but consensus economic forecasts predict the current economic slowdown will bottom and start to recover from Q2 2024.

The valuation and earnings backdrop strengthens our conviction that the outlook for small caps is strong. We explain why below.

Buying a Porsche for the price of a Kia

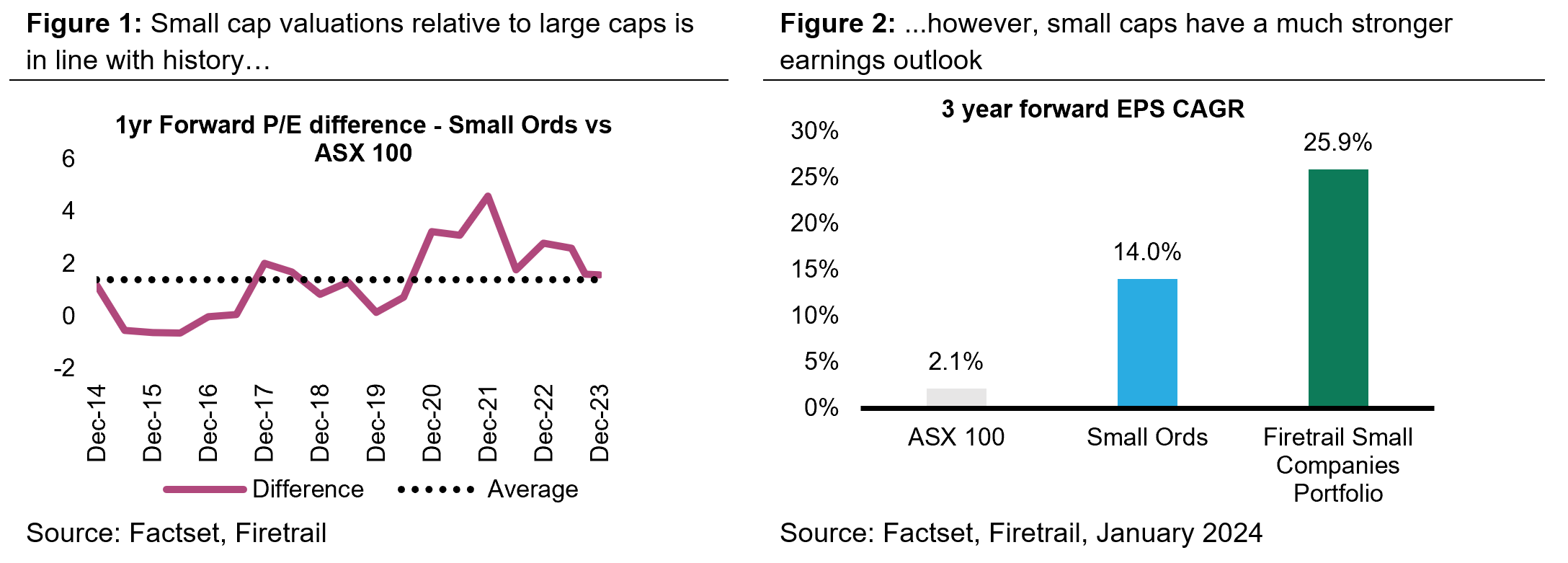

We see compelling value on offer in the small caps market today. The ASX Small Ordinaries Index is trading on a similar P/E ratio to the ASX 100, but is expected to grow earnings six times faster over the next 3 years!

There is significant opportunity for active managers to construct a portfolio even more compelling given the inefficiencies in the small cap market. The Firetrail Small Companies portfolio exhibits nearly double the earnings growth estimates than the ASX Small Ordinaries despite trading on a lower P/E multiple.

To illustrate with a stock example, today you can buy a high growth, defensive, founder-led business like Kelsian on 18x FY2024 earnings estimates, or you can buy Woolworths on 25x. Call us biased, but we know where we are putting our investment dollars!

Looking under hood…

Looking under hood…

The key question investors should be asking is: what is driving the superior small caps earnings outlook? Is it real? If so, what are the stocks and sectors I need to invest in to participate in this growth and potential return?

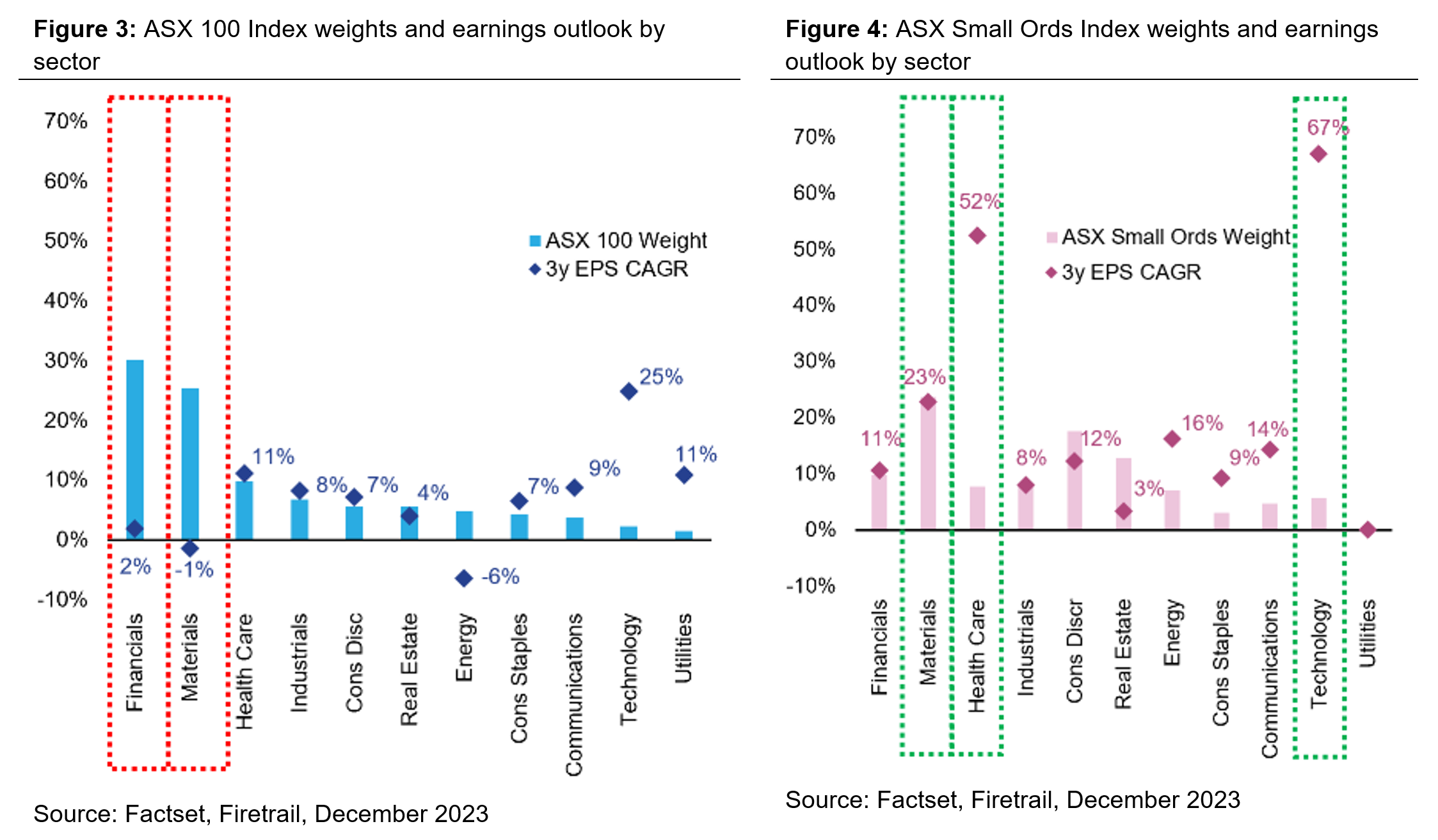

To answer these questions, we need to look under the hood of the small and large cap indices. As shown in Figure 3, the ASX 100 is dominated by the big banks and iron ore miners. Financials and Materials make up 55% of the index. These sectors are expected to grow earnings at less than 1% p.a. over the next three years, a huge drag on total index earnings growth.

On the other hand, the ASX Small Ordinaries (Figure 4) is more diverse and balanced across sectors. Each sector is contributing healthy earnings growth forecasts, with standout contributions from Materials (23%), Health Care (52%), and Technology (67%).

But are these earnings growth forecasts credible??

We are always cynical when it comes to forward earnings forecasts. In the past, bullish growth forecasts for concept stocks inflated index earnings estimates, leaving investors disappointed when the growth didn’t come through.

The Resources sector in recent years provides a case in point. The ‘EV materials bubble’ of 2022 saw spectacular growth expectations for stocks with the potential to supply critical decarbonisation materials, such as lithium, graphite and rare earths. Doing research on these companies revealed that many didn’t even have a viable resource. The bubble burst last year, with six of the Small Ords Index’ worst ten performers in 2023 being decarbonisation materials producers.

While we are skeptical of a select few companies contributing to today’s growth outlook, the difference between today and two years ago is stark. For the most part, the companies driving today’s expected earnings growth are high quality and sustainable. Tying back to the Resources example, investors are now more closely scrutinizing the underlying quality of resources assets, rather than simply buying a thematic trade. More realistic valuations provide the base for a constructive outlook in 2024.

Exposure to sectors with the strongest outlook crucial

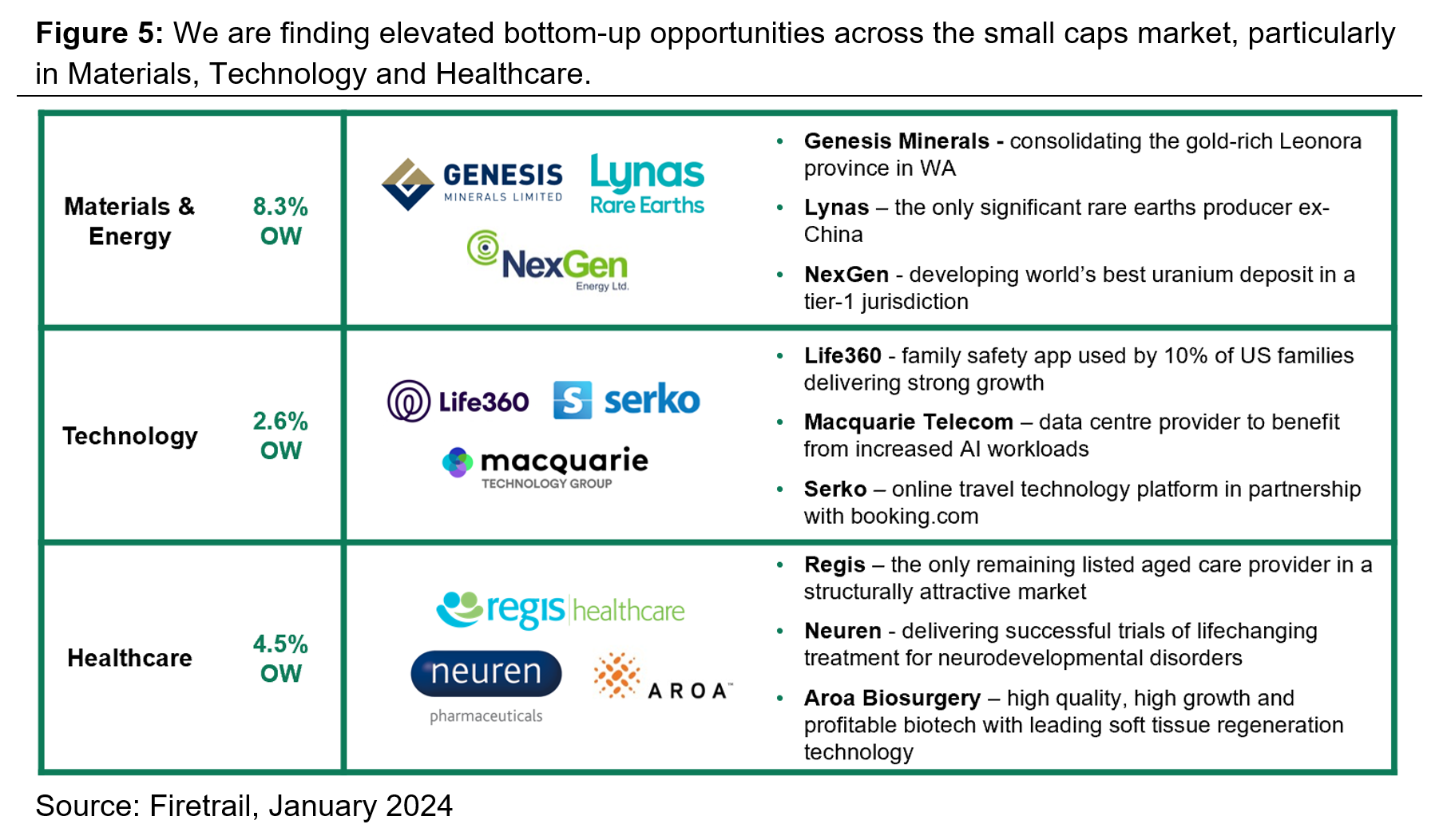

The key takeaway? If you want to participate in small caps’ superior earnings growth outlook, you need to have exposure to the Materials (i.e. Resources), Health Care, and Technology sectors. The Firetrail Small Companies Fund is modestly overweight these sectors, where we are finding compelling bottom-up opportunities.

We share some of our most exciting high conviction positions in Figure 5 below:

Conclusion

Conclusion

After two years of underperformance, the outlook for small companies now looks extremely attractive. History shows that small caps outperform following periods of slowing economic growth. With the current slowdown seemingly in its final innings, and valuations attractive relative to a strong growth outlook, we believe Aussie small caps are primed for significant outperformance over the coming years.

To access the growth on offer in small caps today, investors need to have exposure to the key sectors contributing to this growth, particularly Resources, Healthcare and Technology. We are excited by the bottom-up opportunities on offer in these sectors, and the broader small cap market, today.