1. Financial times…

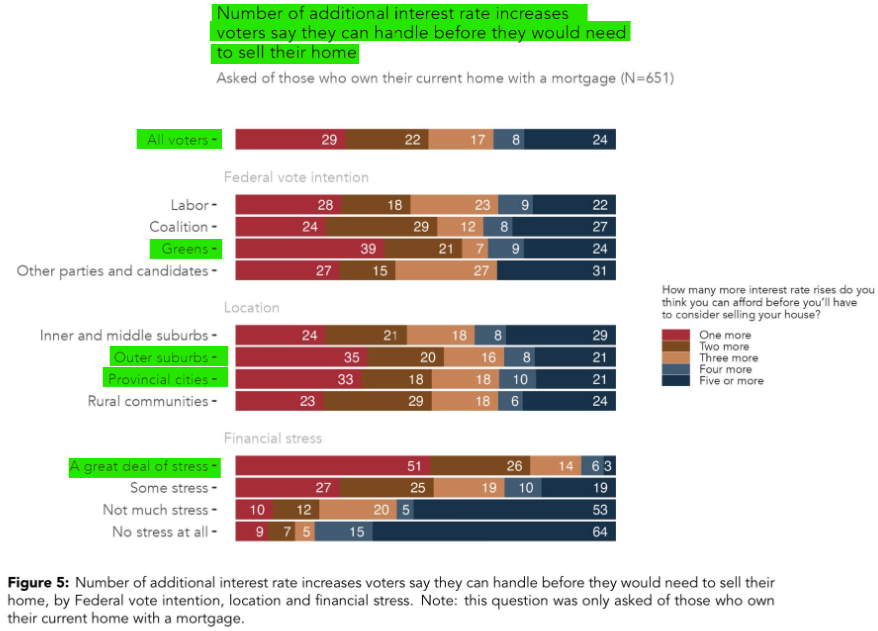

RedBridge Group conducted an interesting survey on Australian consumer finance. They asked consumers how many more interest rate increases they could handle before they would need to sell their home, with 29% of respondents saying just one more. They also grouped respondents by preferred political party, and location. Green voters seem to be feeling the most pain, and those in outer suburbs versus inner city and rural areas.

Source: RedBridge Group (June 2024)

Source: RedBridge Group (June 2024)

2. Young bull…

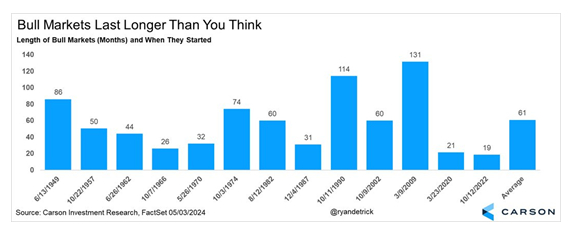

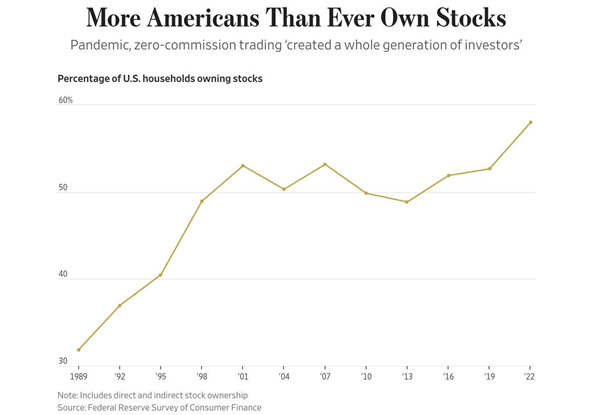

The average bull market lasts 61 months, so we may still be in the ‘calf era’ of the current bull market. The past 12 bull markets lasted more than 5 years long on average. It looks like Americans have seen this data. More Americans than ever own shares, with nearly 60% of US households owning shares. S3 Global Opportunities Fund (Managed Fund) holding Interactive Brokers has certainly attracted some of these new traders as customers.

Source: Craigs (June 2024)

Source: Craigs (June 2024)

Source: Federal Reserve Survey of Consumer Finance (June 2024)

Source: Federal Reserve Survey of Consumer Finance (June 2024)

3. Structural change…

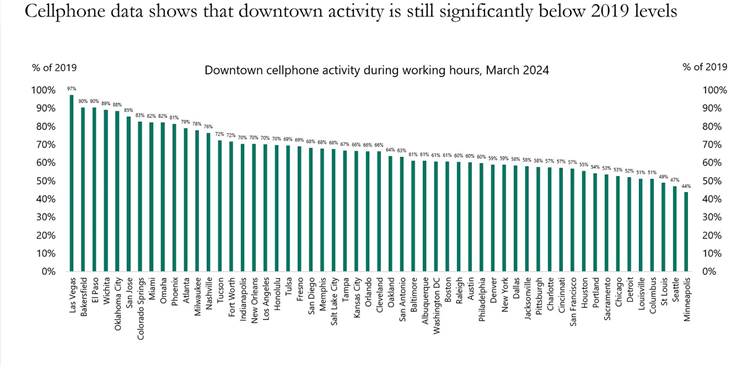

It’s been over 4 years since Covid entered our lives, so we are calling a structural shift in downtown or CBD activity in the US. Data from downtowns across the US show that mobile phone activity at more popular tourist locations like Las Vegas (97%) and Miami (82%) has gotten close to 2019 levels. But the more residential areas have struggled. San Francisco is at 57% of pre-pandemic levels and Chicago is at 52%.

Source: University of Toronto, Downtown Recovery, Apollo Chief Economist (June 2024)

Source: University of Toronto, Downtown Recovery, Apollo Chief Economist (June 2024)

Note: The recovery metrics on this website are based on a sample of location-based mobility data derived from cellphones. Metrics are computed by counting the number of unique visitors in a city’s downtown area in the specified time period, and then dividing it by the standardised number of unique visitors during the equivalent time period in 2019.