1. He’s been everywhere, man…

Blake Henricks, Firetrail deputy MD and Portfolio Manager of the Australian High Conviction Fund, has just returned from travelling the world. He’s been to the United Kingdom, Germany, France, Switzerland, and Norway getting research insights on the ground!

The key takeaways from his trip were:

- Everyone is talking about labour inflation!

- On the energy transition, we expect to see the EU respond to the recent IRA in the US with similar subsidies versus their current approach of a carbon tax.

- Blake didn’t freeze in Norway. He did get an insight into their large EV market. 85% of EV charging happens at home, and people tend to sit in their car if charging ‘on the go’ versus purchase from a convenience store.

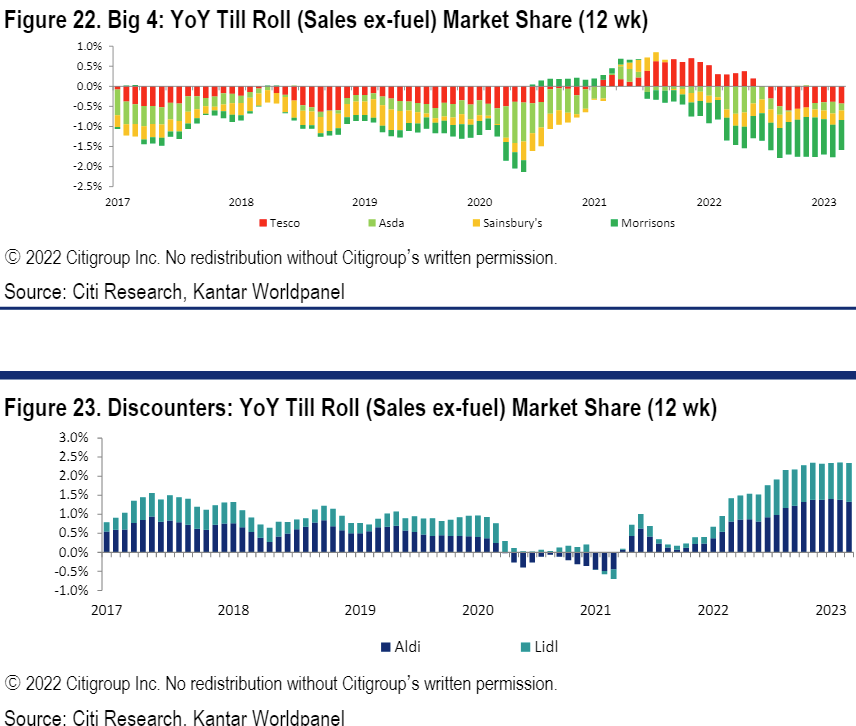

- In UK supermarkets we are seeing the discounters take material share as the industry remains a battleground.

- Blake had a site tour of Vifor (CSL) in Switzerland where he saw how they take iron ore (65% grade) and process it to make it injectable! Vifor estimate 3 billion people worldwide are iron deficient, 1.2 billion being chronic.

Blake visiting S3 Global Opportunities Fund holding Schneider Electric

Vifor (CSL) Iron Ore

UK Supermarkets remain a battleground of the ‘Big 4’ (Tesco, Asda, Sainsbury’s, Morrisons) versus discounters (Aldi, Lidl)

Source: Citi Research. Kantar Worldpanel.

2. Time for takeoff…

As we head into the Easter and school holiday period in Australia, we are keeping a close watch on travel numbers.

IATA (International air transport association) passenger data showed stronger passenger traffic levels for February, led by China’s reopening. IATA total domestic travel in February was up 25.2% YoY while international travel was up 89.7% YoY.

Relative to pre-pandemic levels, China total domestic travel is at 97.2%, while international travel is at 77.5%.

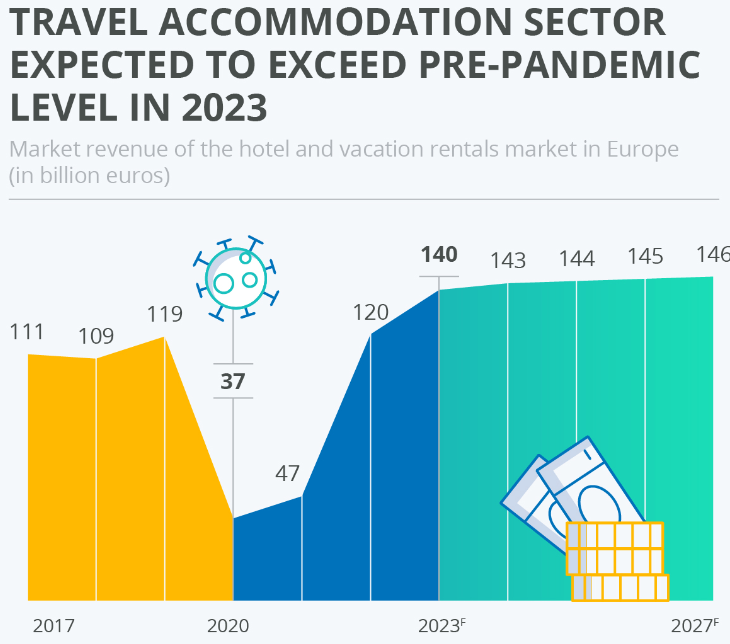

The infographic below shows the total revenue from hotel and vacation rentals in Europe from 2017 to 2022, with a forecast to 2027 showing an increase in travel versus pre-Covid levels.

Source: Morgan Stanley

3. Look out for the crash landing…

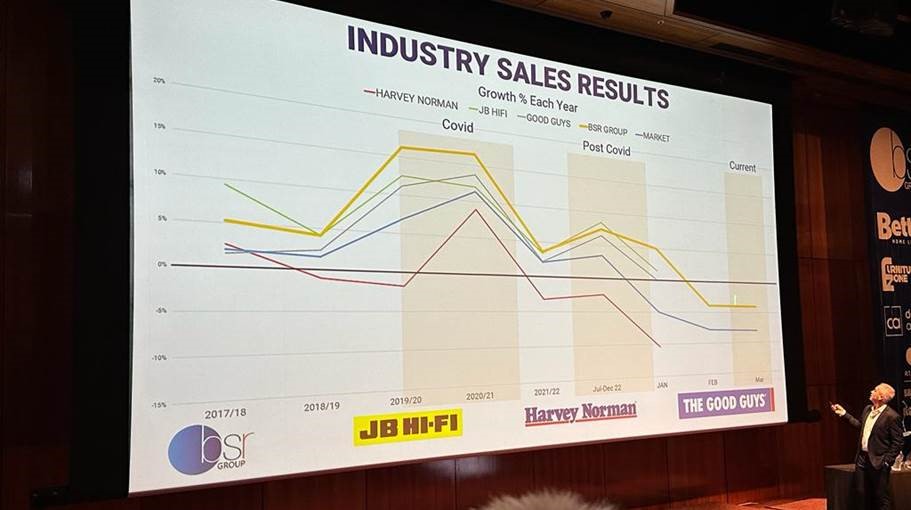

We saw this chart at a Betta Electrical conference last week. It shows sales results for some of the big retailers, including Harvey Norman, JB HiFi, and The Good Guys. And we’ve heard similar feedback from furniture retailers on our recent trips to Melbourne. Sales have softened significantly since the end of January…

Source: Betta Electrical

Companies mentioned are illustrative only and not a recommendation to buy or sell any particular security.