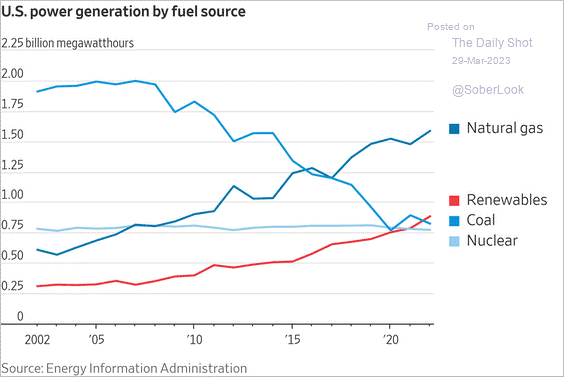

1. Rough time for renters…

If you haven’t heard, Australia is set for its biggest 2 year population surge in its history! An extra 650,000 migrants are expected this financial year and next, which is expected to increase our population by ~900,000. For reference just 300,000 migrants touched down in Aus over the last 3 pandemic years.

On the negative side it’s set to put further pressure on the national housing crisis, following record rent rises. But on the positive side it’s set to ease workforce shortages particularly in retail, healthcare and hospitality. As well as deliver a budget windfall for the government with a boost in consumer spending and taxes to help economic growth.

Get ready for some new friends!

Source: Qualitas

Source: Qualitas

2. Demand versus supply…

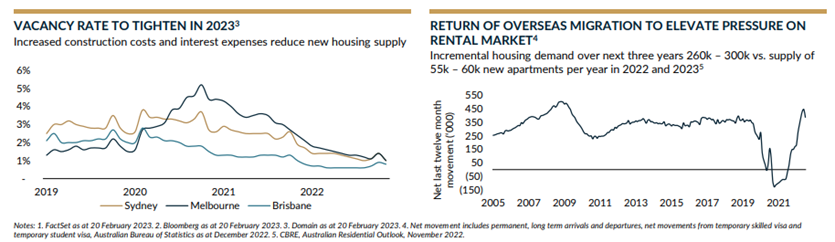

We saw interesting data from MST this week on the underinvestment in energy. The chart below includes data from Exxon, Chevron, Shell and Total, who are approximately 8% of the global oil & gas production, but a good proxy for the sector overall. Interesting to note combined they spent ~US$738bn from 2010-15 on capex and saw production decline ~7%. From 2022-27 the companies and consensus guidance are forecasting a 7% increase in production, whilst spending ~US$312bn.

This comes as we see no material decreases in demand, particularly for gas as a transition fuel source. Globally oil & gas consumption is ~10% above where the IEA said it needed to be on the net zero by 2050 path.

Source: MST

Source: MST

Source: EIA

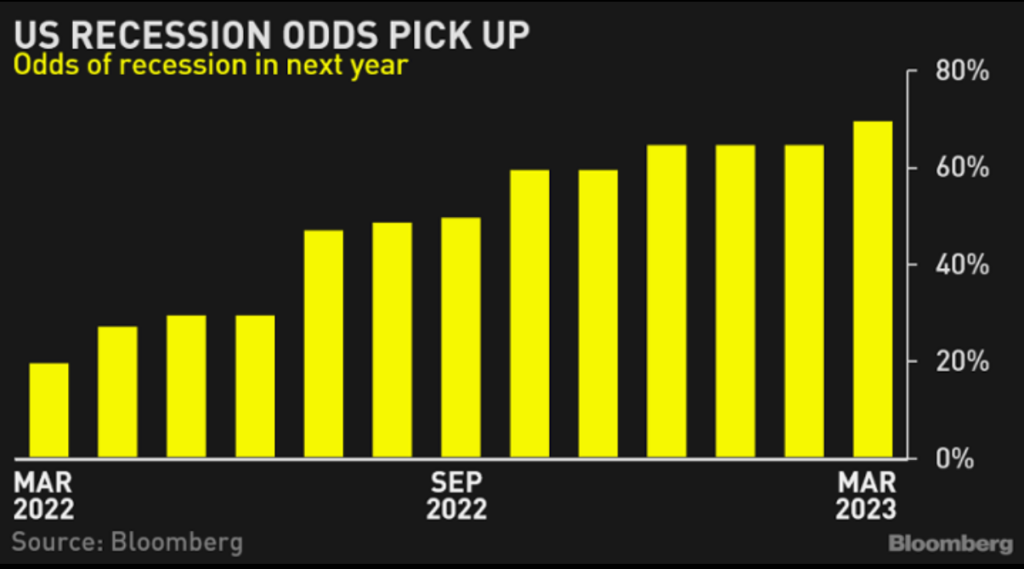

3. Place your bets…

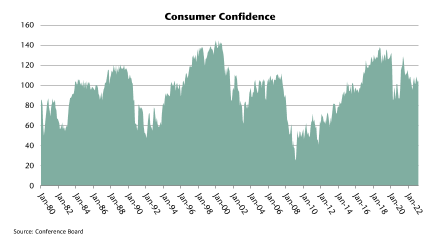

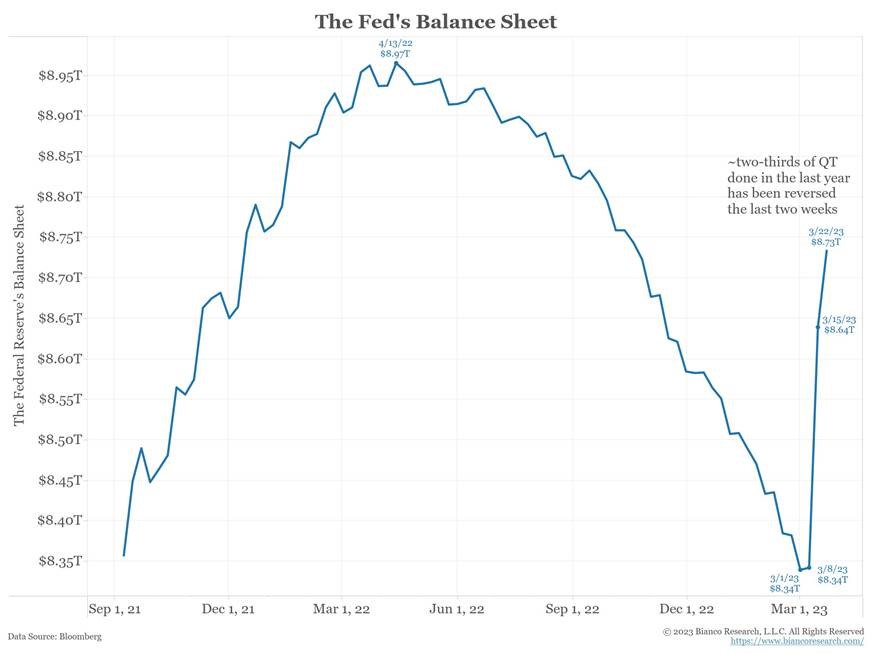

The R word is looming. US Investors continue to increase their predictions for a recession. Yet March US consumer confidence improved to 104.2 from 103.4 in February, and above the consensus for 101. Data was collected as of March 20, so we had seen some of the impact of the banking crisis take hold already. I guess we have become used to the Fed coming to the rescue. About 5 months of quantitative tightening was erased in 2 weeks…

Source: Bloomberg

Source: Conference Board

Source: Bloomberg

Companies mentioned are illustrative only and not a recommendation to buy or sell any particular security.