1. Shopping season…

We had strong spending data released in both Australia and the US this week.

In the US personal spending data rose +0.7% m/m in September while personal income rose only +0.3%, showing consumers are spending beyond their means. US consumers spent about US$60 billion worth of savings to fuel consumption last month, up from the pace in August (US$50 billion). Barclays estimate excess savings remain around $1.19 trillion, so there’s still room for more Christmas shopping!

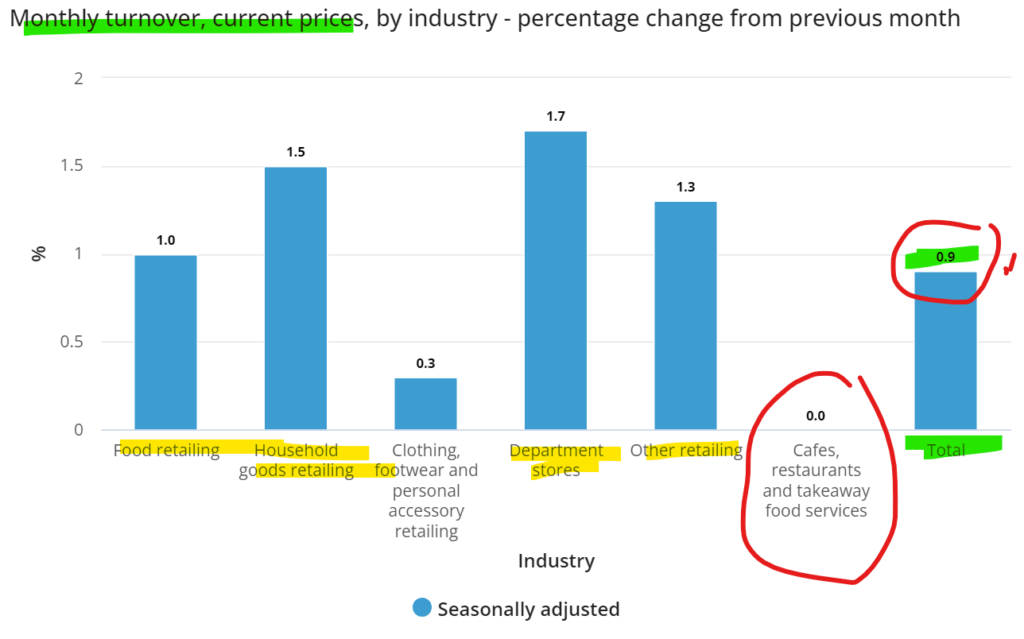

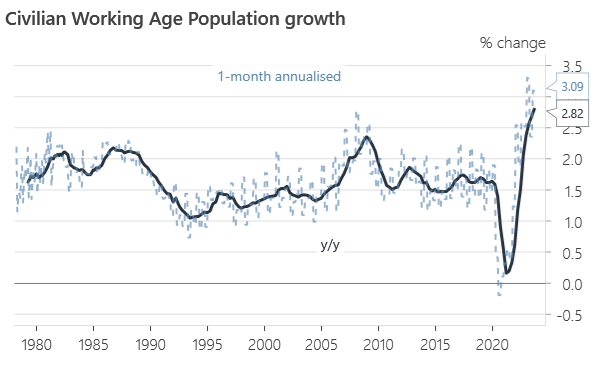

Meanwhile in Australia retail sales are booming, up +0.9% in September, the fastest pace in eight months. Analysts had expected 0.3% growth in the month. The warmer weather has been blamed for our extra retail therapy as we hit the department stores en masse. As well as our thriving working age population, with growth annualising >3%.

Source: Barrenjoey (October 2023)

Source: Barrenjoey (October 2023)

Source: Jarden (October 2023)

Source: Jarden (October 2023)

2. Wait for the ending…

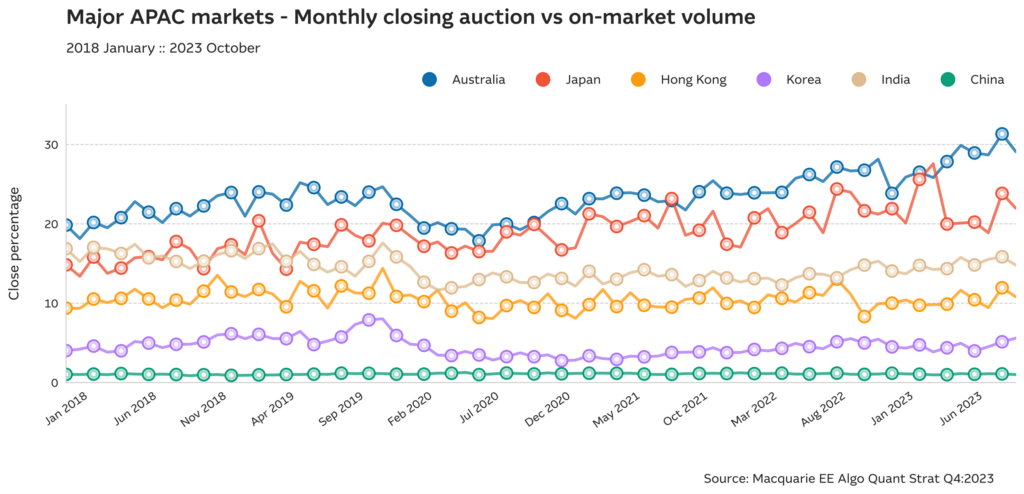

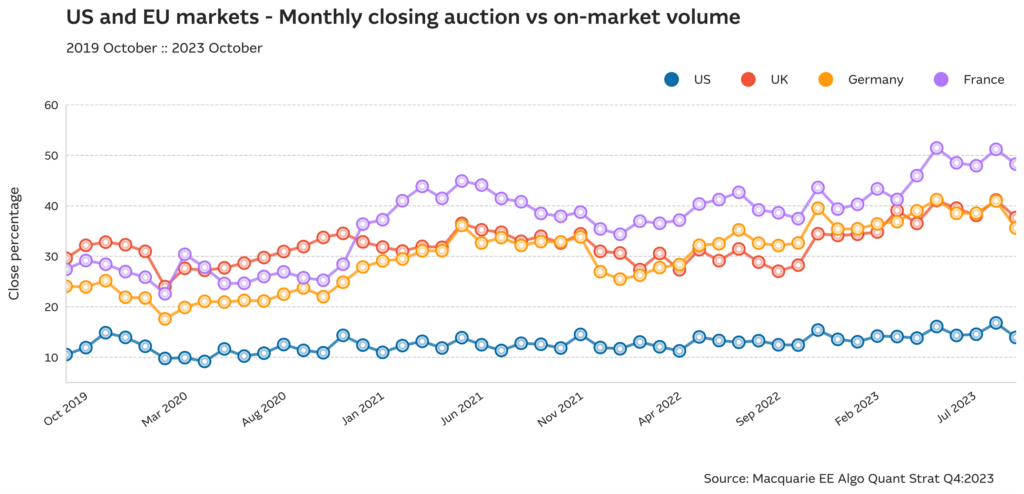

One for the dealers out there. We knew the Aussie market traded a large proportion of its volume on the closing auction. But data from Macquarie below shows how strongly it has grown – from around 20% in 2018, to around 30% now. European markets are also seeing growth in the closing auction volume. But the proportion traded on close in the US continues to hang around 10-15% of the days volume.

Source: Macquarie EE (October 2023)

Source: Macquarie EE (October 2023)

Source: Macquarie EE (October 2023)

Source: Macquarie EE (October 2023)

3. Silly season…

Since 1950, November and December have proven to be the best two-month period of the year on the S&P500, so it is set to get better from here…58 days left in 2023.

Source: S&P500 (October 2023)

Source: S&P500 (October 2023)