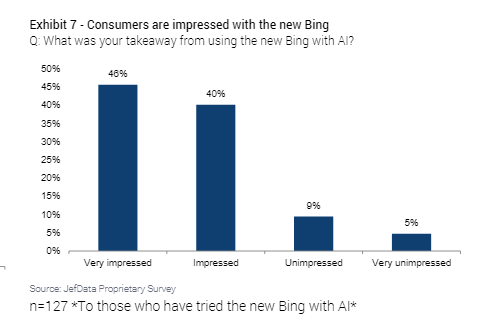

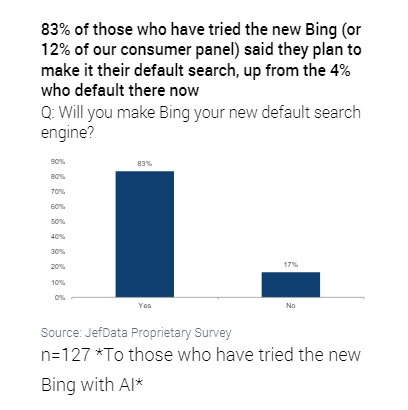

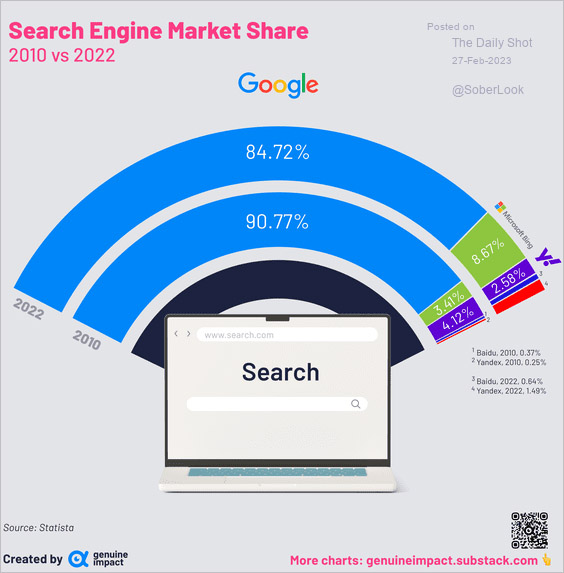

1. Bing is back…

The Firetrail team have been testing the limits of search engines and chat bots recently, like ChatGPT and the new Bing. And Bing has bounced to the top! If you are stuck for ideas on what to do this weekend, why not ask Bing? The growth of Bing bodes well for Firetrail S3 Global Opportunities holding, Microsoft.

Source: The Lottery Corporation

Source: The Lottery Corporation

Source: Stasta

Companies mentioned are illustrative only and not a recommendation to buy or sell any particular security.

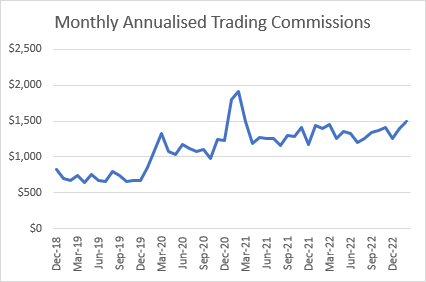

2. The retail army…

S3 Global Opportunities Fund holding, Interactive Brokers, came out with solid monthly stats this week, showing the retail army remain strong. They saw account openings up 20.4% in February, maintaining momentum from January, and a long way above guidance. Trades per account also bounced +5% in February, which is typically a MoM decline month. As such, trading revenues continued their march higher reaching a new high in the post meme-stock period.

Source: Interactive Brokers

Source: Interactive Brokers

Source: Vanda Research

Companies mentioned are illustrative only and not a recommendation to buy or sell any particular security.

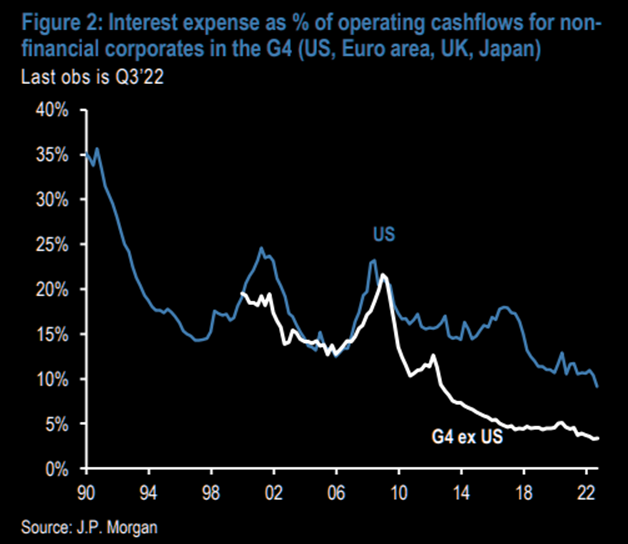

3. The cost of borrowing…

A key theme that emerged out of reporting season was an increased focus on borrowing costs. With interest rates up 3% over the last year in Australia, and nearly 5% in the US, they are set to become a more important line item for analysts.

And it’s been a big deal in property over the last couple of weeks, particularly in the office space. More than 17% of the entire US office supply is currently vacant and an additional 4.3% is available for sublease. Nearly $92 billion in debt for those properties from nonbank lenders comes due this year, and $58 billion will mature in 2024, according to the Mortgage Bankers Association.

Source: JP Morgan

Source: JP Morgan

Source: Mortgage Bankers Association