1. Don’t fall…

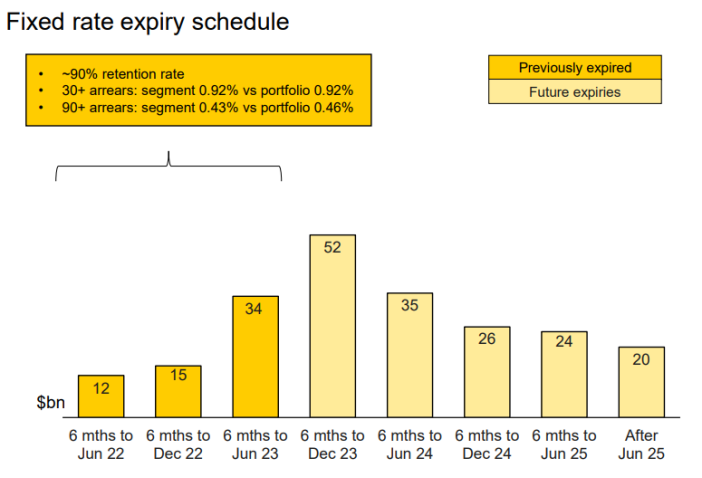

We are right in the middle of the steepest fixed rate expiry cliff, according to CBA. Around $52 billion worth of fixed rate mortgages are set to expire in the 6 months to December 2023.

Did you know, over 60% of Australia’s A$2.2 trillion of mortgage debt is linked to variable rates, and around 30% or A$600 billion, was borrowed in the two-year period when interest rates were ultra-low. The RBA estimates that of the fixed-rate home loans taken out during the low-rate Covid period, around A$450 billion are still pending to refinance with only 35% having already matured.

Source: CBA (September 2023)

Source: CBA (September 2023)

2. Pizza party…

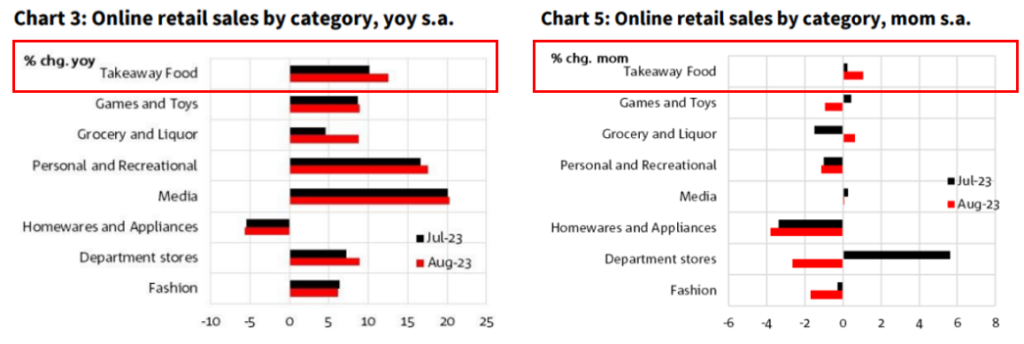

The NAB online retail sales report out this week showed particular strength in takeaway food. This adds to the positive sentiment for High Conviction Fund holdings Domino’s Pizza, who benefits from consumers trading down in tougher economic environments, and historically makes up a large part of the online takeaway spend.

Source: NAB (September 2023)

Source: NAB (September 2023)

Companies mentioned are illustrative only and not a recommendation to buy or sell any particular security.

3. The debt wave is crashing…

Just as US consumers start thinking about holiday shopping, they have their first student loan bills due in over 3 years. As a reminder we noted last month that from September 1 loans started accruing interest again. And come October 1, the first repayments since pre-Covid on the USD $1.77 trillion in federal and private student debts are due. And it looks like the 62+ age group will be hit the hardest, with their average balances at nearly $50,000.

And if you were wondering how US debt is tracking with the higher interest rates – over the last 3 months alone, the US has added $500 billion per month to the national debt, on average. Over the last 5 years, US debt is up 54%. Meanwhile, year to date interest expense just passed $800 billion!

Source: Forbes, UBS (September 2023)

Source: Forbes, UBS (September 2023)

Source: Evans (September 2023)

Source: Evans (September 2023)