1. US companies are reshoring their manufacturing…

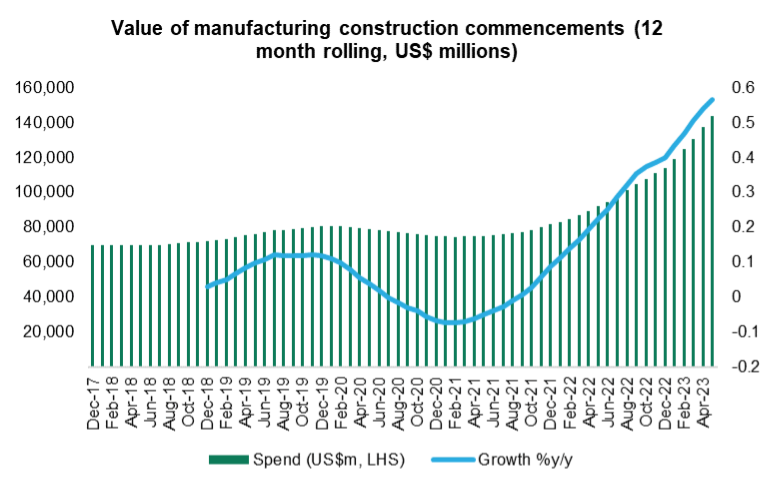

The total value of manufacturing construction spend continues to accelerate in the US. The annual value of spend is now 57% above levels just a year ago. Booming spend is being driven by a wave of new reshoring projects. These includes investment in semiconductor, electric vehicle battery, and renewables supply chain manufacturing projects.

Structural forces, led by the Biden Administration’s Inflation Reduction Act, are driving the heightened level of investment in local manufacturing capabilities.

Source: US Census Bureau, Firetrail, June 2023

Source: US Census Bureau, Firetrail, June 2023

2. Broader US non-resi construction outlook is holding up well…

Companies we’re speaking to are also seeing a healthy outlook for other forms of US non-residential construction. This week, S3 Global Opportunities portfolio holding United Rentals pointed to strong demand from public road, highway, communications, energy, transportation and healthcare construction.

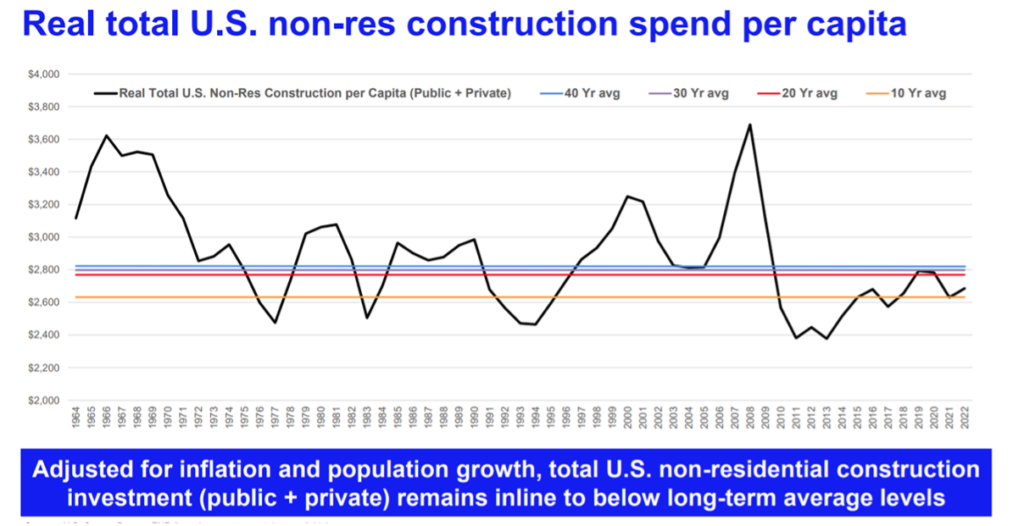

The chart below also highlights that construction activity, when adjusted for inflation and population growth, remains below long-term averages. We believe this provides support to medium-term construction activity (in select sectors) despite a slowing economy. We hold select positions in companies exposed to US non-residential construction with strong bottom-up fundamentals. Valuations are factoring in an outlook which is far too negative compared to what we believe is warranted.

Source: United Rentals, July 2023

Source: United Rentals, July 2023

Companies mentioned are illustrative only and not a recommendation to buy or sell any particular security.

3. Chinese youth unemployment surpasses 20%…

China’s youth unemployment rate continues to trend higher, surpassing 20% in 2023. The issue doesn’t seem to be a lack of work, but a lack of high-skilled, high wage jobs that graduated college students have spent years studying for.

With a population now in decline, there are plenty of jobs available in areas such as manufacturing, and services like housekeeping. However, graduates are preferring to tap out of the job market entirely, or ‘lying flat’ as they are calling it on social media, rather than take a job below their expectations.

Source: OECD, WIND, Macquarie Macro Strategy, July 2023

Source: OECD, WIND, Macquarie Macro Strategy, July 2023