1. An apple a day…

Flu season has well and truly hit Australia, and the Firetrail team! With all the heavy breathing in the office this week, we thought it was time for an update on ResMed, one of the highest conviction positions in the Australian High Conviction Fund.

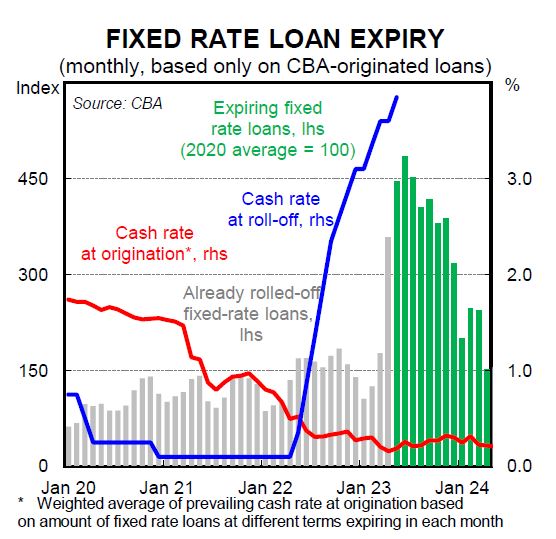

The UBS chart below shows app user numbers for ResMed and their major competitor Philips. We think this is a good indicator of the share they’re taking as Philips devices remain out of the market post their recall of 5.5 million devices in June 2021.

The latest FDA update highlighted that the number of repaired/replaced devices shipped to consumers in the US was much lower than the 2.5 million posted on the Philips website, which counted devices shipped internally at the company as well. We believe this recall could continue to impact Philips for years to come, as they also have an impending Consent Decree to deal with, with more details expected on that in the next 6 months.

Source: UBS Evidence Lab, Sensor Tower

Source: UBS Evidence Lab, Sensor Tower

Companies mentioned are illustrative only and not a recommendation to buy or sell any particular security.

2. Spotlight on the consumer…

The consumer sector was topical this week after Universal Store collapsed 24% following their disappointing trading update. The youth apparel retailer said young customers are facing serious pressure from rising rents and university fees. Meanwhile Abercrombie was up 30% after reporting their highest 1Q sales in a decade. But whilst sales in the namesake brand rose, sales at Hollister, which caters to a younger shopper, declined.

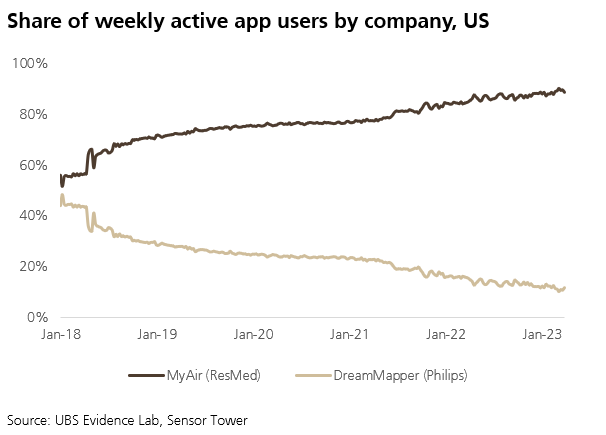

The JP Morgan investor day had some interesting data highlighting that consumer deposit balances and cash buffers are still sitting above pre pandemic levels. But retailer results remain a telling indicator.

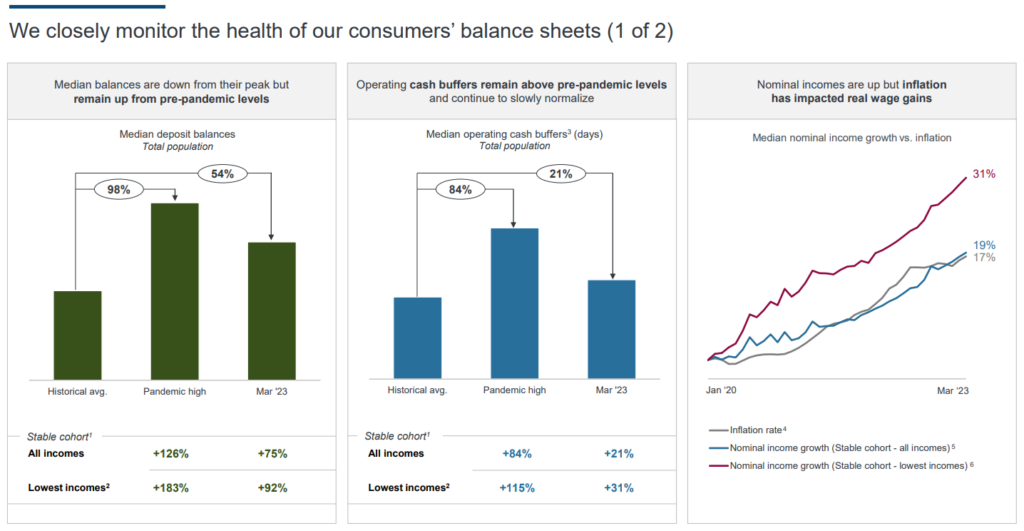

And we are keeping a close watch on the fixed rate loan expiry levels in Australia. June is set to be a critical month.

Source: JP Morgan

Source: JP Morgan

Source: CBA

3. On the road again…

The Firetrail team have been everywhere, man! This week they’ve been to the Netherlands, Indonesia, Boston, Jacksonville, Houston, Tomago and Maryborough. See a roundup of their insights, and selfies, below.

Annabel Riggs, analyst in the S3 Global Opportunities Fund, caught up with the Indonesian microfinance bank, BTPS. Spot her in the middle of the customer group below. She also saw how their fortnightly customer collection group meetings worked. Cash is pledged by the group, with repayments counted manually. They use an iPad now, but up until 2018 it was all on paper!

Annabel and the BTPS customers

James Miller, PM on the S3 Global Opportunities Fund, has continued his exploits across the US. This week he met with the head of carbon development at Weyerhaeuser (the one from that WSJ article). Weyerhaeuser have now completed the exercise of mapping all their forests, and how to best manage them – i.e. choosing between pure timber, timber + carbon, carbon, solar/wind, or real estate. When they assess a use, they value it on a 100-year timeframe.

James Miller, PM on the S3 Global Opportunities Fund, has continued his exploits across the US. This week he met with the head of carbon development at Weyerhaeuser (the one from that WSJ article). Weyerhaeuser have now completed the exercise of mapping all their forests, and how to best manage them – i.e. choosing between pure timber, timber + carbon, carbon, solar/wind, or real estate. When they assess a use, they value it on a 100-year timeframe.

He also caught up with the CEO of Rayonier and learnt about their tree school!

Jimmy visiting Weyerhaeuser

Jimmy at Rayonier’s tree school!

Jimmy at Rayonier’s tree school!

Carta Ryan, analyst in the Small Companies Fund, helped fly the (small) plane that got her to Maryborough to visit some farms owned by Rural Funds Group. Their TRG leased Macadamia development is on track covering 3,000 hectares. They also demonstrated their efficient cotton growing methods that allow them to extract above 20 bales of cotton per hectare, compared to other methods which extract 12 bales per hectare.

Alex Collen, analyst in the High Conviction Fund, headed up to Tomago to see Westrac’s facility for read throughs on the mining sector, and construction in the infrastructure space. A fun fact we learnt from Alex was that the 320-tonne haul truck you can see him ‘driving’ below has sensors which monitor your blinking. If you blink for >2 seconds, the seat vibrates, and the control tower calls you to make sure you’re not sleeping!

Alex Collen, analyst in the High Conviction Fund, headed up to Tomago to see Westrac’s facility for read throughs on the mining sector, and construction in the infrastructure space. A fun fact we learnt from Alex was that the 320-tonne haul truck you can see him ‘driving’ below has sensors which monitor your blinking. If you blink for >2 seconds, the seat vibrates, and the control tower calls you to make sure you’re not sleeping!