1. Can we stop building the pillow fort…

The talk of a ‘soft landing’ continues to build. U.S. consumer sentiment jumped to the highest level in nearly two years in July as inflation subsided and the labour market remained strong. Janet Yellen even said this week “I don’t expect a recession”.

In the UK, Bloomberg has found household spending is holding up better than expected partly because returns on savings are rising faster than the cost of mortgages. Brits are in aggregate ~£10b a year better off as a result of higher rates given the impact of costlier mortgages is being delayed because so many borrowers are on fixed rates that have yet to expire.

Closer to home, the ABS found the net worth of the household sector increased by almost $300 billion in the first three months of the year, thanks to a rebound in property prices and the share market. This takes household net worth to $14.8 trillion.

And we are seeing investors continue their march back into the equity market. The retail investor bull-bear spread indicator from the American Association of Individual Investors survey printed positive for a 7th straight week, the most bullish stance since April 2021.

Source: Bloomberg

Source: Bloomberg

Source: BofA Global Research

Source: BofA Global Research

2. Context is key…

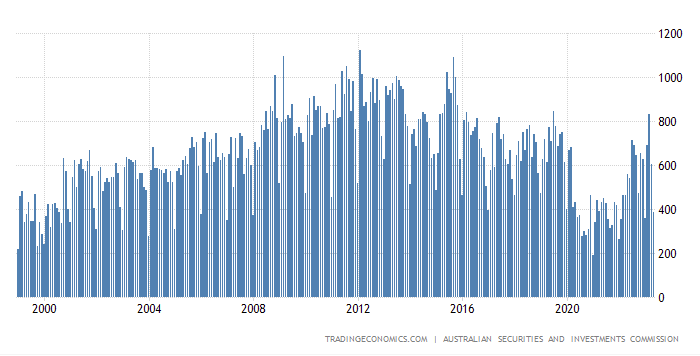

As we head into confession season for Aussie companies, it is important to remember all the distorted events of the last few years. We’ve seen headlines on Australian Bankruptcies up 3x in the past 2 years which sounds catastrophic. But it’s really just getting back to pre-Covid, ‘normal’ levels. The same ‘recovery’ in bankruptcies is happening in the US.

Source: ASIC

Source: S&P Global Market Intelligence

3. Life in plastic, it’s fantastic…

The Barbie marketing machine has been in overdrive this week, as the movie was finally released. And in this Barbie world, we’ve been thinking about our plastic credit cards.

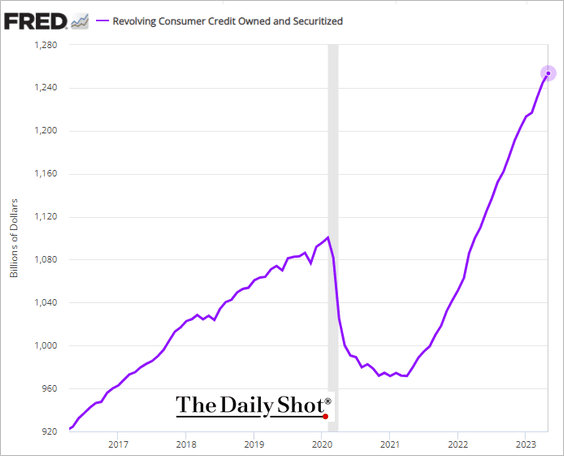

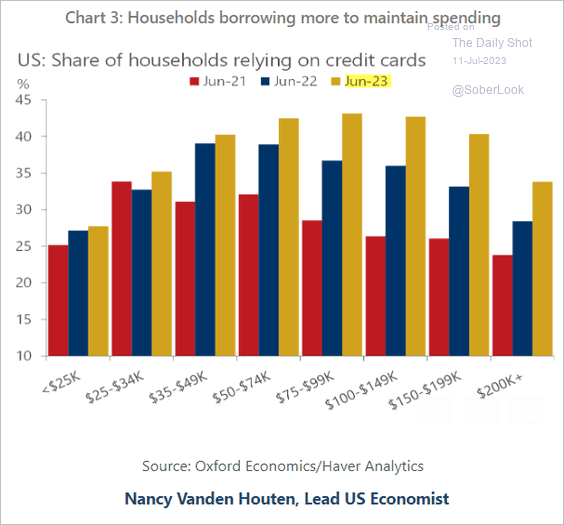

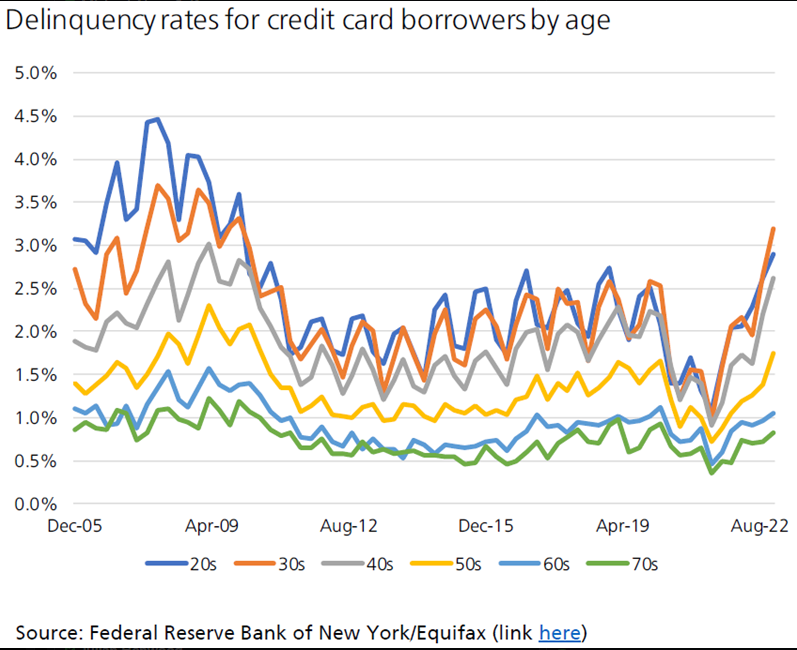

In the US, the average credit card rate has climbed above 22%, a new high. But credit card balances continue to rise as households increasingly rely on plastic to maintain their spending. And it is the younger age brackets who are heading into delinquency at the fastest rate.

And if you haven’t seen – Mattel shares have risen nearly 20% over the last month from the insane amount of marketing around the Barbie film. And if Mattel has its way, there will be more toy movies coming soon…Matchbox Cars the movie anyone?

Source: The Daily Shot

Source: The Daily Shot

Source: Oxford Economics/Haver Analytics

Source: UBS, Federal Reserve Bank of New York, Equifax