1. The great (expensive) Australian dream…

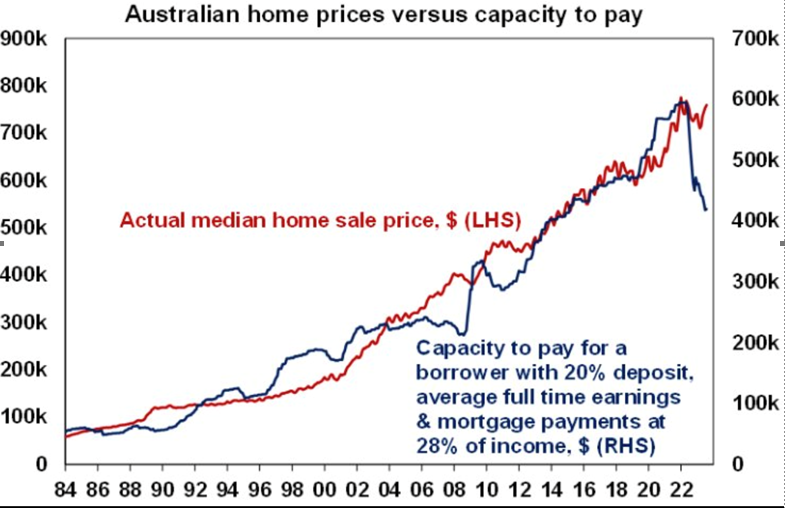

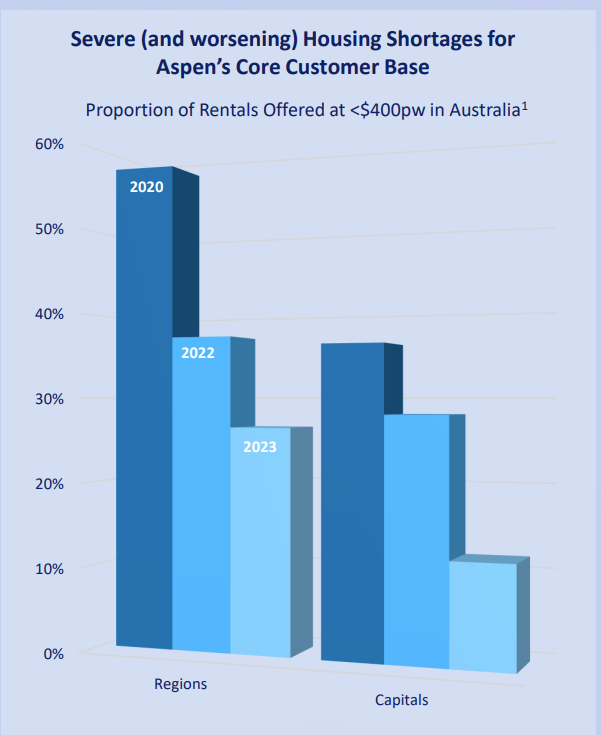

Housing affordability is tough in Australia. We have seen home prices continue to rise as the capacity to pay dropped sharply in 2022/23. We have also seen the supply of affordable housing (<$400 per week rent) drop significantly in the past 3 years. Aspen Group, held in the Small Companies Fund, supplies affordable accommodation in the residential, retirement and parks communities. They are working to fix the severe undersupply of affordable housing (<$400pw and <$400k price) where demand is around 4x the current supply.

Source: ABS, Evans (August 2023)

Source: ABS, Evans (August 2023)

Source: Aspen Group (August 2023)

Source: Aspen Group (August 2023)

Companies mentioned are illustrative only and not a recommendation to buy or sell any particular security.

2. Looking forwards not backwards…

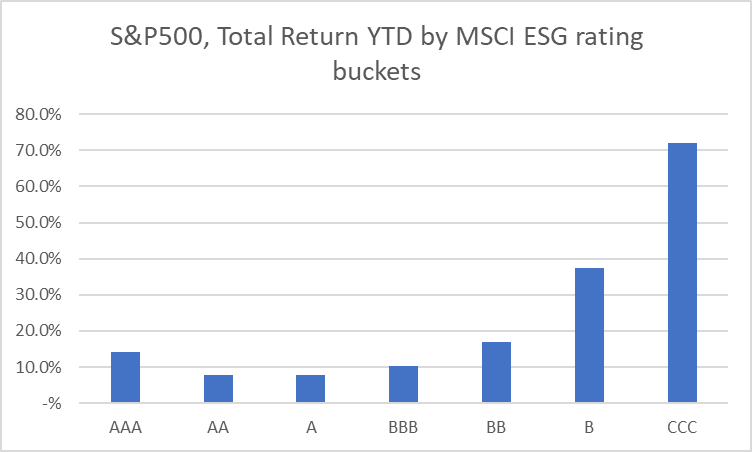

The Firetrail S3 Global Opportunities Fund uses a forward looking, fundamental approach to its ‘S3’ sustainable investment approach. Rather than relying on the backwards looking scores from third party data providers. The data below, on year-to-date performance by MSCI ESG rating, shows how important it is to do your own work rather than just relying on the ESG ratings for performance.

Source: Bloomberg, MSCI, Firetrail (August 2023)

Source: Bloomberg, MSCI, Firetrail (August 2023)

Companies mentioned are illustrative only and not a recommendation to buy or sell any particular security.

3. The price is right…

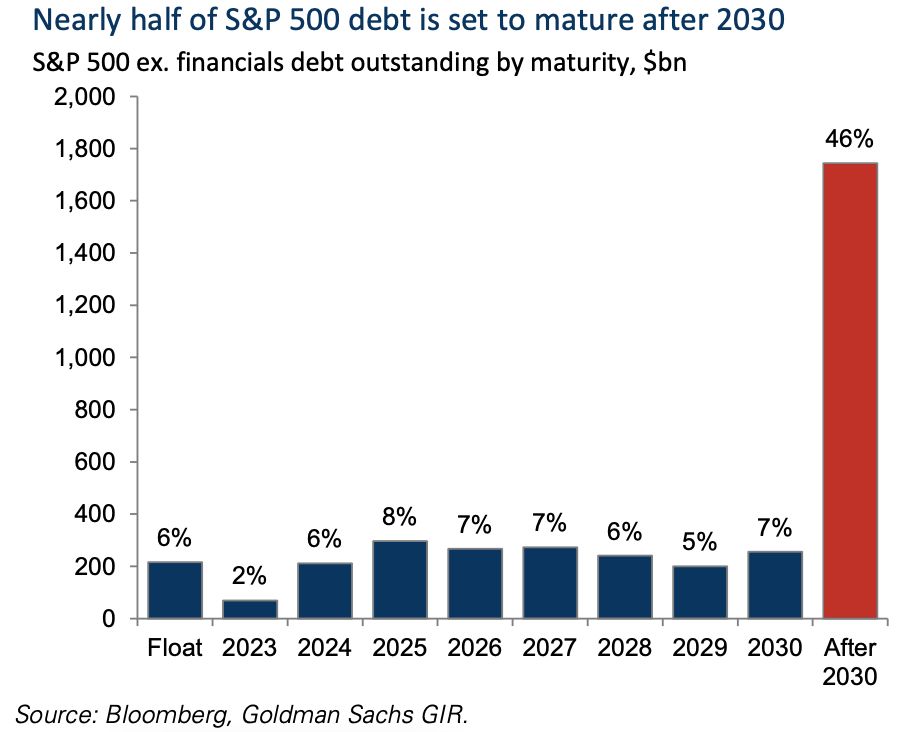

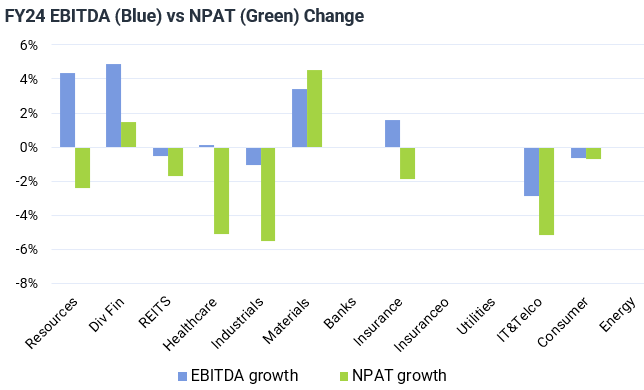

A key theme we have seen across global reporting season has been rising costs, in particular interest costs and wages.

Interestingly, nearly half of the S&P500 debt is set to mature after 2030, so it seems like US companies have been able to lock in lower debt rates. But it hasn’t been as good in Australia, where every sector (ex-Materials) has seen NPAT growth revised lower than EBITTDA growth from higher interest costs.

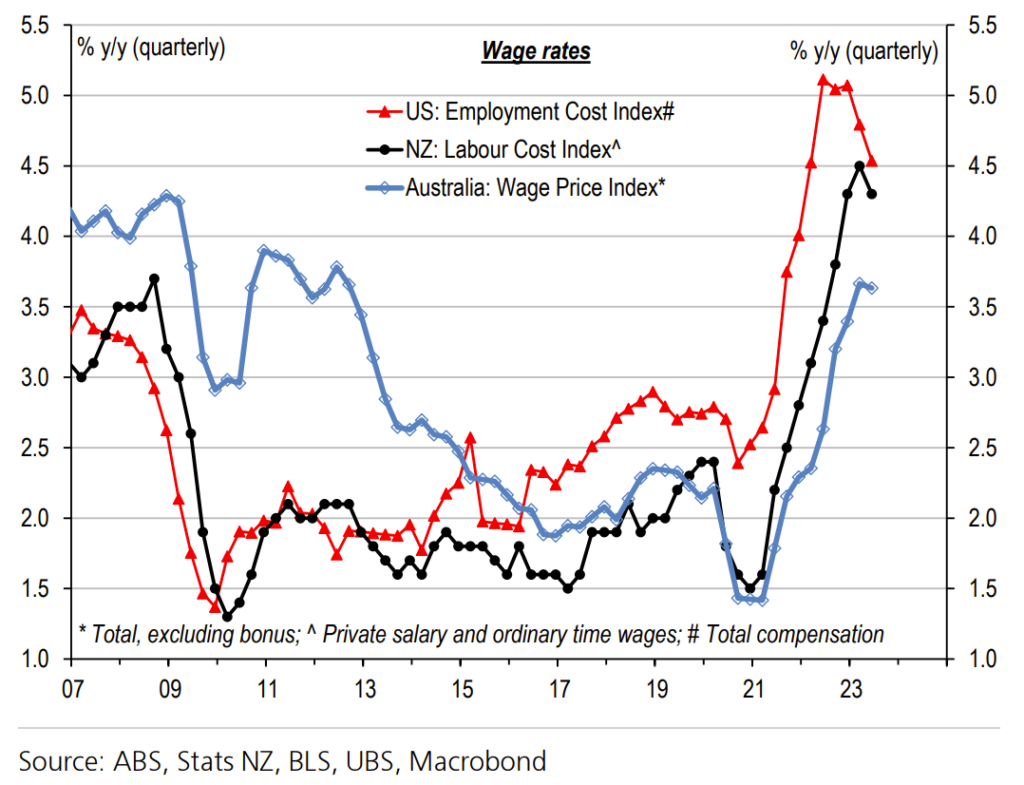

Meanwhile wage rates have spiked across the US, New Zealand and Australia. In Australia, the 12% of private sector workers who saw a wage increase saw an average increase of 4.5%, the highest in over 10 years. And in the UK they saw wage growth accelerate to nearly 8% for the 3 months to June, and whole economy wages including bonuses jumped to 8.2% from 7.2%.

Source: Bloomberg, Goldman Sachs GIR (August 2023)

Source: Bloomberg, Goldman Sachs GIR (August 2023)

Source: Jarden (August 2023)

Source: Jarden (August 2023)

Source: ABS, Stats NZ, BLS, UBS, Macrobond (August 2023)

Source: ABS, Stats NZ, BLS, UBS, Macrobond (August 2023)