1. Another crash mat…

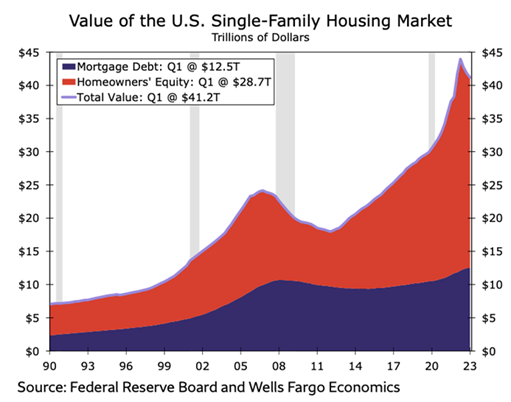

The soft-landing narrative is strong in the US. High home equity levels are one of the reasons Americans may not have felt the expected levels of pain since mortgage rates hit >7%.

According to Wells Fargo, Home values have more than doubled in the 11 years since the GFC. Through the first quarter of this year, the single-family housing market was worth $41.2 trillion (USD), a 129% increase from the 2012 low. But the $12.5 trillion dollars (USD) in mortgage debt outstanding today represents only a 29% increase from its 2012 low. Homeowner equity now stands at 69.6%; off slightly from its peak in Q2-2022, but higher than at any other point since the late 1980s.

Source: Federal Reserve Board and Wells Fargo Economics (August 2023)

Source: Federal Reserve Board and Wells Fargo Economics (August 2023)

2. Micro matters…

The macro noise has quietened down in 2023. According to Goldman Sachs, the share of the typical S&P 500 stock’s return explained by micro factors has risen sharply to 71% from 41% a year ago.

Source: Craigs, Goldman Sachs (August 2023)

Source: Craigs, Goldman Sachs (August 2023)

3. Result round up…

Result of the week went to CBA for providing insight into the health of the Aussie consumer. But some in the Firetrail team struggled to go past the TopGolf Callaway release.

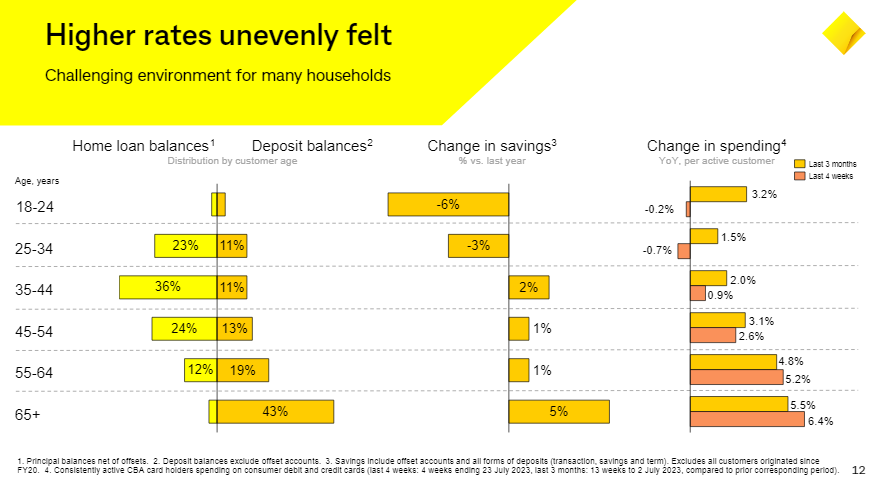

- The CBA result suggested household spending and savings are finally slowing. And it is younger Aussies in particular leading the slowdown in spending. Older Australians have largely been able to maintain their spending growth. Savings by the older age brackets have also grown. As term deposit rates hit levels not seen since 2011.

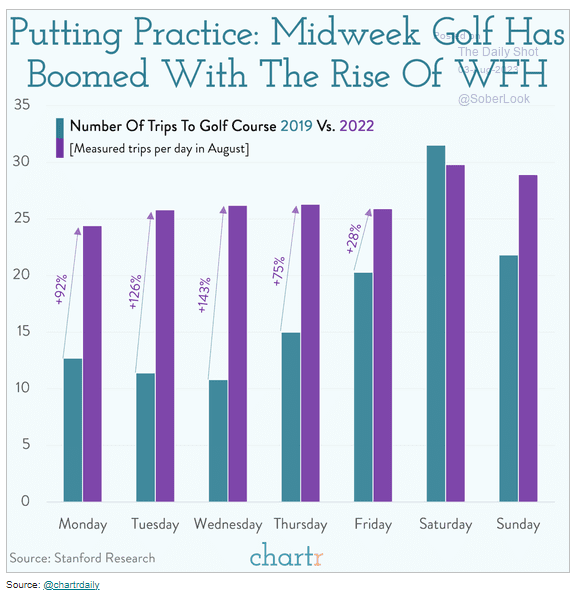

- TopGolf Callaway plunged after releasing their result. Their 3Q guidance was 22% below consensus. But data on the rise of mid-week golf rounds seems to suggest the sport will remain strong as long as WFH does.

Source: CBA (July 2022 – July 2023)

Source: CBA (July 2022 – July 2023)

1. Principal balances net of offsets. 2. Deposit balances exclude offset accounts. 3. Savings include offset accounts and all forms of deposits (transaction, savings and terms. Excludes all customers originated since FY20 4. Consistently active CBA card holders spending on consumer debit and credit cards (last 4 weeks: 4 weeks ending 23 July 2023, last 3 months: 13 weeks to 2 July 2023, compared to prior corresponding period).

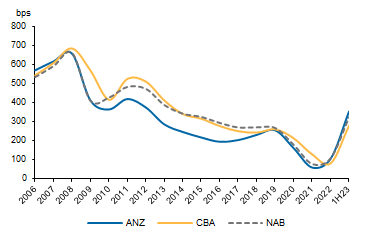

Average TD rate

Source: Macquarie

Source: Macquarie

Source: Chartr