By Chris Robinson, CFA

Investment Specialist

The most common question we are receiving from investors in 2023 is “when is the time to allocate back to Aussie small caps”?

Small caps significantly underperformed their large cap peers in 2022 against a backdrop of rising interest rates and a bleak economic outlook. We’ve seen this movie before. Small caps are more exposed to the economy, have less diversified businesses, and are less liquid than large caps. When the outlook starts to deteriorate, investors rush out of small caps and into large, liquid defensive stocks.

However, this underperformance has historically created a highly attractive entry point for savvy investors. Small caps (particularly actively managed small caps) deliver their strongest absolute and relative performance over large caps when the economic outlook starts to improve.

Small caps are now trading on a material discount to their historical relative valuations versus large caps, despite a strong medium-term growth outlook. With other big tailwinds now emerging, we believe now is one of the best times in history to invest in Aussie small caps.

In this piece, we discuss:

- The best environments for small caps outperformance;

- The rare valuation and earnings opportunity on offer today in small caps; and

- Three emerging tailwinds set to drive small cap outperformance over the next 12-24 months.

1) Small caps deliver their best returns after an economic slowdown

As we saw in 2022, small caps underperform when the economic outlook is deteriorating. However, when the outlook starts to look better than feared, small companies’ economic sensitivity becomes their greatest strength.

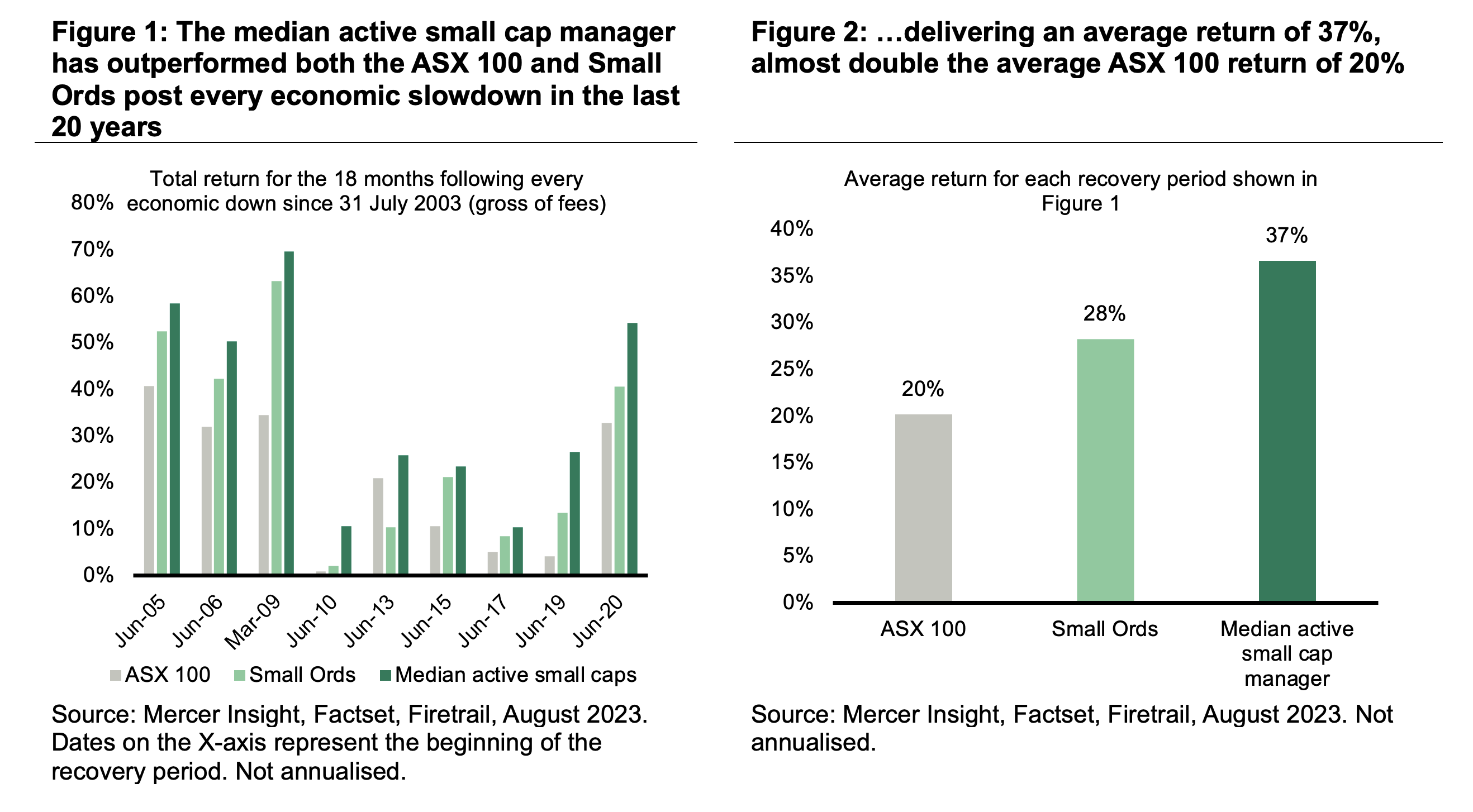

Over the past 20 years, the Australian economy has experienced nine periods of slowing economic growth. In all nine recovery periods (i.e. the 18 months following each slowdown), the median active small companies manager outperformed the ASX 100 index, as shown in Figure 1. The median active manager delivered an average total return of 37% in each recovery, almost doubling the average ASX 100 return of 20% (Figure 2).

2) A rare valuation and earnings opportunity

Unless there is a big deviation from what has played out historically, small caps will significantly outperform large caps once the current economic backdrop starts to improve.

What we are seeing in market strengthens our view. Valuations are attractive, the earnings outlook is robust, and we are finding an elevated number of opportunities through our bottom-up research.

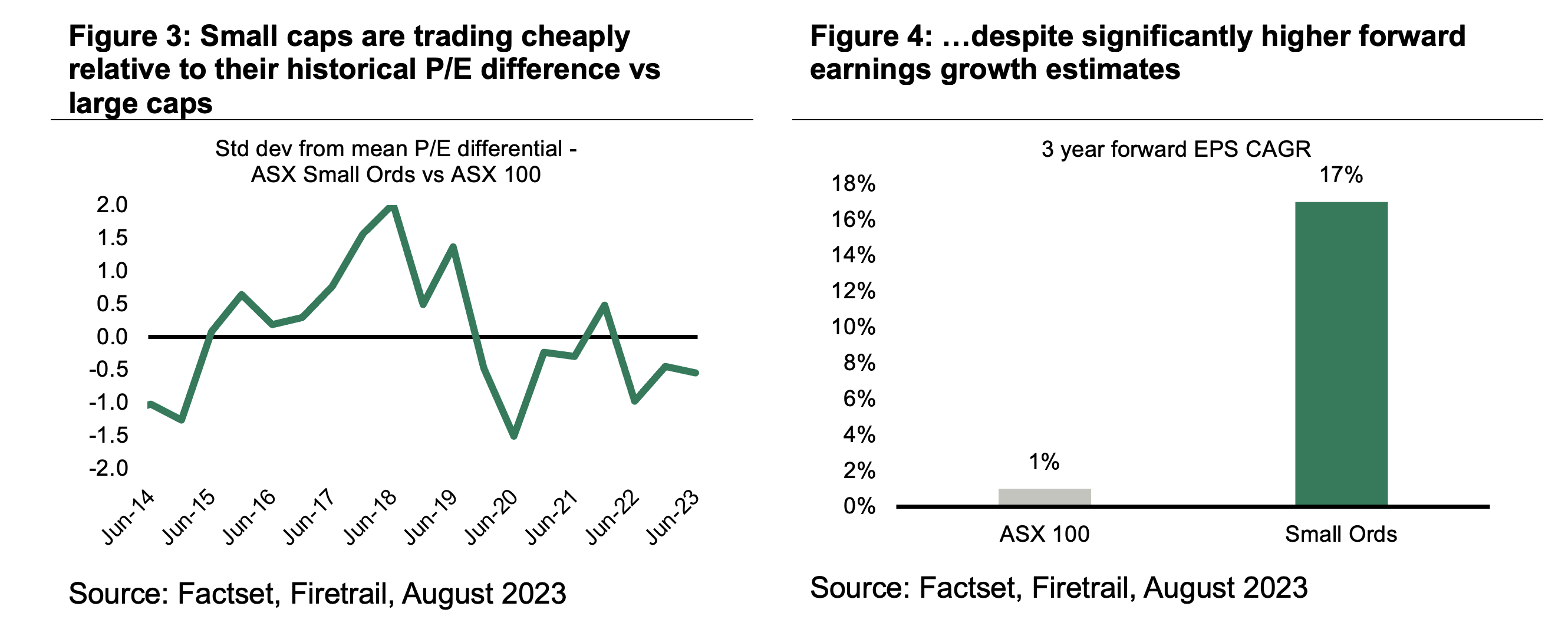

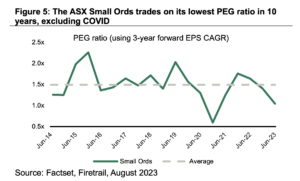

The ASX Small Ordinaries Index is now trading on a meaningful discount to its historical relative valuation to the ASX 100. At the same time, small caps are exhibiting a much stronger earnings outlook. Small cap forward earnings growth estimates significantly outpace those of their large cap peers (17% p.a. vs 1% p.a. over the next three years).

In Figure 5, we combine the ASX Small Ordinaries Index’s valuation (P/E) and earnings growth (3-year forward EPS CAGR) to look at its PEG ratio. The PEG ratio is a measure of the price you are paying per unit of growth. Excluding COVID, the ASX Small Ords is now the cheapest it has been in 10 years relative to its growth outlook.

The dislocation between small company valuations and earnings outlooks is evident in our bottom-up research. At Firetrail, we are uncovering an abundance of both Value and Growth opportunities where companies are being priced on weak FY24 earnings, without accounting for an improving outlook on a three-year view, or positive company-specific developments like improving industry structures.

Nick Scali, a premium furniture retailer, is one Value example. The company was sold off indiscriminately in the first half of 2023 along with other retailers. Yes, furniture is a big-ticket item and sales will be impacted by a weaker consumer. However, the market was missing that 1) Nick Scali has a predominantly baby boomer customer base who are benefiting from higher interest rates on their savings, and 2) the recent acquisition of Plush is delivering material cost savings through improved bargaining power with suppliers. Nick Scali’s reported results in August 2023 revealed that the company is far more resilient than the market feared. The stock has rallied 50% from its lows in June. Even if we assume a 20% fall in same store sales in FY2024, we still think Nick Scali’s share price is undervalued on a three-year view.

Life360, a location-based family services app, is an example of a Growth opportunity which has delivered substantial outperformance for our investors in recent months. While there are not many paying subscribers in Australia, Life360 is the 16th most popular app in the US by daily active users. Life360 is rapidly growing its paying users despite pushing through subscription price increases of up to 50% in the past 12 months. Importantly, the company hit cashflow profitability in the first half of 2023. Life360 shares still trade very cheaply on a 1.8x EV/sales multiple. This is half the multiple of its global “freemium” app peers despite the same growth outlook.

3) Three emerging tailwinds will drive small cap outperformance

Attractive valuations and elevated bottom-up opportunities are providing a platform for significant small cap outperformance over the next 12-24 months. Excitingly, three material tailwinds are now emerging which further strengthen the investment case.

a) Private equity and corporates are capitalising on depressed small cap valuations

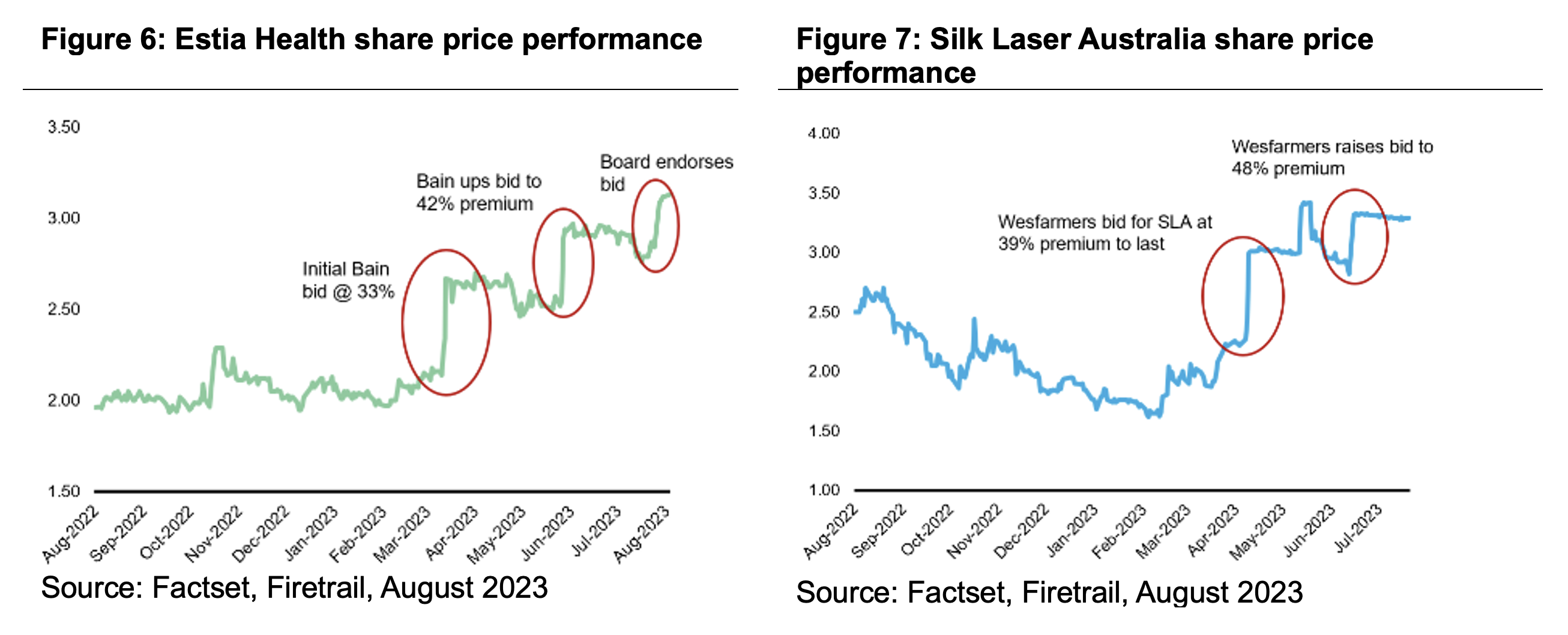

Where listed markets aren’t re-rating undervalued small caps to fair value, private equity and corporates are capitalising. We have seen a rebound in mergers and acquisitions (M&A) activity in 2023, with takeovers often at substantial premiums to listed market valuations. The Firetrail Australian Small Companies Fund has had four portfolio holdings receive takeover offers in 2023, including Estia Health (42% premium) and Silk Laser Australia (48% premium).

Our conversations with investment banks suggests this could be the beginning of a multi-year M&A cycle. Private buyers have greater confidence in the outlook now that rates, while high, have stabilised. The Australian dollar trading at US$0.64 also makes Australian companies highly attractive to offshore buyers. Given share price weakness in quality small caps with strategic assets, now is the time to capitalise.

Resources companies in particular will find themselves on acquirers’ wish lists. The energy transition is causing a significant demand uplift for strategic minerals. At the same time, project times and costs have blown out substantially. Most mining management teams we speak to agree M&A is the most attractive option for growth. There are also many sub-scale resources companies on the ASX who would realise significant value for shareholders through consolidation with nearby projects.

b) Institutional investors are deploying capital into small caps

On the investor side, we are seeing increasing appetite from institutional investors to increase small cap allocations. Since April 2023, Firetrail have received enquiries from five large industry superannuation funds about available capacity in our Australian Small Companies strategy. In 2022, we received just one enquiry about small companies. The Future Fund also recently announced that “Changes in domestic markets have made small cap equities attractive to us for the first time and we have commenced a new program to invest in them in recent months”.

A lot of institutional capital left the small companies market in 2022. Signs are emerging that capital is starting to flood back in.

c) A more vibrant IPO market is around the corner

Over 95% of initial public offerings (IPOs) are small companies. These opportunities have been a significant source of outperformance for the Firetrail Australian Small Companies strategy since inception. However, the IPO market was largely shut in 2022, meaning this alpha lever was closed off to active small cap investors.

We are seeing very early signs of activity re-emerging. As a medium-term investor with meaningful funds under management, all major IPOs and placements are put in front of the Firetrail investment team. We are hearing more from investment bank contacts that IPO pipelines are building.

However, many IPOs will end up trading below their listing price. As the deals come through, deep dive fundamental analysis of each company will be crucial. Firetrail will continue to be meticulous in selecting the deals we participate in to ensure IPOs and capital raisings remain a strong alpha generator for our clients over the long-term.

Conclusion

The best time to invest in small companies is before the recovery from a period of economic slowdown. With interest rates high but stable, and inflation starting to fall to a more manageable level, we believe small caps are poised to deliver strong performance over the coming years.

At Firetrail, we are finding an abundance of opportunities in undervalued companies with attractive medium-term outlooks. Private equity and corporates are actively buying up small caps at substantial premiums, institutional capital is starting to come back into small caps, and a more vibrant IPO market is around the corner.

It’s always darkest before dawn. If you want to be there for the sunrise, now is the time to invest in small caps.