Two interesting trends have emerged from the pandemic. Australians are having more babies and they are swapping out their city lifestyle for the beach and bush. In contrast to short term phenomena such as the hoarding of toilet paper, these shifts have potential long lasting implications for the economy and listed companies. In this article we discuss these two trends and the opportunities they have created for companies in the Firetrail Australian Small Companies Fund.

COVID baby bump or boom?

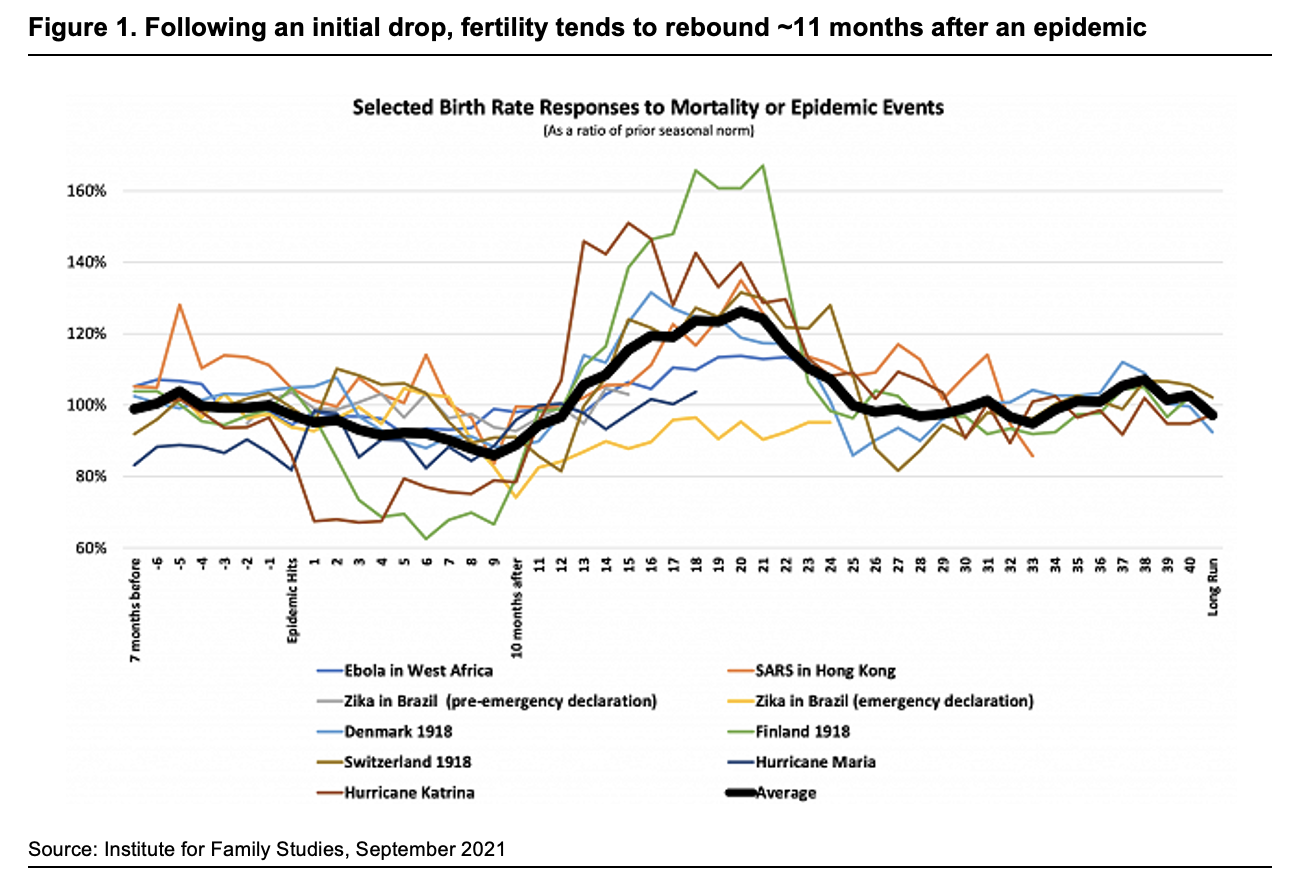

When large mortality events occur including diseases, earthquakes and wars, birth rates decline and on average, reach a trough some nine months later. As shown in Figure 1 below, this pattern holds for events such as both World Wars and the influenza outbreaks of 1918. Following an initial drop, fertility tends to rebound. Birth rates begin to recover ~11 months after an epidemic and then increase in the subsequent 1-5 years.

The end of World War II sparked one of the biggest baby booms of the 20th century. Could we be at the start of a post-COVID generation? Estimates by academics regarding the post-COVID birth recovery vary widely. The Institute for Family Studies notes that COVID has the potential to boost births over the next four years by anywhere from 0.3% to 40%. We admit this is a wide range to draw a conclusion from just yet. However, recent trends in birth rates and anecdotal evidence provide reason for optimism:

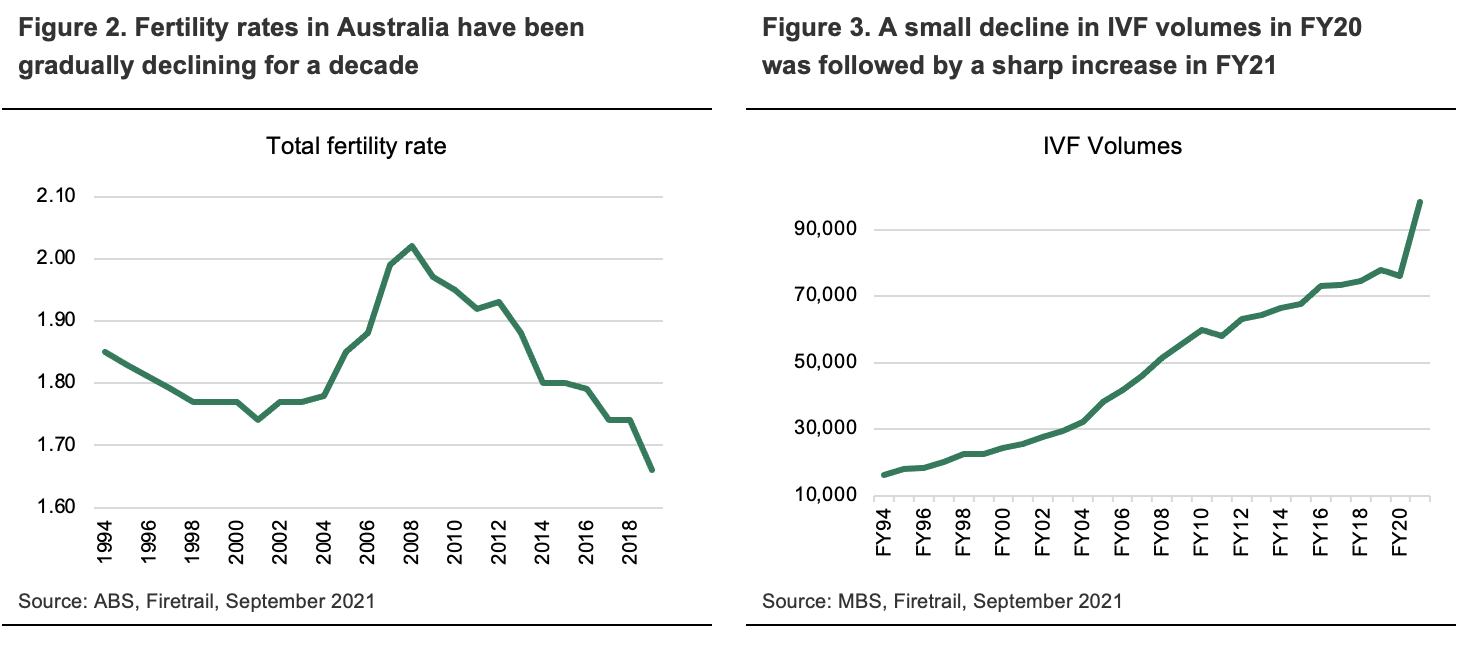

- The number of babies born in NSW public hospitals during the June quarter was the largest on record. A total of 19,113 births were reported, an increase of 9% on the prior year. This is a significant upswing compared with the declining fertility rate over the last 10 years.

- Prior to the pandemic IVF volumes had been increasing gradually over time. But in FY21, 98,290 IVF cycles were recorded, up 29.3% compared to FY20 and the highest figure on record.

The increase in IVF volumes has benefited portfolio holding Monash IVF. During FY21, Monash recorded a 40% increase in new patient stimulated cycles and there are no signs of a slowdown. New patient registrations in 2H21 were up 8% compared to 1H21, and up 35% on 2H20. ~70% of patient registrations are converted into patient treatments within ~3-6 months.

COVID-19 has sparked a behavioural shift amongst Australians. Restrictions on travel and a greater focus on family, health and wellbeing is resulting in a re-direction of priorities. While it is still early days to call it a baby boom, recent birth rates and trends IVF trends indicate we are at the onset of a baby bump.

Looking beyond the headline impacts of escaping the city

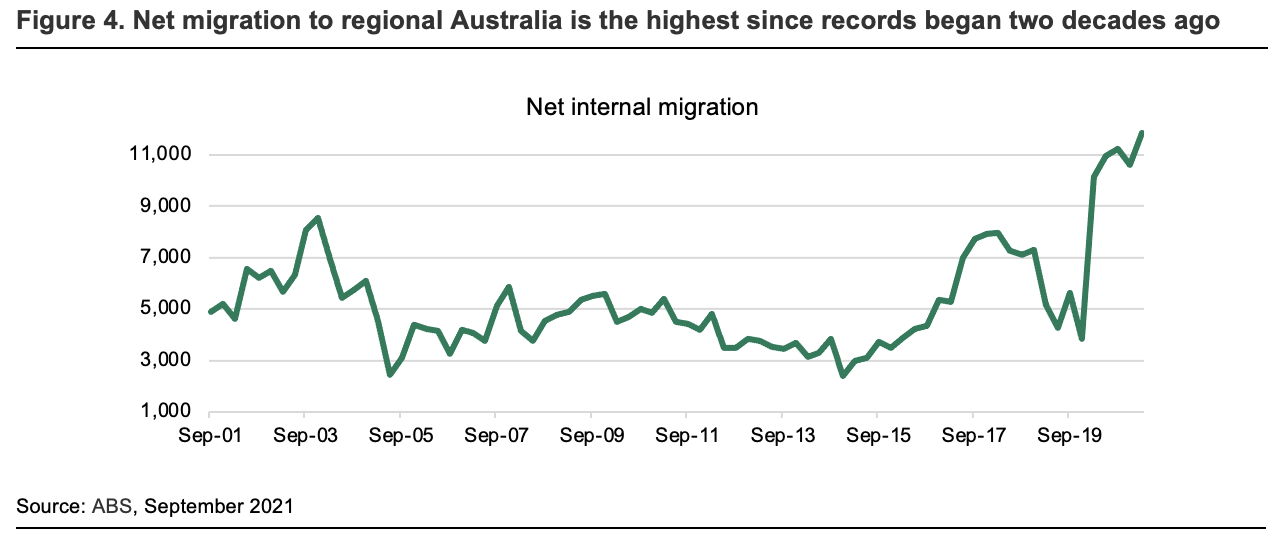

For decades the lack of job opportunities in regional areas has seen many Australians relocate to capital cities. Then the pandemic hit. The sudden shift to working from home has made a tree change or sea change possible and more attractive for many Australians. ABS data shows net migration to regional Australia is the highest since records began two decades ago. In the 12 months to March 2021, net migration to regional areas increased 87.1% year-on-year. The impact of demand for housing on prices in regional towns has been widely publicised. Digging beneath the headlines, second order impacts are more interesting and perhaps even more important.

Demand for products and services across some industries increase as more people move to regional areas. Regional houses are larger and hence require more bricks to build and more lights to illuminate. For listed companies with strong brands, regionalisation has created an avenue to expand store footprints, increase sales, and grow market share. Portfolio holding Beacon Lighting is capitalising on this opportunity. It plans to open three additional regional stores this year including Ellenbrook (WA), Butler (WA) and Melton (VIC). The City of Melton, where Beacon Lighting is expected to open a new store in FY22, is one of the fastest growing areas of Australia. 11 new suburbs have been proposed to be added to it! In 2020, the city recorded a population increase of 4.6%, more than double the increase for Greater Melbourne which grew at 1.6%.

Increased sales in regional areas often come hand-in hand with supercharged margins. This is a direct result of limited competition and lower costs of doing business. A key cost line for many retail companies is rental expense. Bendigo is over 150km away from Melbourne CBD. Looking at recent advertised rents, it is ~50% cheaper to rent a large retail space in Bendigo than it is in areas close to the Melbourne CBD like Southbank. Going regional also comes with less competition from smaller niche retailers that often compete on price. Regionalisation has created an opportunity for companies like Beacon Lighting to increase sales, grow market share and generate better returns on a per store basis.

Conclusion

There are many interesting phenomena that have emerged from the pandemic, many with direct and lasting implications for listed companies. Restrictions on travel and a refocus on family has contributed to a spike in birth rates and IVF volumes. The sudden shift to working from home has driven many Australians away from the cities to regional areas. The baby bump (or potential boom?) and regionalisation trends have created an opportunity for many companies in the Firetrail Australian Small Companies Fund.