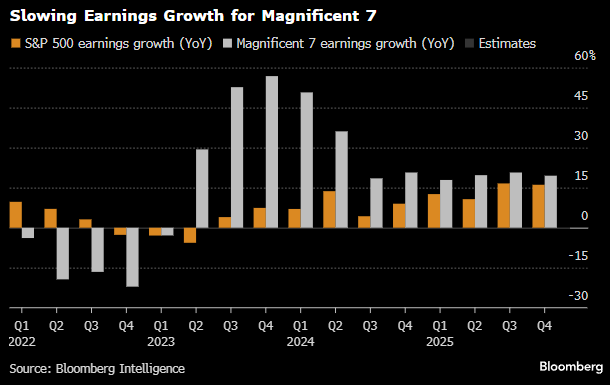

1. Earnings growth found OUTSIDE the Mag7?!!! Surely not!

We note there is a year of estimates in the below chart (which could be wrong) but the numbers suggest similar earnings growth for the Mag7 and the overall S&P. Given the weighting of the Mag 7, it implies the S&P493 are still growing slower, but the gap will be the closest in 3 years.

Source: Bloomberg (November 2024)

Source: Bloomberg (November 2024)

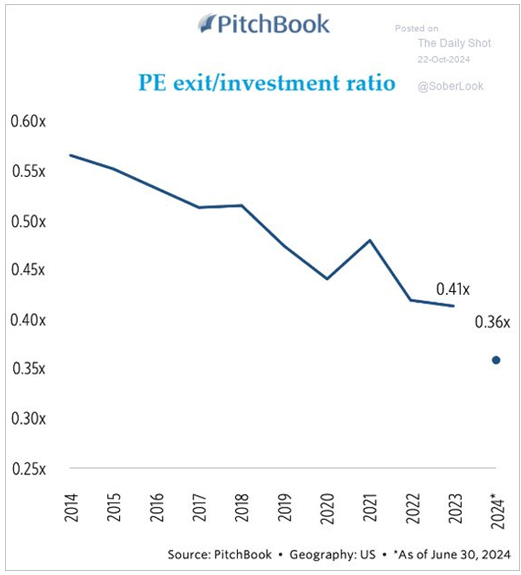

2. Private equity – Exits becoming harder to come by

Markets are at all-time highs and earnings multiples are reasonable but private equity firms are finding it hard to make realisations. Data from Pitchbook suggests exits vs investments are at decade lows with 2024 set to be the worst. We went away to examine the reasons and couldn’t put our finger on it.

Our rationale: Ex-technology, the economy isn’t great with many industrials struggling to maintain or grow profits in the face of inflation and tepid top lines. PE tries to maximise their exit value and selling on depressed earnings isn’t a great way to do that. But you can’t wait forever!

Source: Pitchbook (November 2024)

Source: Pitchbook (November 2024)

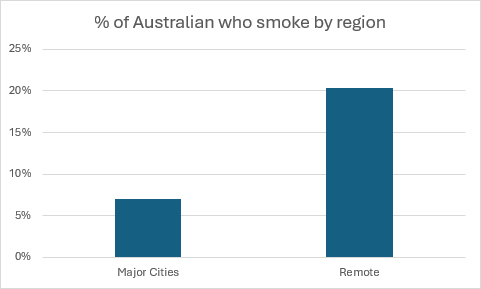

3. Smoking rates

Out on the road we are hearing that illicit tobacco sales are rising sharply as consumers look to save money. Some have estimated 30% of Australian cigarettes sold are illicit. We found the following chart on smoking rates and were surprised that remote areas have 20% smoking rates while just 7% of people in major cities smoke.

Source: Australian Institute of Health and Welfare (November 2024)

Source: Australian Institute of Health and Welfare (November 2024)

Please contact us should you wish to receive the original version of this article, or would like access to a prior version.