2021 was an exciting year for initial public offerings (IPOs) and placements. 55 companies with an offer price greater than A$20 million made their debut on the ASX during the year. Up a staggering 62% from the year before! Secondary placements experienced a more modest increase, up 6% from 2020.

Most equity capital market (ECM) activity took place in the small cap end of the market. Providing a material opportunity for institutional small cap managers like Firetrail to add value for their investors.

In this article, we analyse the success of small cap IPOs and placements in 2021, provide key takeaways for investors, and what to expect in capital markets in 2022. We conclude that corporate activity will remain elevated in small companies throughout 2022. Creating meaningful opportunities for investment managers willing to do the work to identify the best opportunities.

IPOs and placements outperformed in 2021

It wasn’t just the sheer number of IPOs and placements that broke records in 2021. Together, new ASX-listings raised a total of A$12 billion! Among them were a record number of billion-dollar floats, such as APM, SiteMinder and PEXA.

On the first day of trading, these IPO companies outperformed the market by an average of 20%. However, we did see this outperformance moderate by the end of the year.

We saw the inverse occur in the market for secondary offerings. Average day one performance hovered around 10.1%. While calendar year performance rose to 15.4%! The total amount raised by secondary offers was A$37.7 billion.

But that doesn’t seem like an accurate reflection of performance from a market perspective.

Careful stock selection is critical

If we adjust for the size of the raise, the story changes. We see big declines for first day and calendar year performance for both IPOs and secondary placements. Suggesting that the relative performance is skewed by a handful of big winners.

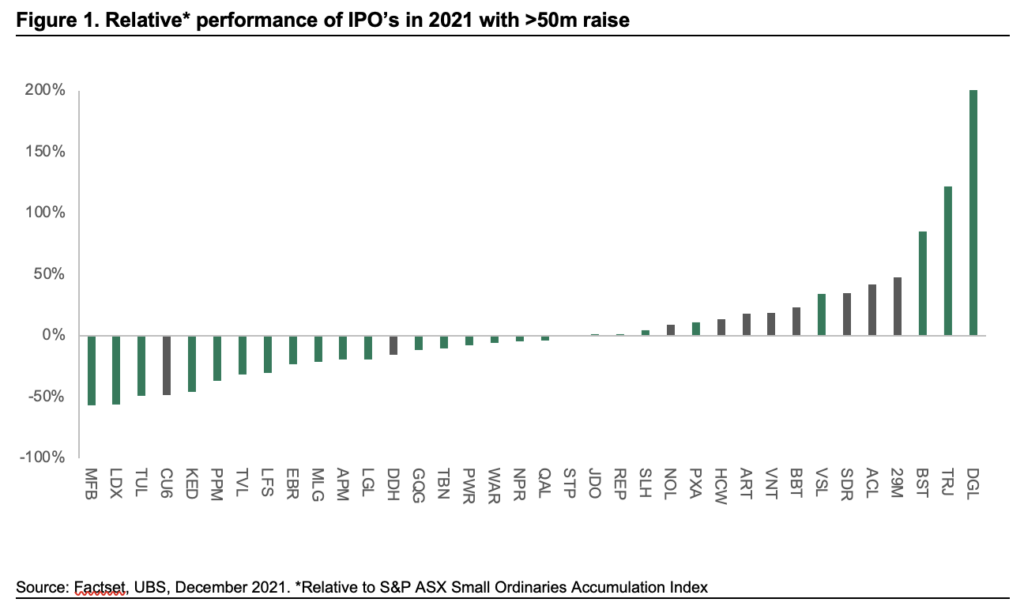

In the IPO space, performance was dominated by a few key players. DGL, a chemical manufacturing and storage group, and Trajan, an analytical science and devices company, experienced greater than 100% returns in the calendar year.

To account for this asymmetry, we took the median performance for the calendar year. The median return for IPO stocks was just -4%. Providing a more accurate reflection of capital market performance.

Clearly, an ability to pick winners is key to harnessing value from corporate activity. The chart below compares the relative performance of IPOs that raised more than $50 million. While average performance was strong, there were more losers than winners.

Through deep fundamental analysis, Firetrail were able to pick the winners this year. The median return from our IPO participation was 18% for the 2021 calendar year (shaded in grey in Figure 1).

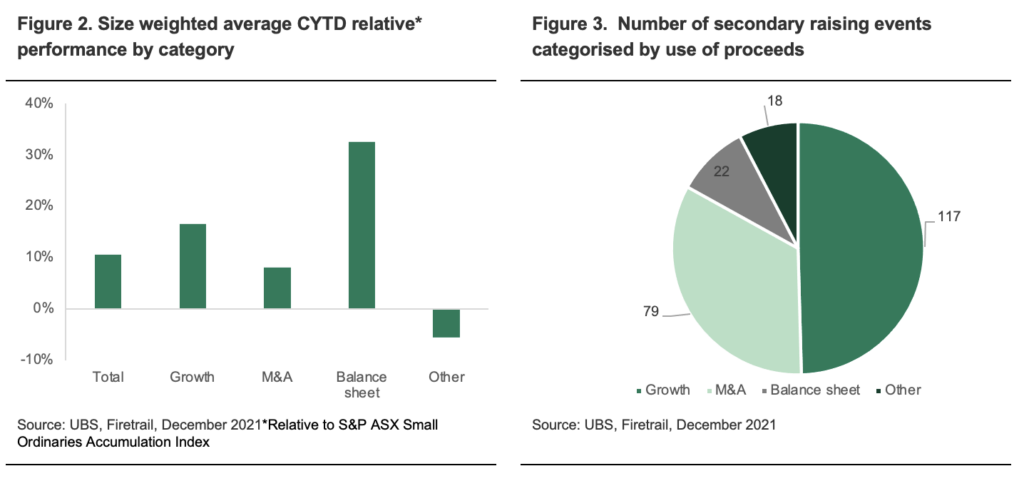

Careful selection is also key for managers trying to maximise returns from secondary placements. In 2021, we saw a wide dispersion in results.

The best returning secondary issuances were in companies in need of balance sheet repair. The average placement in this category delivered 33% excess. In many instances we observed that the ‘raise’ was already priced in by the market. Hence recapitalisation was the catalyst to refocus the market on business fundamentals.

The market also rewarded companies raising capital to grow organically far more than M&A. Raisings for growth dominated the market (Figure 3). In contrast, there were few M&A bargains in 2021 due to intense competition for assets. Many companies were willing to pay listed multiples for strategic acquisitions.

Opportunities will remain elevated in small caps in 2022

ECM events are a consistent source of opportunity and strong returns for small cap investors. Access to these opportunities is key, and the Firetrail team have a strong track record of leveraging our corporate relationships and fundamental expertise to access attractive corporate opportunities for our investors. Since the inception of the Firetrail Team’s Small Companies strategy in 1998, previously the Macquarie Australian Small Companies Fund, these events have contributed an average 20% of the total excess returns, or ~3% p.a.

Looking ahead to 2022, low interest rates and high valuations will continue to encourage companies to raise capital. We expect ECM activity to remain elevated and to continue delivering material opportunities for small cap investors like Firetrail.

Conclusion

2021 was a year of frantic ECM activity and we see no sign of this abating as we move through 2022. As small cap investors, we are excited by the opportunity and potential returns offered by IPOs and secondary placements in the coming year. Our experience shows that meaningful returns are out there if managers are willing to do the work to find them!