ResMed is a $50 billion medical device company that specialises in the treatment of sleep-disordered breathing and other respiratory illnesses. It is a market leader in the production of cloud-connected medical devices.

ResMed’s share-price has performed strongly in recent months, largely in response to a product recall by its main competitor Philips. Notwithstanding its near 40% rise, we believe ResMed remains a compelling investment opportunity with substantial valuation upside. In this article, we explain why.

ResMed 101

The most common illness treated by ResMed products is obstructive sleep apnoea – a condition in which sufferers stop breathing involuntarily for extended periods during sleep. It occurs because the muscles that support the soft tissues in the throat temporarily relax, narrowing or closing the airway such that breathing is cut off. Sleep apnoea can seriously inhibit regular functioning and is related to high blood pressure, heart attacks and daytime fatigue.

ResMed manufactures continuous positive airway pressure (CPAP) devices to assist patients with sleep apneoa. These devices send a steady flow of oxygen into the nose and mouth during sleep, keeping the airways open and allowing normal respiratory function. The CPAP device involves a machine and a separate respiratory mask, see figure 1.

Less common but equally debilitating is chronic obstructive pulmonary disease (COPD) – a lung disease that causes obstructed airflow and predominantly occurs in smokers. ResMed produces cloud-connected ventilators to treat COPD, depicted in figure 2.

A large addressable market with low penetration

ResMed’s addressable market is large, growing and predominantly unpenetrated. ResMed assumes a total addressable market of 1.5 billion people based upon the following estimates:

- Sleep apnoea – 936 million people with sleep apnoea world-wide – whether that be obstructive sleep apnoea, central sleep apnoea or a combination of the two.

- Chronic obstructive pulmonary disease (COPD) – 380 million people.

- Asthma – 340 million people worldwide. While asthma cannot be cured, its symptoms can be managed using ResMed devices.

While we think ResMed are overstating the opportunity by capturing cohorts with very mild symptoms, we do agree that the opportunity is very large.

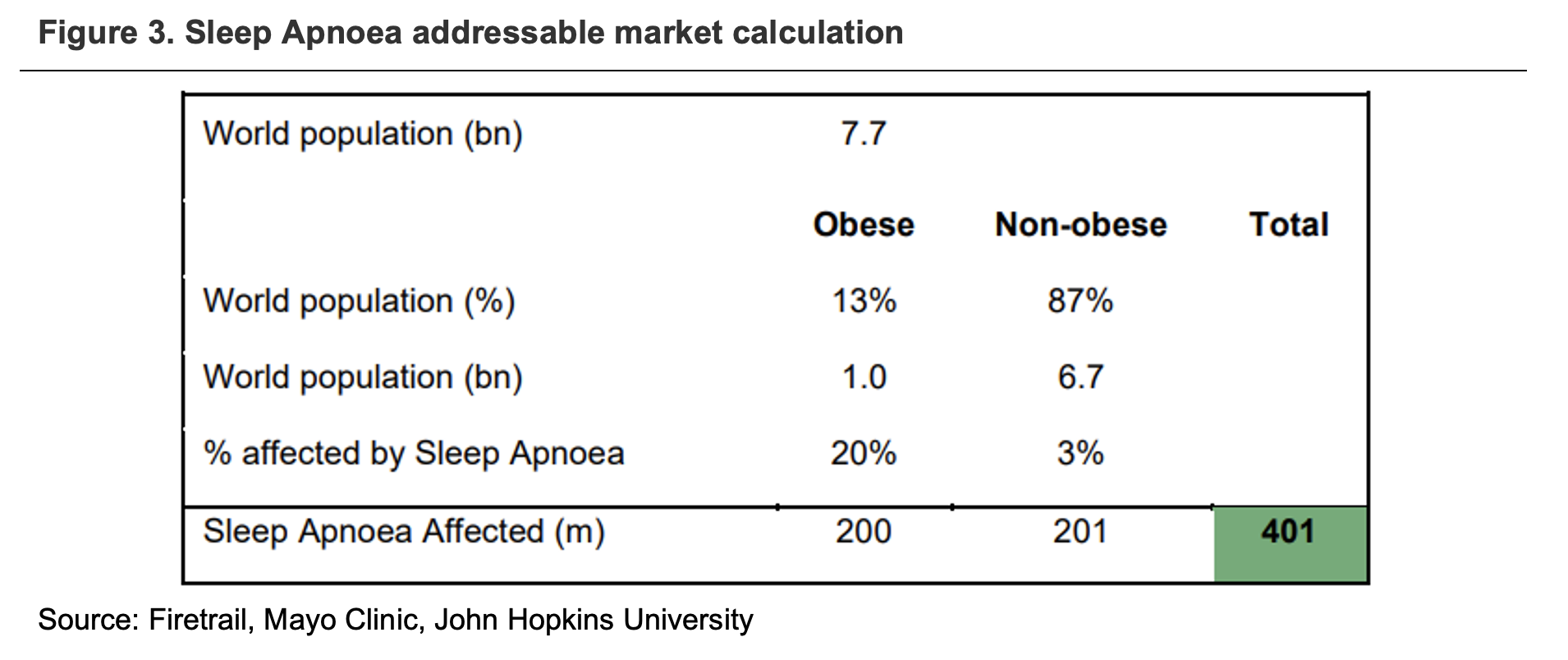

Using a bottom-up approach, we estimate the sleep apnoea addressable market to be 401 million people, as reflected in the figure below:

ResMed believes penetration currently sits below 20%, which means more than 80% of the large addressable market is up for grabs.

Putting it together, we see significant growth for ResMed’s end market, driven by:

- Population growth – more people in the world

- Obesity growth – continued growth in obesity and prevalence of sleep apnoea

- Penetration – awareness and treatment growing from current <20% levels

An opportunity to increase market share

ResMed’s key competitor in CPAP devices is Philips. In June 2021, Philips voluntarily recalled a range of products, including their legacy CPAP range.

The recall was driven by deterioration of the sound abatement foam used in Philips’ first generation DreamStation CPAP flow generators and several of its other devices. In total, it expects to repair or replace ~3.5 million devices over the course of 12 months. The withdrawal of Philips from the market presents a significant opportunity for ResMed to dominate new CPAP flow generator installations over the near term while Philips is busy replacing its existing fleet.

Factoring in the impact of the recall, we expect a 10% increase to ResMed’s share of new patient demand in the first half of fiscal year 2022. Moving into the second half, as the impact of chip shortages lessens and ResMed is able to lift production, we see this share increasing further to 72%. There is the potential for even greater upside if ResMed can negotiate a lift in chip supply earlier than anticipated.

This trajectory does however depend on the pace with which Philips returns to market and begins servicing new patients. Currently, Philips expects to be out of market for twelve months, but their market share loss could last longer. Cochlear provides a useful case study – when it initiated a product recall in 2011, its market share remained depressed for almost ten years, showing a long-term impact on market structure. Even after Philips returns, we believe some of ResMed’s market share gains will remain.

With mask sales also likely to benefit as more new patients purchase ResMed devices, we see total revenue growth for ResMed in the mid-teens for at least the next two years.

Cloud-based care delivers increased efficiency and a better user experience

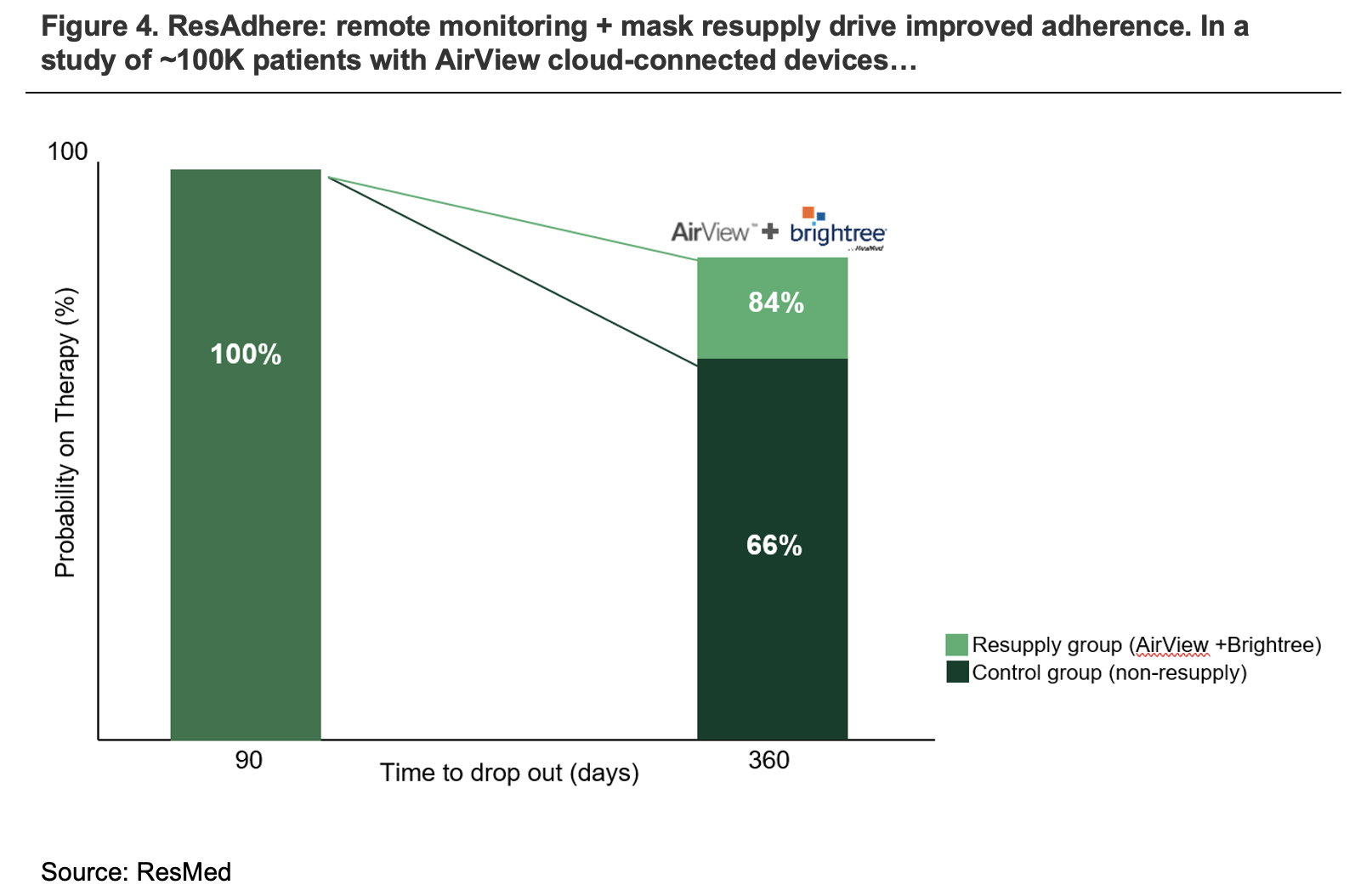

ResMed began its venture into cloud-based health informatics with the purchase of information technology group Brightree in 2016. It has since continued to add to its technology offering with the purchase of several other software providers, most recently Snapworx and Citus Health. These acquisitions provide ResMed with a substantial suite of digital solutions across a number of types of out-of-hospital care.

As shown in figure 4 below, the integration of Brightree services into ResMed products has substantially improved patient adherence rates.

We see scope for ResMed to continue to integrate its SaaS business more closely with healthcare providers over the medium-long term, driving significant value and improved retention.

Conclusion

ResMed is a market leader in the production of CPAP devices with a proven capacity to attract and retain a large customer base. We consider ResMed well-positioned to capitalise on the short-term market disruption caused by the Philips recall and to strengthen its leadership position over the medium to long term. Given this, we believe it remains undervalued by the market. ResMed is a holding in the Firetrail High Conviction Fund and the Absolute Return Fund.