By Scott Olsson

Portfolio Manager

IAG’s pricing tailwinds and innovative reinsurance deals create a strong earnings outlook for FY 2025 and beyond.

Insurance Australia Group (IAG) was a new addition to the Firetrail Australian High Conviction Fund during the quarter. We forecast earnings upside versus current market expectations, driven by pricing power, margin improvement, and robust reinsurance protection. Below, we outline the key drivers behind this outlook.

Price increases now translating into higher margins

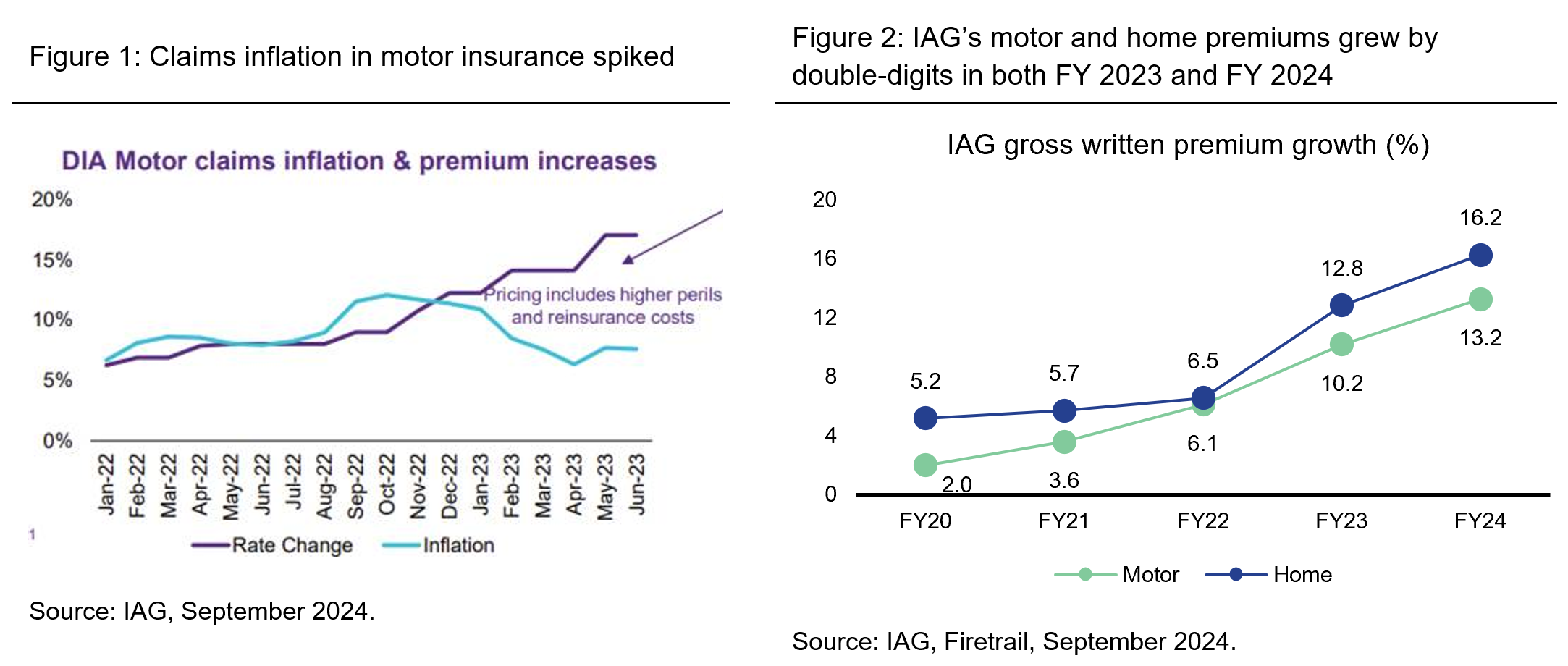

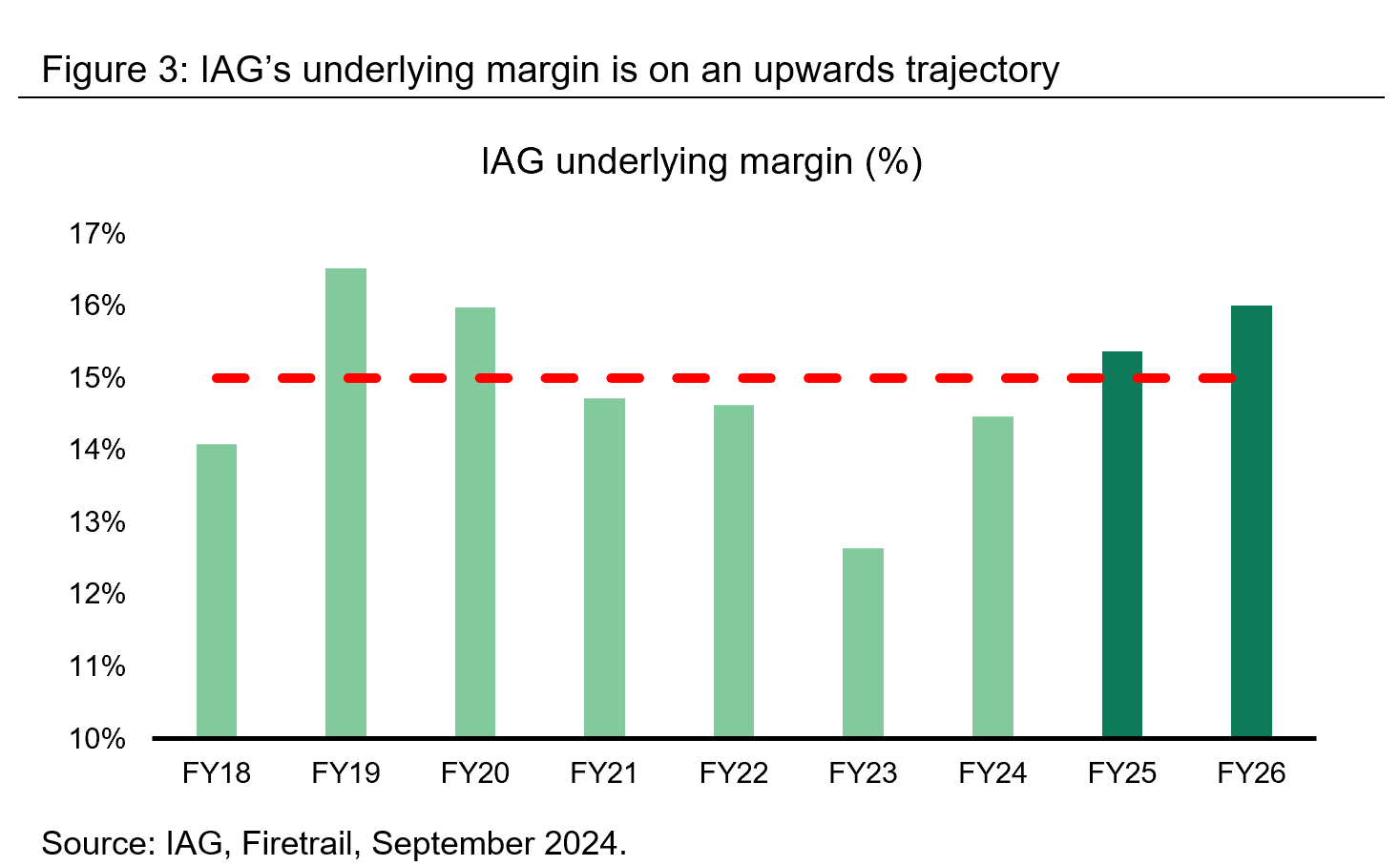

The second half of 2022 was a meaningful period for IAG and the wider Australian insurance industry. As seen in Figure 1, claims inflation in motor insurance spiked to above 10%. Home insurance also experienced elevated claims inflation during this period which pressured profitability. In response, all players increased pricing materially. IAG’s motor and home premiums grew by double-digits in both FY 2023 and FY 2024.

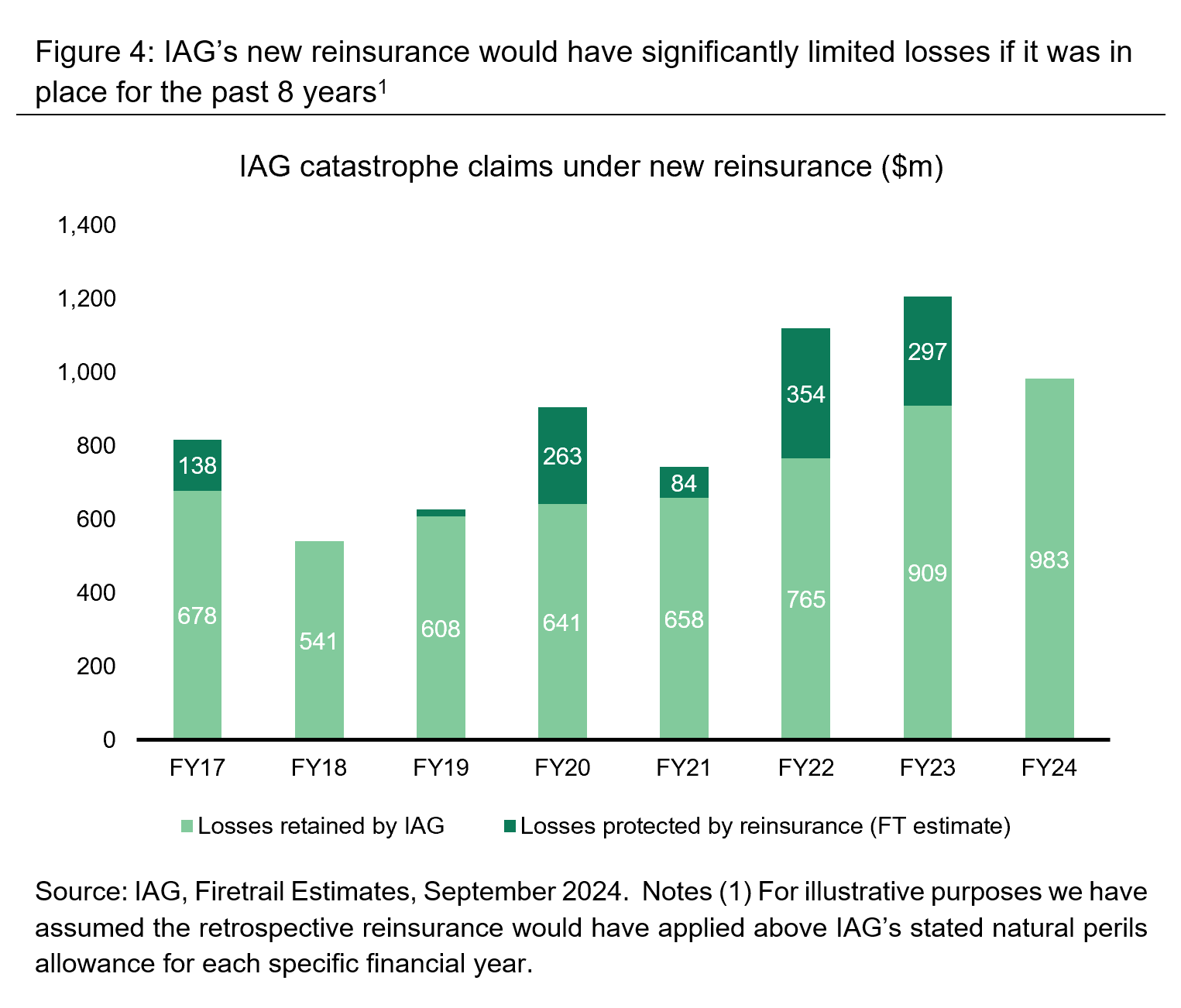

As a result of these sustained price increases, IAG’s “underlying” margin increased by almost 2% in FY 2024 and should improve again in FY 2025 as inflation continues to moderate. We expect IAG will be modestly above it’s through-cycle margin target of ~15% in both FY 2025 and FY 2026.

Reinsurance provides point of difference versus peers

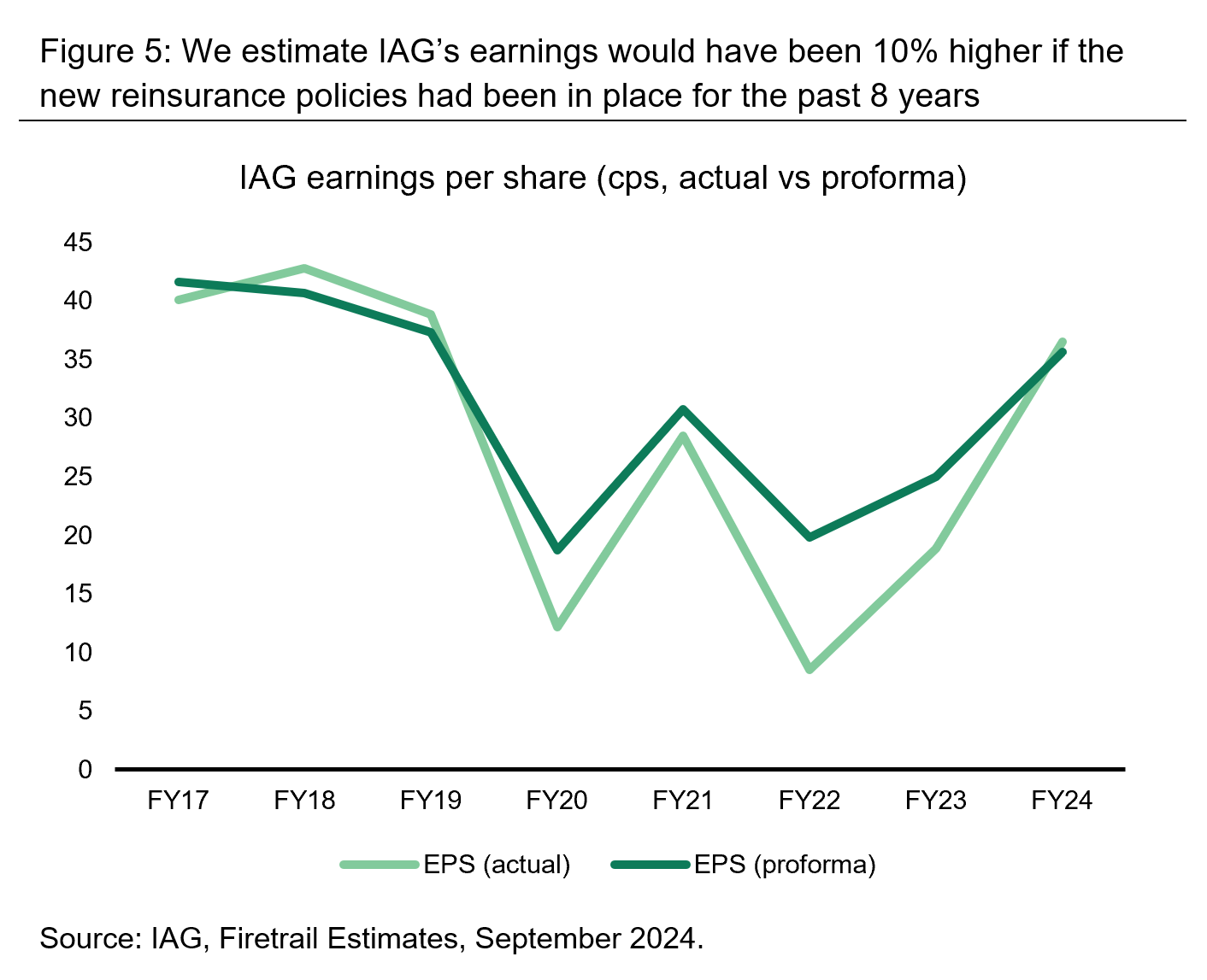

A further underpin to the IAG investment thesis is the degree of downside earnings protection it now has, following two reinsurance deals announced in late June 2024. The new covers announced were:

- Protection against negative moves in claims reserves held against various portfolios up to $680m.

- Protection against claims costs from catastrophe events above a certain level for five years.

While we had seen reinsurance structures like this in the past, none had provided protection of the same quantum or duration that IAG was able to negotiate.

For illustrative purposes, Figure 4 shows what proportion of catastrophe claim costs would have been passed on to the reinsurer if this arrangement had been in place for the past eight years. In aggregate, the reinsurers would have contributed more than $1 billion of claims protection, limiting IAG’s downside in particularly bad years.

Extending this to earnings per share (EPS), we estimate IAG’s earnings would have been 10% higher on average under this scenario, with less variability and lower capital intensity.

Valuation

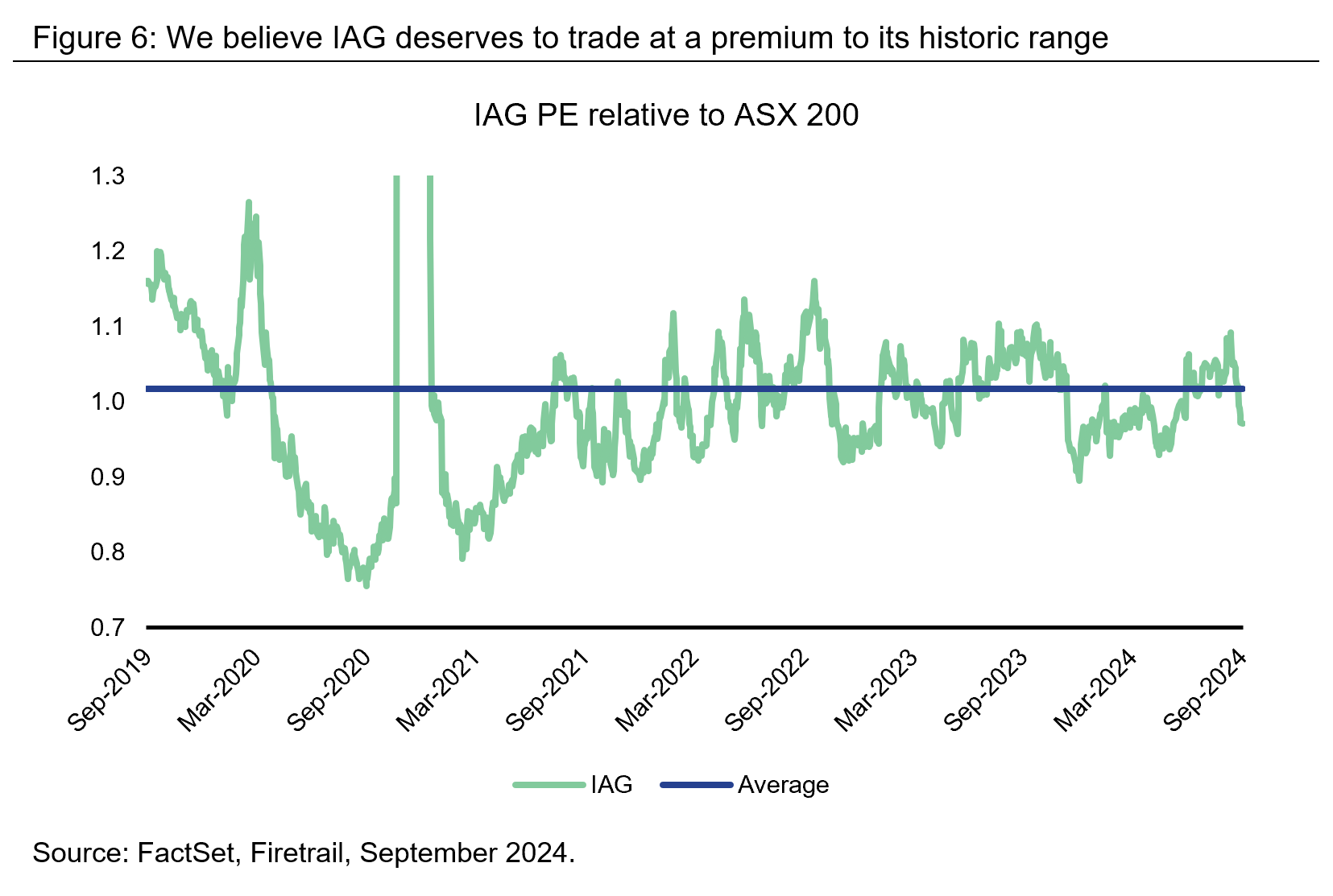

Given a positive industry backdrop, reduced earnings volatility and substantial surplus capital, we believe IAG deserves to trade at a premium to its historic range and its closest peer, Suncorp. Indeed, due to the reinsurance coverage now in place, IAG’s business should be more predictable and capital-light than a typical insurance underwriter. We believe consensus EPS is likely to be upgraded over the course of FY 2025/26, which will highlight the resilience of IAG’s earnings profile.

Conclusion

In summary, IAG is well positioned to capitalise on the current tailwinds in the Australian insurance sector, with adequate structures in place to limit downside volatility. We believe there is scope for the market to place a higher multiple on the stock as IAG delivers what we believe will be strong earnings over the next few years.