A look at how Integral Diagnostics is harnessing AI and teleradiology to scale operations and capitalise on a fragmented imaging market for substantial growth.

Integral Diagnostics is a key holding in the Firetrail Small Companies Fund that provides diagnostic imaging services to GPs, medical specialists and hospital groups. Integral Diagnostics has 91 sites across Australia and New Zealand that offer a range of imaging modalities including MRIs and CTs. The imaging services industry benefits from several structural growth drivers including:

- An ageing population

- Increasing incidence of chronic disease

- A shift to higher cost imaging modalities that increase diagnostic accuracy such as MRI and CT devices

- A more proactive approach to management of illness

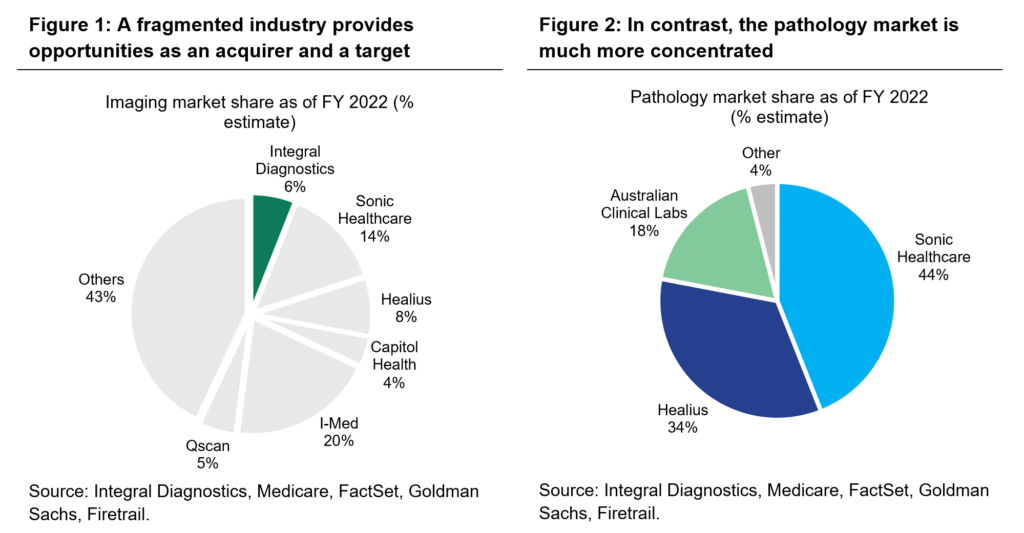

Large, high quality imaging players also have the potential to grow via acquisition. The industry is fragmented relative to the pathology market with 43% of the imaging market made-up of small independents relative to a mere 4% of the pathology market. Integral Diagnostics has been acquisitive having made five acquisitions since FY2020.

Whilst we believe Integral Diagnostics will continue to pursue an inorganic growth strategy, in the near term the company is focused on organic growth, increasing labor productivity and a recovery in EBITDA (earnings before interest, taxes, depreciation, and amortization) margins. Below we discuss two factors which we believe the market is missing when it comes to Integral Diagnostics expanding EBITDA margins over the medium term.

Artificial intelligence diagnostic tools to increase labor productivity

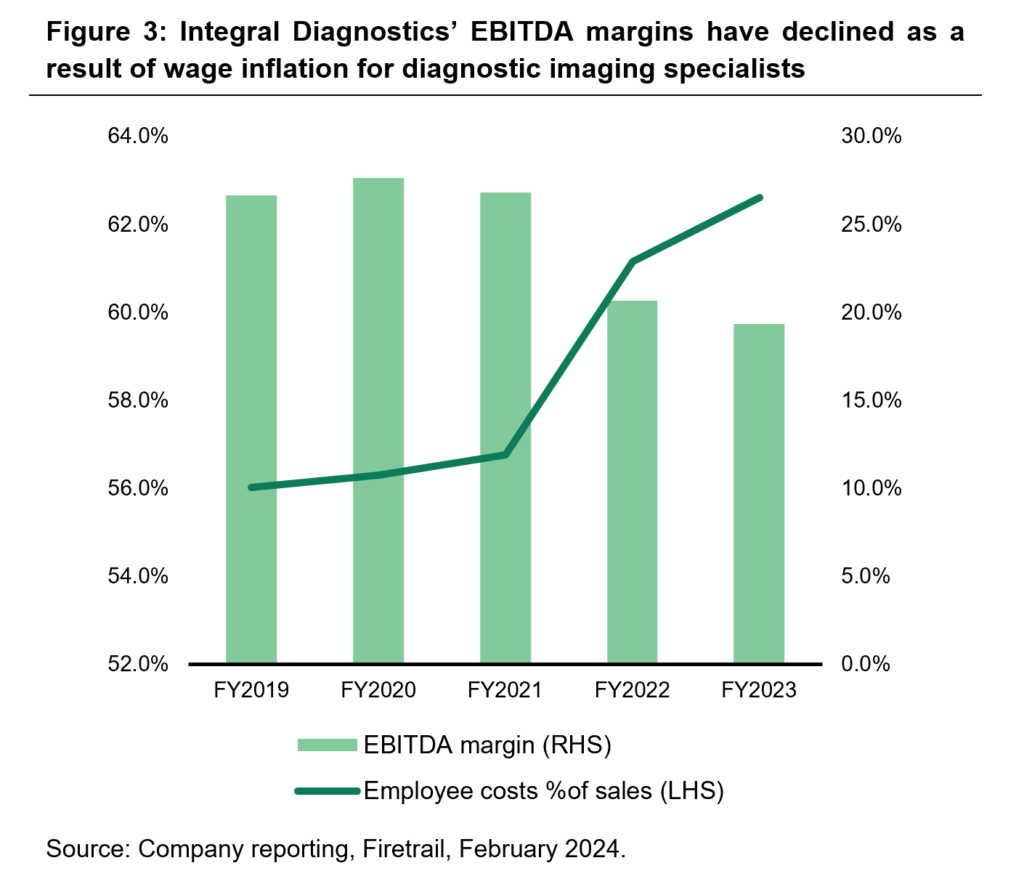

A shortage of radiologists, sonographers and nuclear medicine practitioners has driven significant wage inflation across Integral Diagnostics’ business. As the below chart shows revenue growth has not kept pace with the increasing wage costs driving substantial EBITDA margin declines.

Artificial Intelligence (AI) has the potential to materially improve labor productivity for large, high quality imaging players such as Integral Diagnostics that have made the requisite investment in technology and workflow systems. AI can be applied to scans to identify abnormalities and draw radiologists’ attention to areas of concern allowing for faster assessments.

AI diagnostic tools are currently being applied to high volume, low complexity scans such as ultrasound and X-Ray. Radiologists therefore have more availability to focus on higher cost, higher complexity images such as MRI and CT. MRI, CT and Nuclear Imaging are up to 8 times more expensive than an X-Ray scan.

Currently, 5% of scans assessed by Integral Diagnostics use AI diagnostic tools. The company expects the number of scans using AI to increase by 2-3 times over the next 12 months. A productive radiologist can get through 200 scans per day on average. As more AI tools become available and confidence in their diagnostic ability increases there is the potential to increase the scans assessed per radiologist 5-fold to 1,000 scans per day. A material tailwind to labor productivity if realised.

In addition, AI tends to be better at multi-tasking than a radiologist. Radiologists focus on a specific condition, organ, or region of the human body when assessing an image. AI may prove better at identifying abnormalities outside the original scope of testing, improving patient outcomes. The volumes will likely grow in tandem as further scans are required to verify the potential diagnosis. A more wholistic and proactive approach to diagnosing health conditions will help reduce the growing burden of an ageing population on the healthcare system.

Margin tailwind from Teleradiology

Teleradiology involves patient’s scans being sent to a radiologist, that is not on site at the clinic, for assessment. The radiologist may be working from a more centralised larger clinic or even from home. Having the ability to route patient images to different locations allows companies like Integral Diagnostics to better manage the supply of workers. In addition, Teleradiology provides less costly assessments with a 3-4% margin benefit from routing scans through this channel. Integral Diagnostics estimates approximately 15% of their imaging volumes are assessed via teleradiology. The company expects teleradiology to double to 30% over the coming years, improving both the supply of radiologists and reducing the cost per scan.

In summary, AI and Teleradiology present tangible ways for Integral Diagnostics to improve its labor productivity, imaging volumes and drive better margin outcomes over the medium term.

Companies mentioned are illustrative only and not a recommendation to buy or sell any particular security.