Decarbonisation is front of mind for investors, individuals, and companies across the world. Much of the focus is on the reduction of emissions – or ‘getting to net zero’. What tends to be overlooked is ‘how are we getting to zero’. Words are easy. Actions are harder.

In this insight we will analyse Firetrail’s engagement in two critical areas:

- Decarbonisation Solutions Providers

- Carbon Removal

Decarbonisation Solutions Providers are at the intersection of environmental action and financial outcomes. Without the tools to decarbonise, there can be no emissions reduction. Carbon removals are also important as an offset for currently hard to abate emissions on the path to zero. They will also be critical beyond net zero to cool the world down.

These issues are particularly pertinent to US-listed timberland owner Weyerhaeuser, a holding in our Firetrail S3 Global Opportunities Fund. We believe there is a lot of value that can be realised for the company. We have analysed the steps Weyerhaeuser is taking to demonstrate the value of its forests in decarbonisation, and provided some insight into the active role we are taking in helping them get there.

Forests – a carbon removal machine

Forests are the best natural carbon dioxide absorber. The process of photosynthesis enables carbon dioxide to be stored as solid carbon within trees. Half the mass of a tree’s trunk, branches and roots is stored carbon.

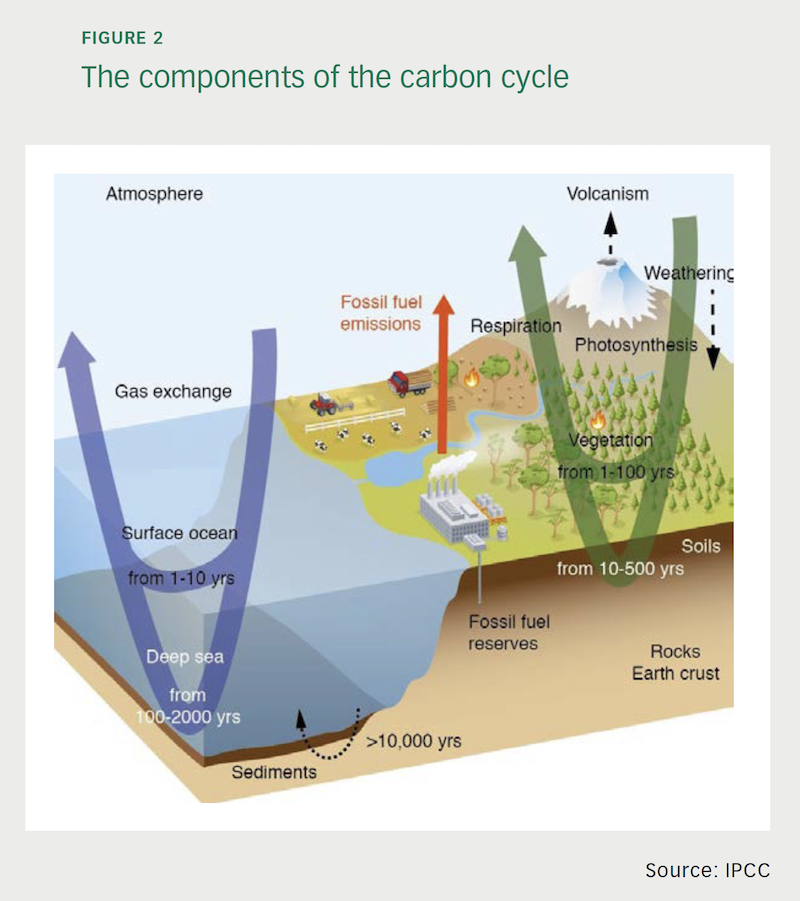

A hectare of pine trees – one of the fastest growing trees – can absorb up to 40 tonnes of CO2 each year in the right conditions. This compares to human based emissions of ~50 billion tonnes of CO2 equivalent per annum. Whilst we often refer simply to emissions from fossil fuels, it is important to remember that the carbon cycle has many components – including absorption by vegetation and oceans.

Weyerhaeuser is the largest private landowner in North America. It owns 11 million acres of sustainable forests across the Pacific Northwest, and South of the US. Not only are its trees absorbing carbon dioxide, but the land can also be used for renewable energy purposes (wind, solar), and below ground can be used for carbon capture and storage. The company is in the prime position for playing a role in the decarbonisation of the world.

Weyerhaeuser putting trees to work

Weyerhaeuser’s core business is the growing and harvesting of timber for use in home construction. Over the past year we have been pleased to see Weyerhaeuser increasingly invest in and start to realise the value of its environmental assets. It has created its Natural Climate Solutions business to focus on this opportunity, with the business being led by the former CFO of the business, Russell Hagen. A 2025 financial target of at least $100 million EBITDA has been set for the Natural Climate Solutions business.

The issues with accounting for Carbon Emissions and Removals

Even though US listed companies have been lagging other parts of the world with their emissions disclosures, Weyerhaeuser has been proactive with its emissions disclosures.

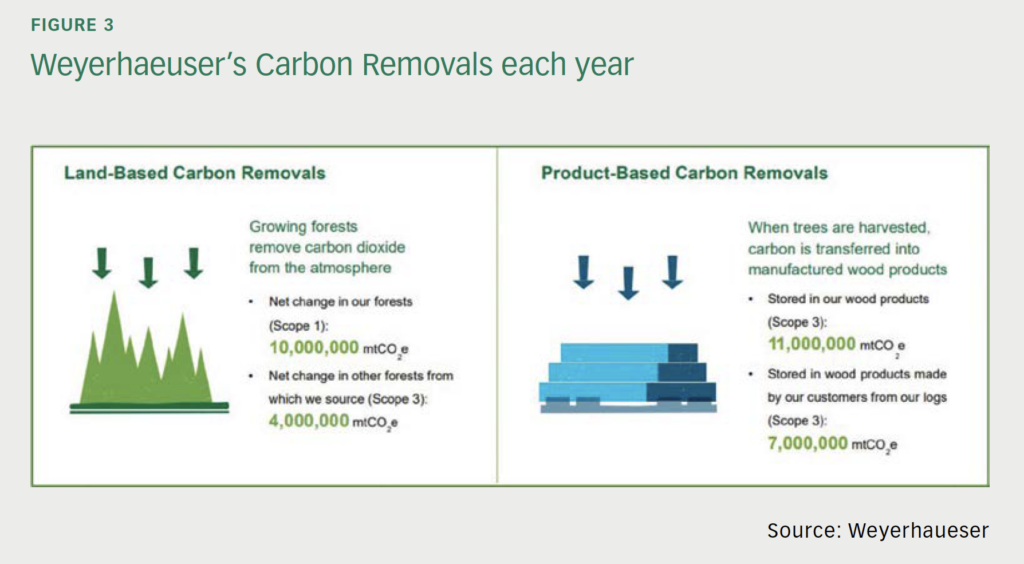

The company faces a unique issue in that it is one of the very few companies that is carbon positive – being that its operations remove more carbon dioxide from the atmosphere than it emits. ESG ratings agencies and data providers have been focussed on the collection and disclosure of Scope 1 and 2 absolute emissions of listed companies. This is the right approach for most companies – cement producers, steelmakers, airlines etc. But we believe that a company like Weyerhaeuser, that has measured its Scope 1 and 3 removals, should have this recognised by providers and the market. This is an area of discussion we have had with Weyerhaeuser.

The second issue is that under most accounting standards the harvest of wood counts as an emission. This is not for a reason of science, as the harvested wood often gets stored for hundreds of years. There are 18 million tonnes of carbon dioxide stored in the wood products created by Weyerhaeuser each year. When a harvested tree is used in construction the carbon dioxide is on average removed from the atmosphere for much longer than if a tree dies and decays in the forest. This is another issue we engage with the company on.

Realising the value of carbon

In 2021 Weyerhaeuser began the most recent part of its climate journey – being the monetisation of its trees for carbon offsetting. Weyerhaeuser has made the correct decision to only focus on the highest quality of carbon offsets. These are rigorous and certified offsets by organisations such as Verified Carbon Standard.

Carbon offset revenue can be earnt primarily from delaying harvests or skipping thinning and pruning. Weyerhaeuser’s first forest carbon offset project in Maine, USA, is in the process of being certified and will be earning carbon offset credits in the 2022 year.

Firetrail’s engagement to lead a better outcome

We continue to engage with Weyerhaeuser as they continue along their carbon journey. As a US listed company, with primarily US investors as shareholders, Firetrail have been able to engage in a unique dialogue by providing a global perspective on carbon. Our perspectives on carbon markets outside of the US, and the various trading schemes around the world, has resulted in productive discussions with the company.

Whilst the carbon price in the US is currently only ~$8 per ton, Weyerhaeuser is planning its business based upon emissions prices rising and converging towards prices currently seen in other markets (which in some jurisdictions are above $100 per ton). We believe this is the best course of action.

It is entirely plausible that we soon reach a point whereby Weyerhaeuser may earn more from keeping trees growing permanently for carbon, rather than harvesting them for timber. Our engagement with Weyerhaeuser has enabled us to quantify and value this opportunity. At higher carbon prices this would not only be a win for shareholders, but also a win for the world’s journey towards net zero.