Decarbonisation is one of the most important challenges of our time, but it is also often one of the most difficult to successfully invest in.

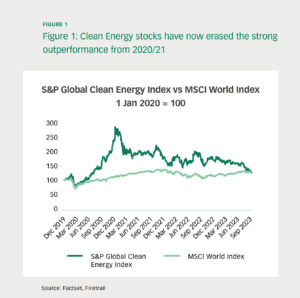

Renewable energy stocks have been among the most popular and talked about investments in recent years, thanks to low interest rates, government subsidies, and strong demand from consumers and investors who want to support a greener future.

However, valuations of these stocks became very expensive, reflecting their current leadership rather than their future potential.

In this article, we will explain why we have been cautious about investing in renewable energy stocks and where we see better opportunities in the energy sector.

What are the challenges?

One of the main challenges for renewable energy stocks is that they are very sensitive to changes in interest rates. Renewable energy projects have long-dated cashflows that depend on the future price of electricity and the cost of capital. When interest rates are low, these cashflows are more valuable and attractive to investors. However, when interest rates rise, as they have recently, these cashflows are discounted more heavily and lose some of their appeal. This is especially true for projects that rely on debt financing, which becomes more expensive as interest rates increase.

Another challenge for renewable energy stocks is inflation. Renewable energy projects often require large upfront investments in equipment and infrastructure, such as solar panels, wind turbines, and transmission lines. These costs are subject to inflationary pressures, which can erode the profitability of the projects over time. Recent downgrades of wind turbine manufacturers have demonstrated that costs have risen dramatically. This means that renewable energy projects need to generate higher revenues to cover their rising costs, which may not be possible in a competitive market.

A third challenge for renewable energy stocks is local regulation. Whilst there may be federal incentives, renewable energy projects often face opposition from local communities who do not want projects like a wind farm in their backyard. For example, wind farms can face resistance from residents who complain about noise, visual impact, wildlife disruption, and property value decline. Renewable energy projects may also face regulatory hurdles from environmental agencies, landowners, grid operators, and other stakeholders who have different interests and agendas. These factors can delay or derail renewable energy projects, reducing their expected returns.

However, the biggest long term challenge for renewable energy stocks in our view is that most renewable energy sources provide intermittent rather than baseload power. This means that they depend on weather conditions and cannot guarantee a constant supply of electricity. This creates a problem for grid stability and reliability, which requires a balance between supply and demand at all times.

Energy storage in batteries is often seen as a solution for this problem, but it still has a long way to go before becoming widespread and cost-effective. According to the International Energy Agency (IEA), battery storage capacity needs to increase by more than 40 times by 2040 to support the growth of renewables.

Opportunities: Where to invest?

Given these challenges, we have been looking for opportunities in both providers of existing baseload power from sources such as hydro and nuclear, as well as solutions for reducing energy demand.

One example of the latter held within the Firetrail S3 Global Opportunities fund is Schneider Electric, a French company that provides products and services for energy efficiency and management. This is a solution that can be implemented now, as an immediate solution.

Schneider Electric helps its customers reduce their electricity consumption and carbon footprint by offering solutions such as smart meters, sensors, software, automation, lighting, heating, cooling, and electric vehicle charging. Schneider Electric benefits from growing demand for energy efficiency solutions from various sectors such as buildings, industries, data centres, and infrastructure. Schneider Electric also has a diversified geographic exposure and a solid financial performance.

S3 Characteristics are important!

We believe that decarbonisation is important, but we also believe that we need to approach investing in the sector in a pragmatic way. We are not interested in chasing popular or overvalued stocks that may not deliver on their promises or expectations. We are interested in finding undervalued or overlooked stocks that offer sustainable earnings and cashflows, sustainable business models, as well as sustainable positive change.

As one company executive we met recently said: “One of the most important facets of sustainability is remaining a going concern”. We think this is very true in the current environment.