HVAC – the industry producing the most effective technologies to reduce greenhouse gas emissions.

Do you have an air conditioner installed in your home?

A mainstay of US and Australian households for decades, the air conditioner is now becoming a requirement for those that live in historically cooler climates. Global warming, a growing middle class and favourable regulatory support has meant that the Heating, Ventilation, and Air Conditioning (HVAC) sector is seeing significant demand growth. We expect to see additional market tailwinds from megatrends including urbanisation, demographics, resource scarcity, indoor air quality and climate change.

Heating and cooling the places where we live and work is responsible for 50% of all energy consumption in buildings and 16% of all global greenhouse gas emissions.

Improving the heating and cooling footprint of buildings will be key to meeting climate-related objectives of governments and corporations. It is one of the few areas where existing technology today can materially reduce emissions whilst also having a no impact on comfort or ambience levels.

It is important that as more HVAC units are installed, they are more efficient and less energy intensive than the legacy units. Technology continues to improve, and it is estimated that installing a new HVAC system is an easy way for households and businesses to reduce their emissions and energy bills by around 30%.

What is a heat pump?

A heat pump refers to an air conditioning system with both heating and cooling functions. They are powered by electricity and transfer heat using refrigerant. The key benefits of heat pumps include not burning fossil fuels, and one system being able to provide all the buildings heating and cooling requirements.

In the US, buildings have historically been heated by an oil or gas furnace in winter and a ducted air conditioner in summer. Ducted air conditioning is a central system where air is sent through ducts from one central location to heat and cool all rooms.

A heat pump can be ducted or ductless. In Australia the most common form of heating is a ductless heat pump or “reverse cycle air conditioner”. A ductless system has the benefit of being decentralised, cheaper to install and not losing efficiency as the air is transported.

Heat pumps will be vital for reducing carbon emissions

Heat pumps haven’t been popular in the Northern Hemisphere as the technology was not adequate for cold winters. This is no longer the case. Heat pump technology has now reached a point where it is adequate for most climates.

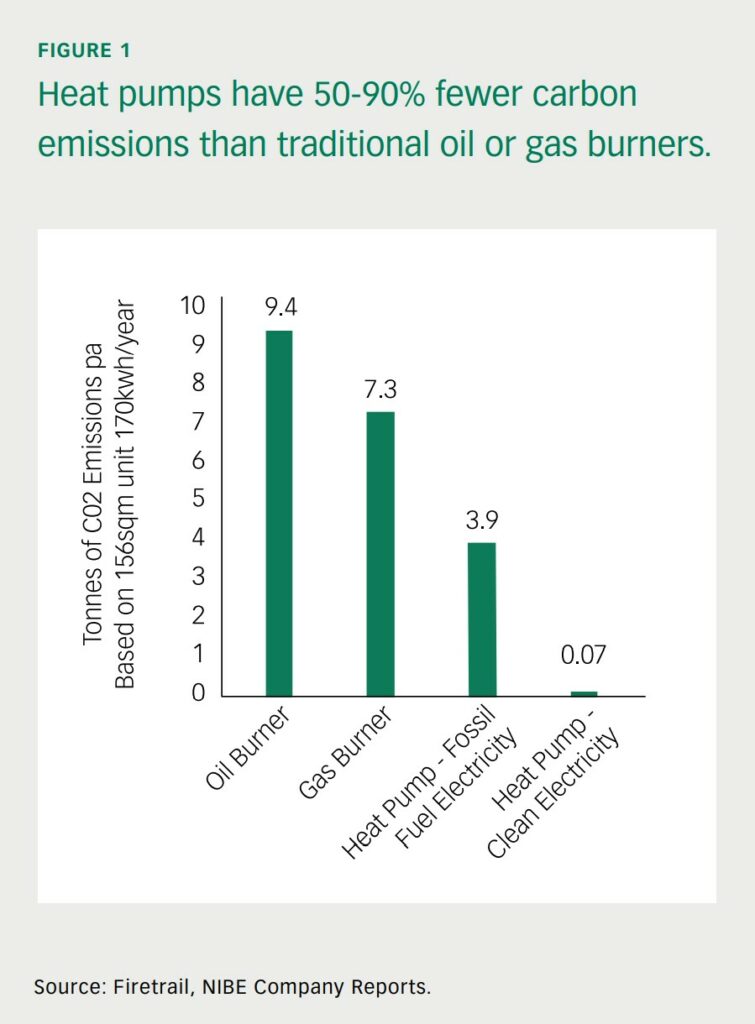

Figure 1 shows that heat pumps generate 50-90% lower carbon emissions than legacy oil and gas burners. Additionally, the high energy prices and subsidies being offered in both the US and Europe mean affordability is improving and payback periods have reduced.

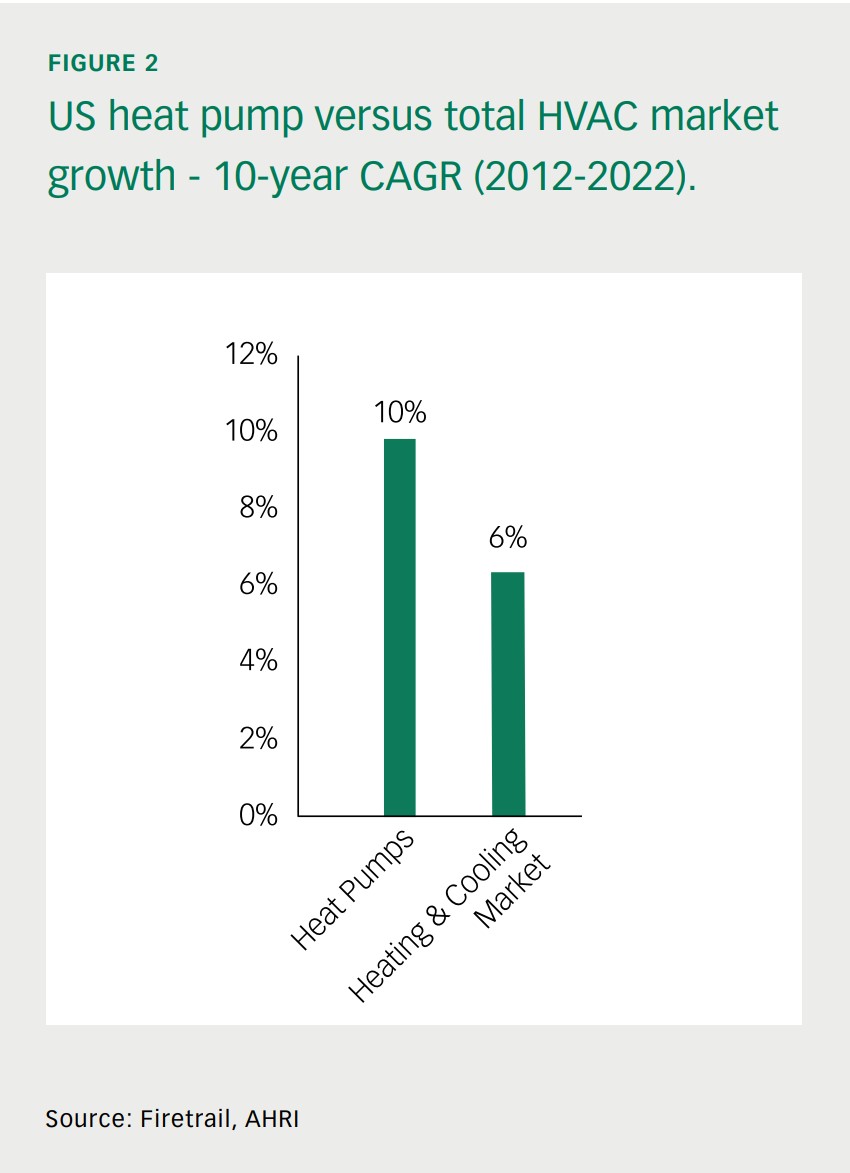

In the US, heat pumps sales are growing at twice the rate of standard air conditioners. Because of its superior efficiency, a heat pump can be priced at a premium in the market. This adds to our positive outlook for the industry.

As people spend more and more time indoors (today about 90% on average), the need for healthy and safe indoor environments is growing. This has been fuelled even more by the COVID-19 pandemic. HVAC companies also provide air purification tools and measurement systems which are further adding to the demand outlook.

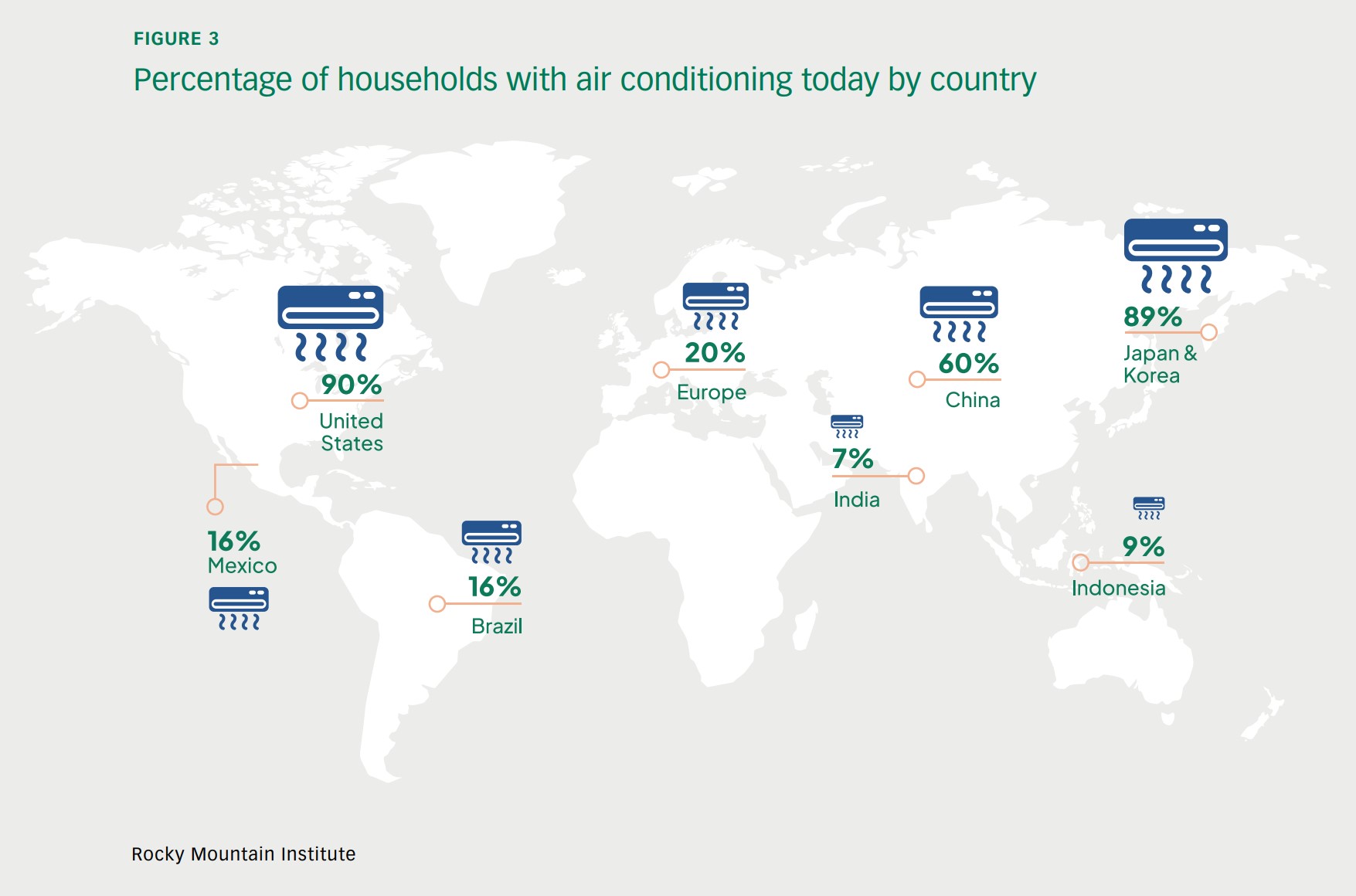

A market of only a few major companies

Over the last 50 years the HVAC market in the US has consistently grown at 5-6% p.a., as penetration has grown from around 25% in 1950 to around 90% today. This is much higher than in Europe, where we estimate HVAC penetration is only around 20%. Over time, we expect European and Asian HVAC penetration to trend towards the US, representing a growing market.

The US HVAC market is dominated by few companies – Carrier, Trane, Johnson Controls and Lennox. These companies have a combined market capitalisation of USD $130 billion as at March 2023. The US HVAC equipment market is estimated to be between $50-60 billion in size.

Faster market growth is underpinned by two key trends:

- Households and commercial properties are likely to increase the use of their HVAC systems (due to temperature changes), which will reduce the lifespan of installed units.

- Those that are replacing or purchasing a HVAC unit are likely to buy higher quality

(but more expensive) units, as more energy efficient systems become a priority to reduce emissions. Upgrading a legacy air conditioner and saving 30% on energy makes both environmental and economic sense.

An industry with a structural growth tailwind

For Carrier, Trane, and Johnson Controls, around 80% of sales are generated from the commercial end market – heating and cooling hospitals, schools, data centres. New residential exposure is only around 5% of group sales. This means that even if new housing volumes are down 30% the impact on the top line of these companies is less than 2%.

Our analysis indicates that the commercial market has a robust outlook due to warming temperatures. Additionally, commitments to decarbonisation for corporations is being supported by tightening regulation.

HVAC has benefitted from government regulation and monetary support from stimulus funding and incentives. In coming years, the HVAC sector is set to benefit from the Inflation Reduction Act (IRA) as well as the transition to more efficient refrigerants incentivising replacement of HVAC units over repair.

The US government has begun phasing out the higher global warming potential refrigerant 410A, starting with mandated supply reductions and a full phase out by 2025. This has caused the price of “repairing” a legacy system to increase from around USD$1,200 to $2,000 over the last year, a large increase when considering an entry level system (approximately 50% of the market) is $5,000.

This should continue to drive strong growth for sustainability-related areas in the HVAC market including intelligent/healthy buildings, indoor air quality (IAQ) and higher efficiency products like heat pumps.

A Health and Wellbeing positive change leader

Carrier had years of underinvestment due to being part of a conglomerate. Now a standalone company, it is better positioned with management focussed on providing the best energy efficient heating and cooling solutions in the industry.

30% of Carrier’s residential heating sales in North America are heat pumps, while 33% of its commercial heating sales globally are heat pumps (this is up from 15% five years ago and it projects it to grow to 50% within 5 years).

Carrier is the number one provider of commercial heat pumps in Europe and is seeking to leverage its manufacturing footprint in this geography as residential households migrate towards heat pumps. Taking full ownership of Toshiba’s HVAC business in mid-2022 is also expected to further accelerate Carrier’s leading global presence in both the residential and commercial end markets.

The business is well positioned for future growth. We expect that as management build a multi-year track record, Carrier will become known as a current leader in positive change. It is an ideal company for the Firetrail S3 Global Opportunities Fund with a sustainable business model contributing to positive change through lower emissions from heating and cooling solutions and improving air quality in buildings.