By Scott Olsson

Portfolio Manager

Last year Newmont, a large US-domiciled gold miner, paid a 35% premium to acquire Newcrest Mining in a cash and scrip deal. We held Newcrest in the Firetrail High Conviction Fund prior to the bid and maintained our holding in Newmont after deal completion. Newmont’s primary listing is on the NYSE but is now also listed on the ASX through a CDI structure.

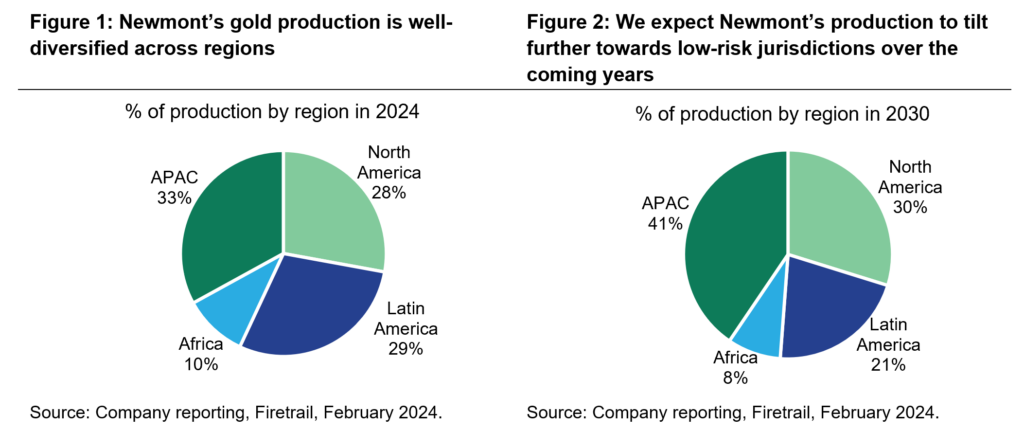

The combination of the two businesses cements Newmont’s position as the world’s largest gold miner, now responsible for 13% of global production. Newmont owns 20 mining assets that are well-diversified and mainly across low-risk geographies, as summarised in Figure 2 and 3.

The performance of Newmont has been disappointing since the announcement of the Newcrest deal. However, we believe the market has incorrectly extrapolated some short-term issues into the share price. In our view the current depressed share price presents an attractive opportunity for our investors.

Production outlook set to improve

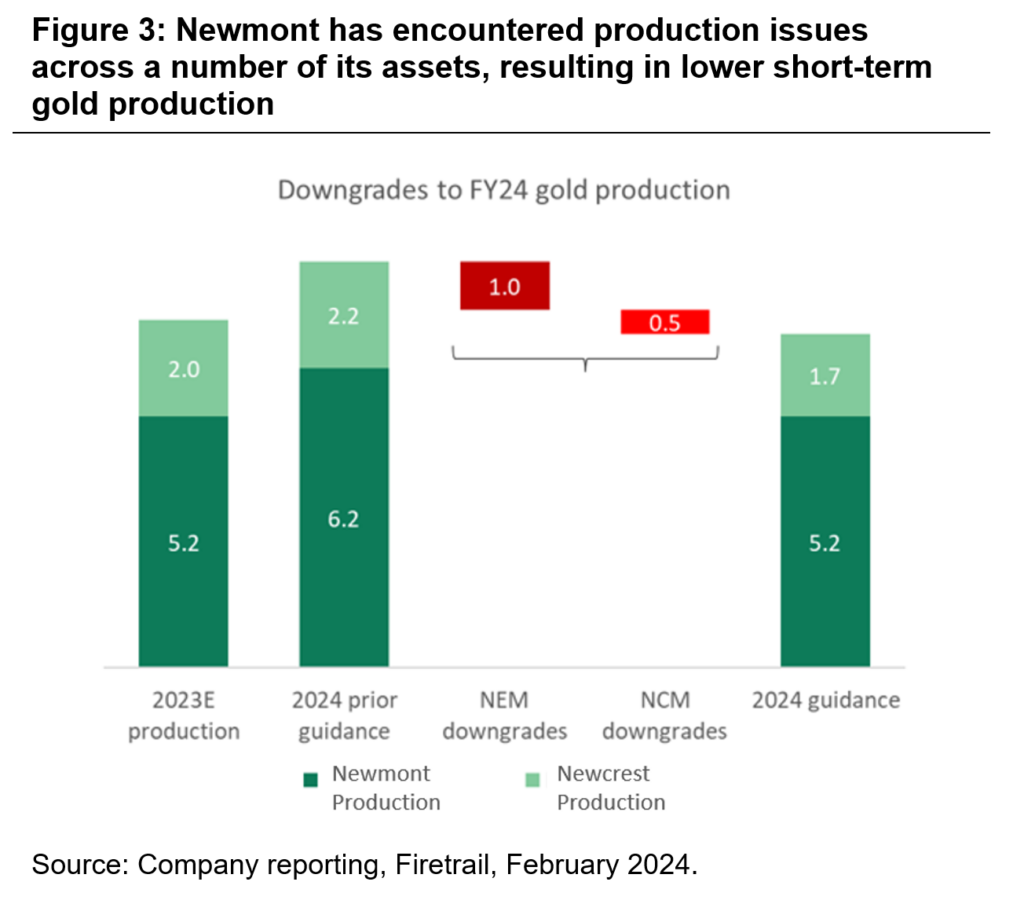

Over the past six months, Newmont has encountered production issues across a number of its assets. As a result, initial expectations for 8.4 million ounces of production in 2024 have been reduced by almost 20%. One third of the disappointment has been driven by recently acquired Newcrest assets and the remainder has been from Newmont’s existing business.

The outlook beyond 2024 is strong:

- We do not believe any of the issues permanently impair the value of any of the affected assets.

- We estimate that around half of the production issues have already been fixed.

- From our conversations with management and other industry contacts, we do not believe there are reasons for us to have any broader concerns around operational performance or controls at Newmont.

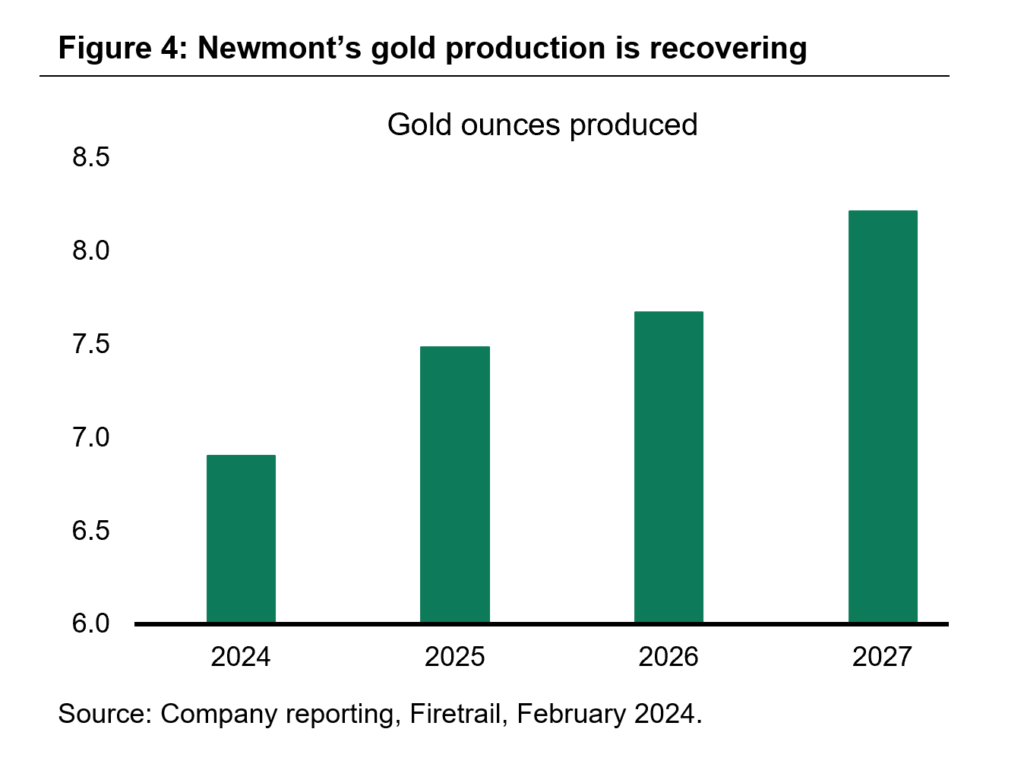

As a result, we forecast total Newmont gold production to progressively recover over 2024-27. This not only drives revenue growth of 6% per annum (at constant commodity prices) but will also logically lead to reductions in unit costs as assets return to efficient levels of operation.

Our confidence is underpinned by Newmont’s recently reported production of 1.68m oz (or 6.7m oz annualised) in the March quarter. With a number of assets still ramping up following disruptions, guidance for 6.9m oz in 2024 looks highly achievable or perhaps conservative.

Dividend cut is just the headline – focus on buybacks

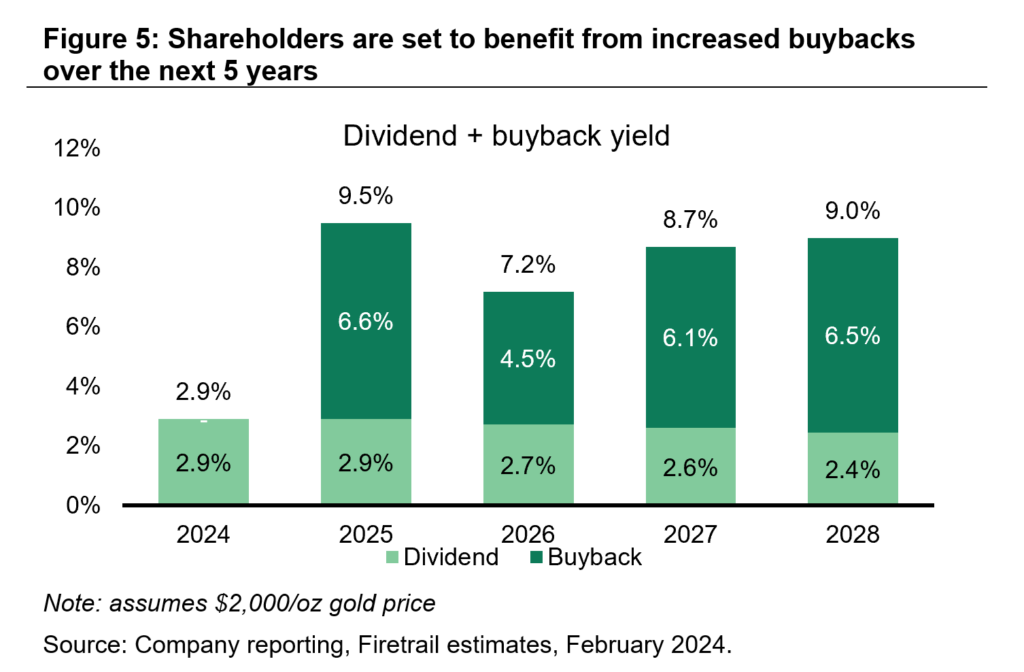

In February, Newmont rebased its dividend from US$1.60 per share to US$1.00 per share, a 37.5% cut. However, we are of the strong view that this merely represents a change to the method of capital returns to shareholders, rather than a reduction in the total quantum.

Going forward, Newmont has committed that once it reduces net debt to US$5bn, any additional cash will be returned to shareholders through buybacks. Based on our current forecasts and a US$2,000/oz gold price, we estimate that Newmont can commence buybacks early in 2025. Over 2025-28 we believe Newmont could repurchase more than 20% of shares on issue, amounting to total returns of shareholders of 8% pa.

If the spot gold price holds near current levels of US$2,300-2,400/oz, total returns to shareholders could be well above 10% p.a.

Asset sales on the way

Newmont has identified six non-core assets that it is seeking to sell across North America, Australia and Africa. We estimate the earmarked assets could fetch proceeds of at least US$2.5bn, however the number could be larger with US$5.7bn of assets classified as “held for sale” on Newmont’s balance sheet. Finalisation of some or all of those asset sales would open up earlier buybacks than 2025.

Valuation

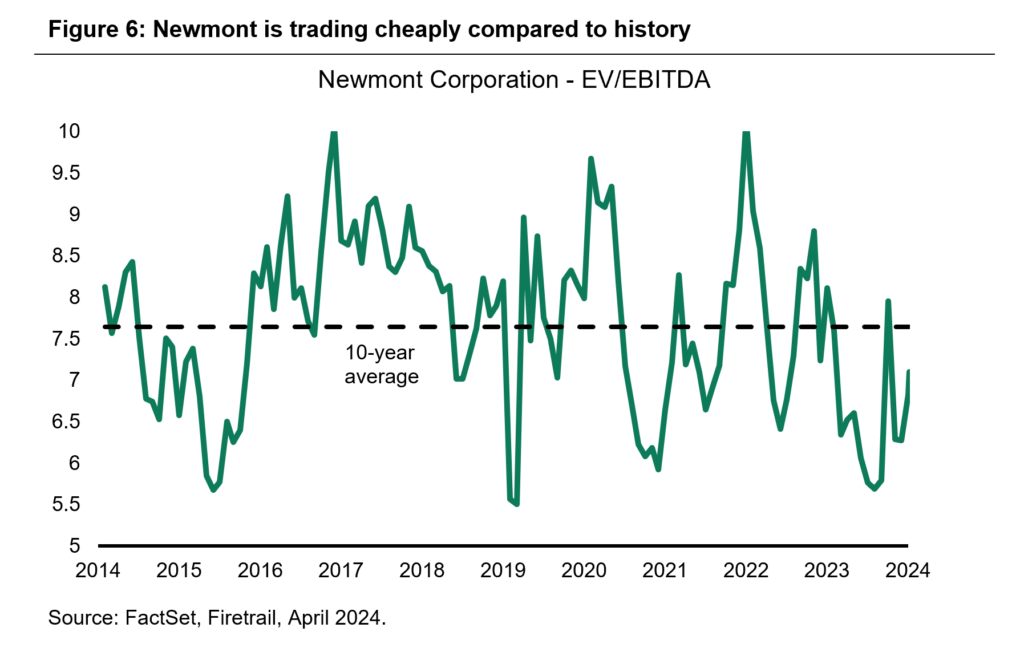

Newmont is currently trading at an EV/EBITDA multiple of 7x, which is towards the low end of its historic range and is only on a temporarily depressed 2024 earnings base. We believe there is a strong case for the multiple to re-rate as Newmont progressively demonstrates it has addressed production issues and begins to buy back shares. A premium multiple is warranted for Newmont given the quality (long life, low cost) and diversity of assets.

On a net present value basis, we calculate 30% upside to the current share price based on long-term gold price of US$2,000/oz. If the current spot price were to persist at $2,300/oz, the upside is 65%.