Firetrail ESG Insight: Carbon Capture and Storage

Carbon Capture and Storage (‘CCS’) is the most debated topic in climate discussions right now. On the one hand, some view the technology as unproven and expensive. Others believe CCS is the only solution to reducing emissions in some sectors.

At Firetrail, our research has led us to conclude that CCS technology can reduce carbon emissions in ‘hard to abate’ industries and is critical to meeting net zero targets.

In this Firetrail ESG Insight, we take a deep dive into the CCS process, provide case studies of where the technology has and has not worked, and outline why CCS can reduce emissions for Australian energy company Santos on their quest for 2040 net zero targets.

Carbon Capture and Storage 101

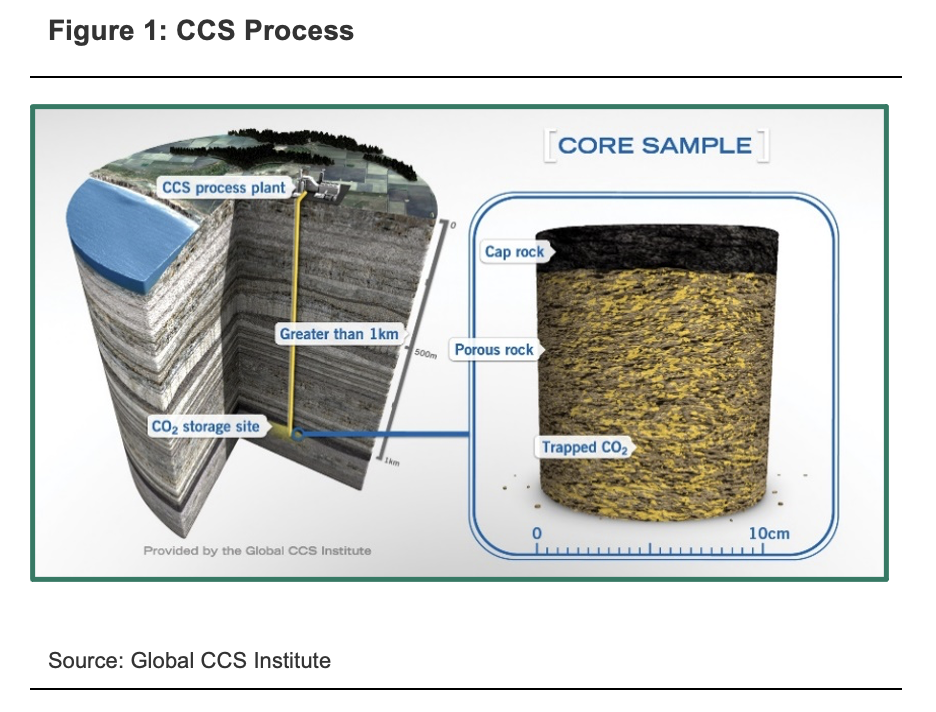

CCS involves capturing carbon dioxide (CO2), compressing it for transportation, and injecting it deep into a rock formation for long-term storage.

CCS is a three-step process that involves:

- Capturing carbon dioxide (CO2) at the emission source. CO2 is separated from the other gases that are produced during the industrial process. These fugitive (quick to disperse) emissions contribute approximately 6% of total greenhouse gas emissions globally.

- Compressing it for transportation. The CO2 is then compressed and transported via pipelines, trucks, or ships to the storage site. Potential sites can include depleted oil and gas reservoirs or saline aquifers.

- Injecting the CO2 into a rock formation for long-term storage. The carbon dioxide is stored in permeable rock formations that are typically located at least 1km underground. The CO2 is then sealed within the earth with a cap rock to prevent leakage (see Figure 1 below).

CCS is particularly effective in capturing emissions that are produced from stationary energy sources and ‘hard to abate’ processes including cement, steel, fertiliser, and the operations of oil and gas facilities.

Is CCS a reliable technology?

Our analysis suggests that CCS is a proven technology with strong merits to help companies and economies transition to a lower carbon world.

Below we provide two case studies that illustrate where CCS technology has and hasn’t worked. Our conclusion, following months of research and consultation with a variety of experts, academia and industry bodies is that CCS is a reliable and economical technology under the right conditions.

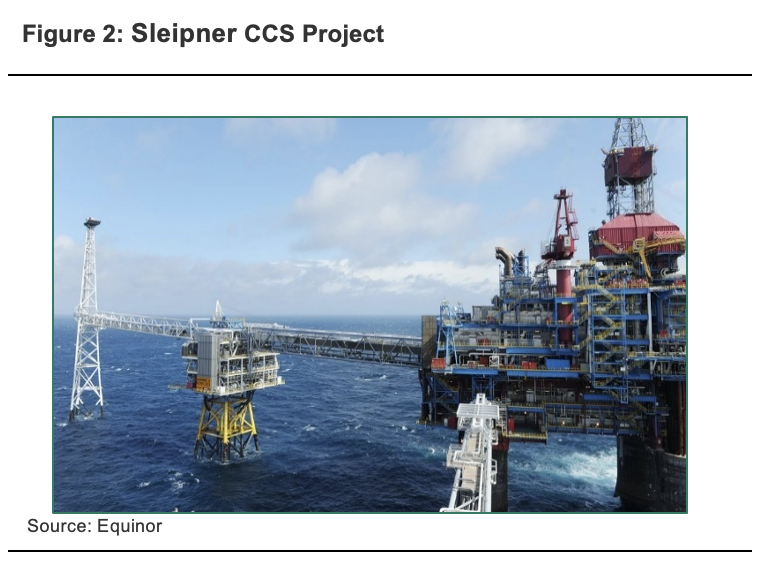

CCS Case Study #1 – Sleipner project

The world’s first CCS project, ‘Sleipner’, provides a case study for the reliability of CCS technology. For over 20 years, the Sleipner CCS project has successfully stored CO2, 250km offshore, in a 1km-deep saltwater aquifer located in the North Sea (see Figure 2 below).

Sleipner was built on the back of the 1991 Norway carbon tax. Providing an economic incentive to reducing the carbon intensity of oil and gas operations in the country.

Since 1996, Sleipner has been successful in capturing and storing fugitive emissions with no leakages being detected. Norway has proven that CCS works, and that CO2 can be stored safely over long time periods

CCS Case Study #2 – Gorgon project

The Gorgon gas facility in Western Australia is the world’s largest ‘dedicated’ CCS project. Purely devoted to reducing carbon emissions (not Enhanced Oil Recovery). The project was heavily backed by Chevron, Exxon Mobil, Shell, and the WA Government.

Gorgon is often referred to as a CCS project failure. Based on our analysis the key issues with the Gorgon project were:

- A poor choice of reservoir.

- Complex design that required large amounts of residual water and sand to be pumped out before CO2 could be injected into the wells.

- Excess substances and design complexity resulting in corrosion and clogging of gas pipes.

The result was an increased in costs and delay in operations. To date, the plant has been running at 50% injection capacity (since 2019). Whilst the project remains the poster child for CCS as a failed technology, it was difficult for us to locate any more examples of projects that have failed.

Does CCS leak?

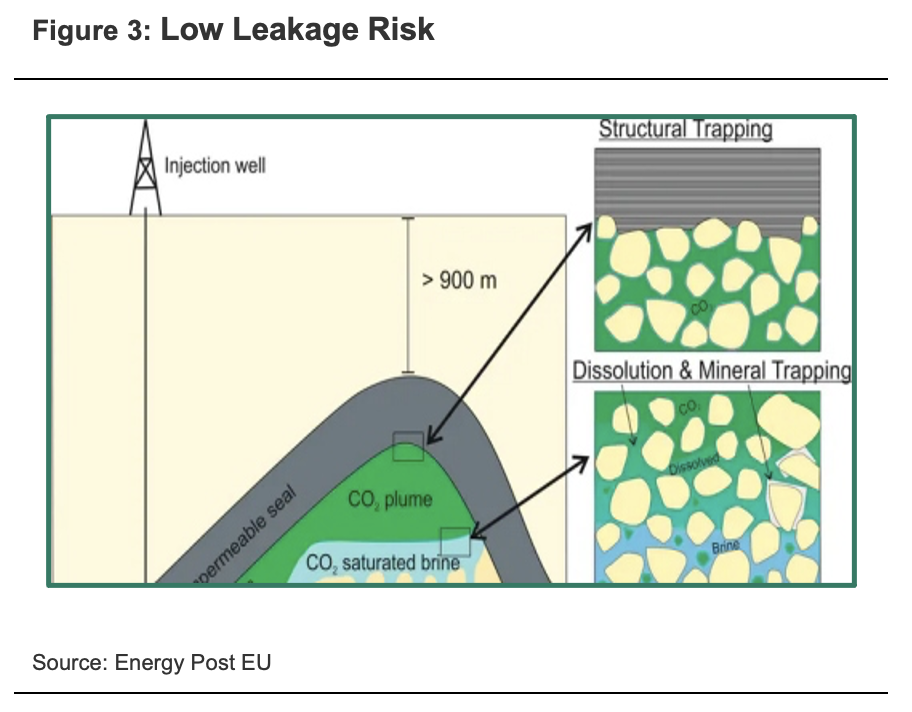

We found no evidence to suggest leakage risks are an issue in CCS technology. In fact, our analysis of CCS projects globally found the potential for leakage from the transport and long-term storage of CO2 is minimal. However, the Gorgon project highlights that without the right infrastructure, location and geological conditions, CCS projects can be uneconomic.

Infrastructure, location, and geological conditions key to successful CCS projects

Globally, there are 27 fully operational CCS facilitates. Based on our analysis of these operations, the most economical and successful CCS projects:

- Have a pure CO2 stream from existing infrastructure

- Are situated close to the storage location

- Use depleted oil or gas reservoirs for storage

Australia has a competitive advantage in CCS technology

In Australia, we have a prevalence of geological storage basins which are conducive for the storage of CO2. Many of these basins are located within a proximity to high emitting projects, which significantly reduces transport costs and leakage risks.

Oil and gas reservoirs stored hydrocarbons naturally for millennia. They are capped by large ‘seal rocks’ (see Figure 3) which reduces the risk of leakage. Evidence suggests that 98% of CO2 stored in these reservoirs will remain sequestered for ten thousand years.

Santos invests in CCS technology to reduce carbon impact

Santos is committed to reaching net zero Scope 1 and 2 emissions by 2040. A key element of their strategy is CCS technology in two key projects:

1. Moomba CCS project

Santos has a $220 million CCS project in development at Moomba with operations expected to commence in 2024. Here, they plan to store more than 1 million tonnes of CO2 each year at a life cycle cost of A$25-30 per tonne.

Firetrail believes the project meets the criteria for successful implementation of CCS technology. In addition to storing Santos’ carbon, we believe Moomba will act as a CCS ‘hub’, injecting over 20mtpa across the Cooper Basin once they start to receive additional flows of CO2 from third parties.

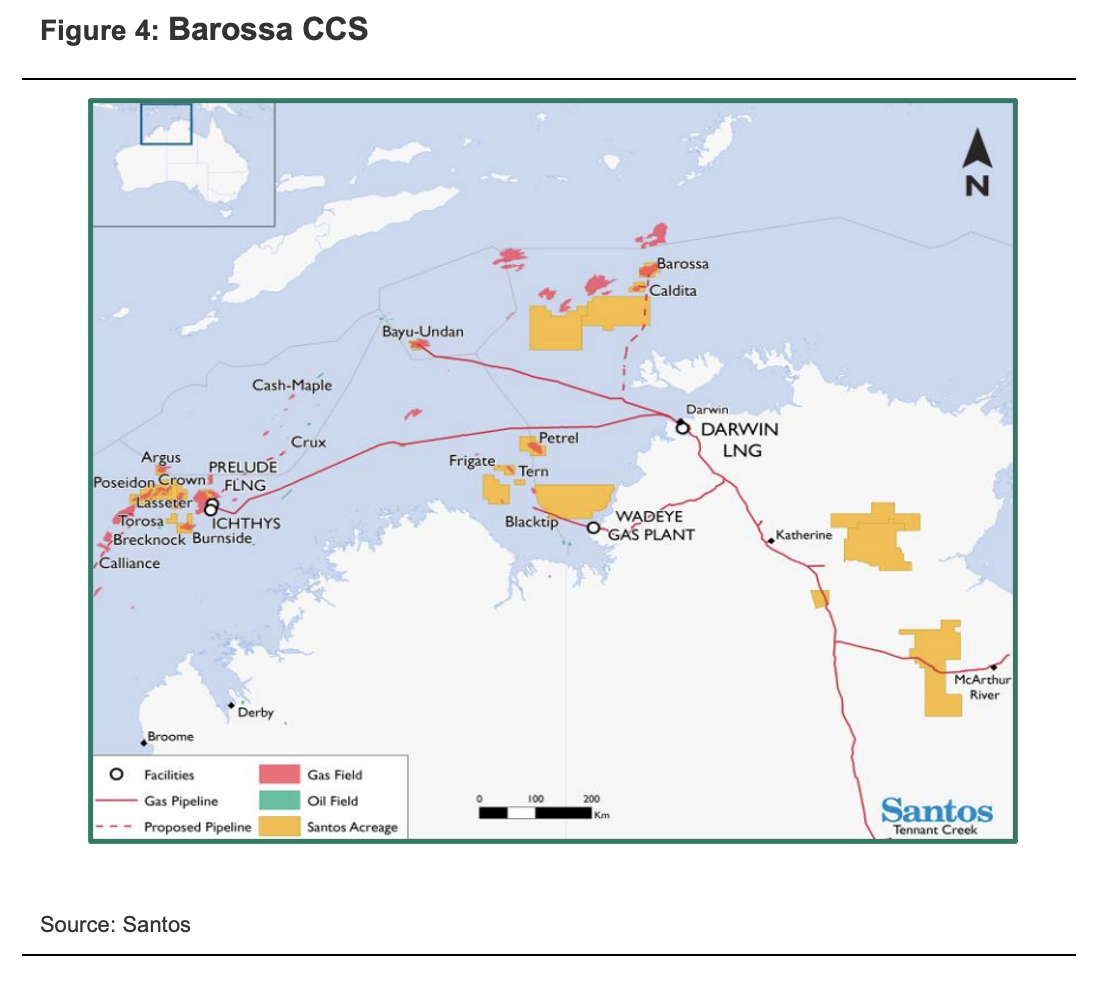

2. Barossa LNG CCS Project

The second key project is Santos’ new LNG gas field at Barossa. The project is expected to be carbon intensive. In fact, it will be the highest emitting CO2 LNG project in Australia. As such, finding solutions to reduce carbon intensity from operations Barossa LNG will be key for Santos to reach their 2040 targets.

Firetrail have actively engaged with Santos on the project and conducted our own research and believe CCS is a good solution. The key advantages of the project are access to infrastructure and proximity to oil and gas operations.

Looking at the map in Figure 4 below highlights the opportunity for CCS in the region:

- Barossa gas will be transported to the Darwin LNG plant

- The Darwin LNG plant will strip CO2 to inject directly into the soon to be depleted Bayu-Undan gas field.

- Ichthys gas field located west may provide 3rd party tonnes of CO2 to improve the economics of the CCS project and further reduce carbon intensity in the region.

Conclusion

Carbon Capture and Storage (CCS) technology is a hotly debated topic. Our research shows that CCS is a proven technology that can reduce the carbon footprint of ‘hard to abate’ industries.

Australia has many of the right conditions for successful and economic CCS projects including significant infrastructure and depleted reservoirs. Santos’ commitment to CCS is critical to meet their 2040 net zero commitment.