Getting to net zero emissions is a sizeable challenge. As investors in global companies, we ask ourselves: how can we contribute to and benefit from the transition to a lower carbon future?

Traditional ESG strategies address the net zero challenge simply by excluding high emitting companies from their portfolios. In this article, we outline the risks of this approach. We then outline a different approach we believe will lead to superior investment and climate outcomes.

Where are the emissions?

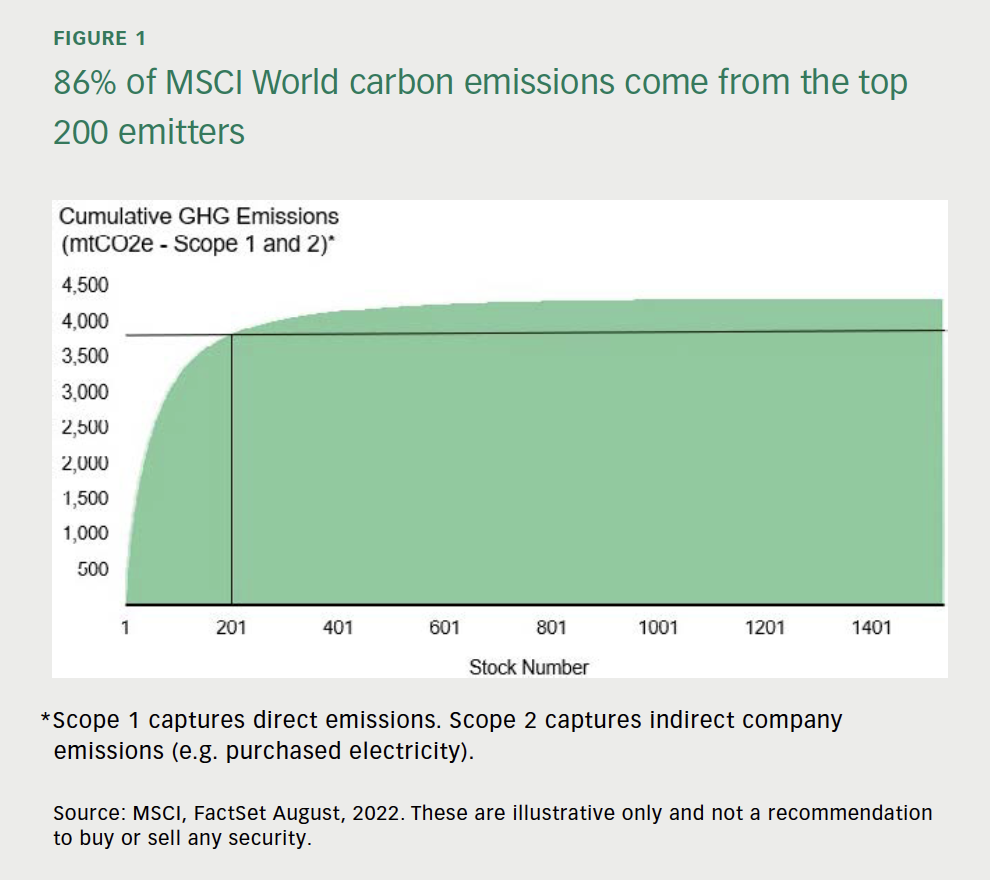

The vast majority of current global carbon emissions are concentrated in a small number of companies. In fact, out of over 1,500 MSCI World Index constituents, 86% of all Scope 1 and 2 emissions come from just 200 companies.

But what are the implications of strictly excluding higher emitters from portfolio consideration? What exposures are introduced? And what opportunities may be foregone?

Relative exposures

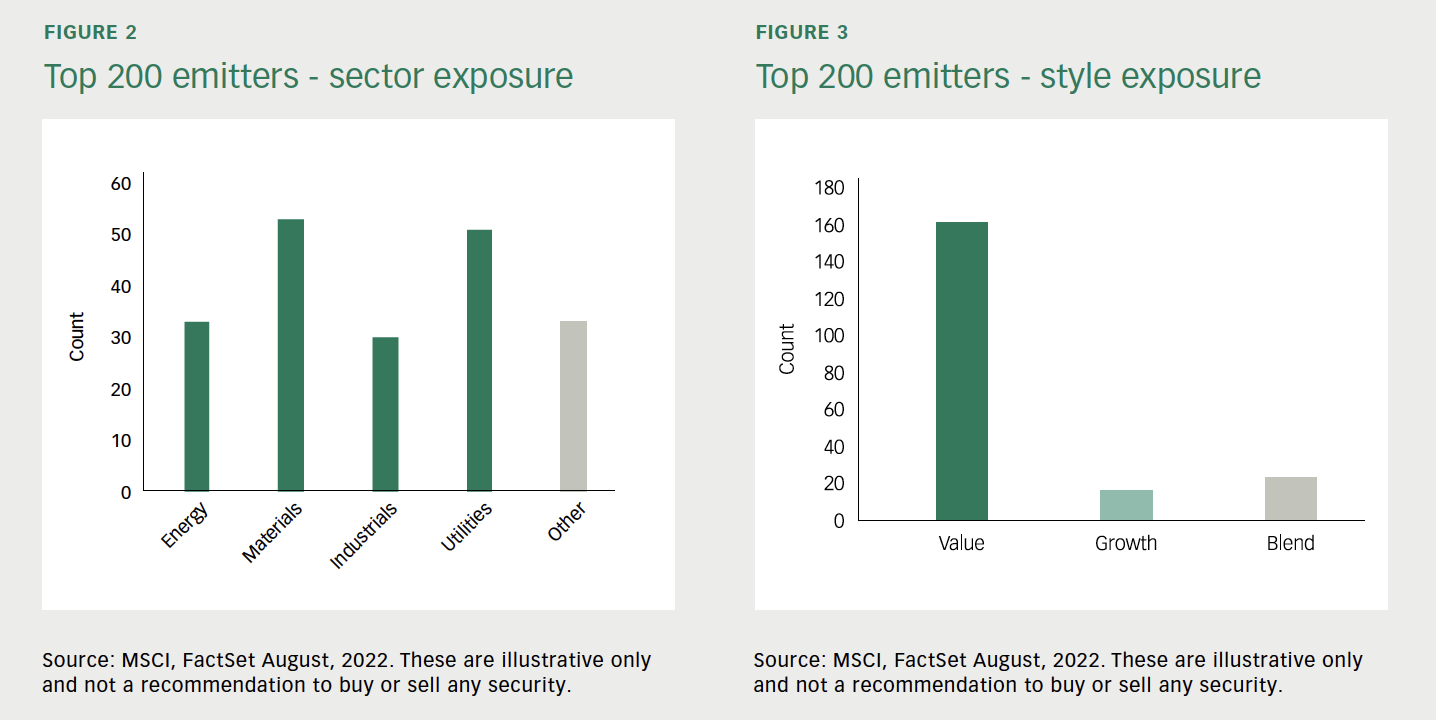

As you might expect, the top 200 emitters are concentrated in a small number of sectors. 167 of the 200 companies operate in the Energy, Materials, Industrials or Utilities sectors.

Using the MSCI World Value and Growth indexes to identify style exposures also shows a clear skew. 161 of the top 200 emitters have Value characteristics, 16 have Growth and 23 have a blend of both styles.

Value companies are currently responsible for 84% of total index emissions. While some of these companies may be trading at justifiable discounts due to their carbon risk, excluding them can result in a portfolio with a significant Growth style bias.

The Key to Achieving Net Zero

If 90% of emissions come from the top 200 emitters, reducing the carbon footprint of these companies is the key to achieving net zero.

In other words, transitioning the global economy to a net zero future will be driven by:

- The successful transition of heavy emitting industries (e.g., transport), and

- The development of key enabling technologies (e.g., electric vehicles, green hydrogen).

Opportunities in reducing carbon footprint

The decarbonisation options available and the cost of decarbonising will be different for each company. Not all will represent attractive investment opportunities. However, in our experience some of the greatest investment opportunities occur when companies go through ‘positive change’.

A company significantly reducing its carbon emissions is one such example of positive change, whereby lower emissions lead to:

- lower climate risk;

- more resilient future earnings; and

- higher valuation multiples.

With the market slow to recognise positive change, these opportunities can help to drive portfolio outperformance as well as carbon reduction.

Opportunities in low carbon enablers

Whilst a carbon footprint measures the negative impact of a company’s emissions, a carbon handprint measures the positive environmental impact of a company’s products.

In addition to reducing their own emissions, many companies are also involved in enabling others to reduce theirs, through innovative technologies and solutions. These companies can also represent attractive investments where demand for their products and services are increasing and may not yet be fully reflected in valuations.

Firetrail S3 Global Opportunities Fund

In the Firetrail S3 Global Opportunities Fund, rather than avoiding the problem by excluding all high emitters, we search for underappreciated opportunities that can drive real change.

Whilst their current carbon footprints may be higher than the market average, these companies come with significant scope to drive progress towards a lower carbon future.

Importantly, we engage with companies to understand their carbon reduction plans. While longer-term net zero targets are an important first step, we focus on fundamentally measuring the specific near-term reduction potential across our portfolio.

We also look to invest in a mix of both Value and Growth companies so that portfolio performance is not dominated by swings in style returns.

- For the Firetrail S3 Opportunities Fund, we manage our carbon exposure by:

Measuring and constraining our current carbon footprint; - Working with portfolio companies to understand their tangible short-term carbon reduction plans;

- Based on these concrete plans, projecting our future reduction in emissions over a 5-year time frame.

This allows us to appropriately balance our current emissions with the future investment opportunities.