By Matthew Fist

Portfolio Manager

Why now is the time to diversify with active small caps

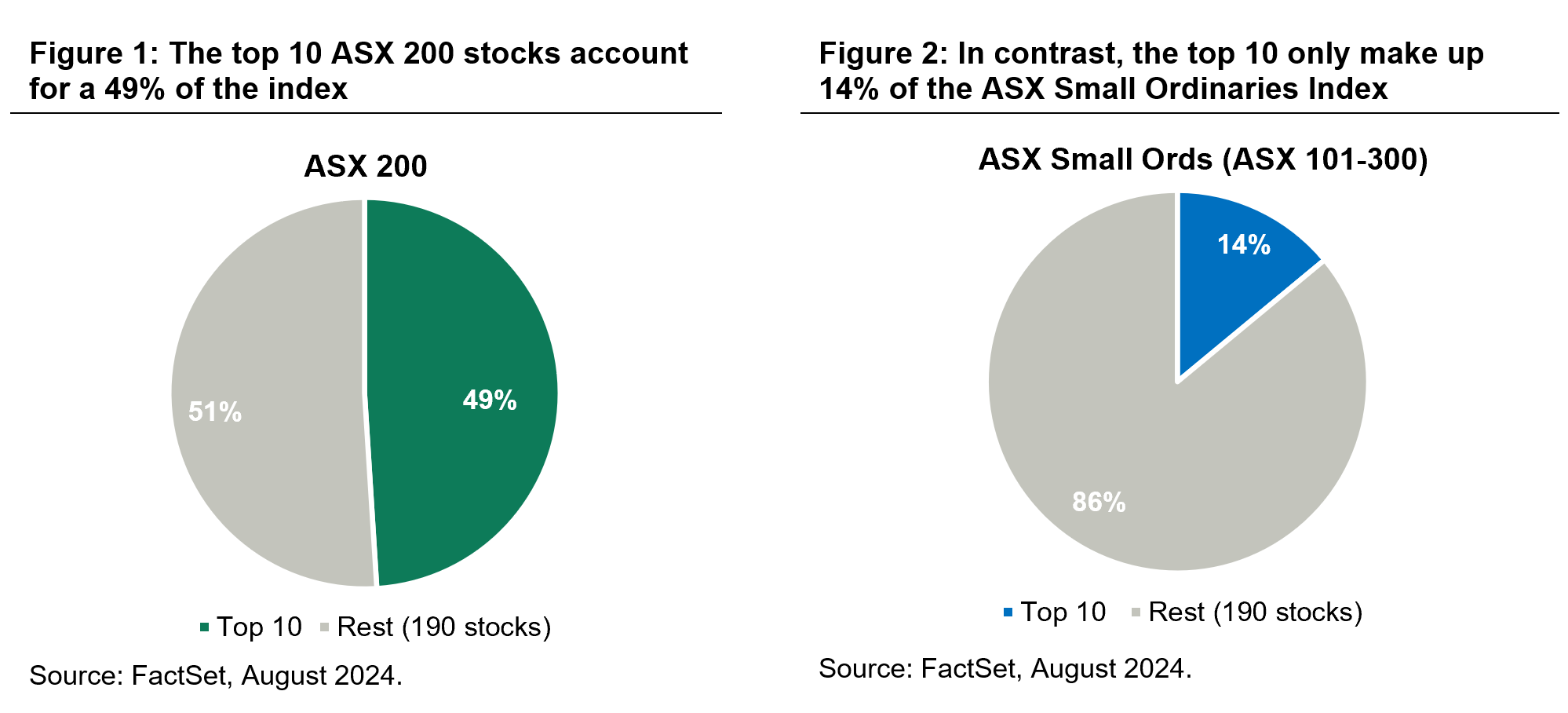

In recent times, much has been made of the growing concentration of the S&P 500 index; now at is at its highest level in 30 years. The top 10 stocks now make up 35% of this benchmark. For Australian investors however, concentration risk is nothing new. The top 10 stocks in the ASX 200 account for a whopping 49% of the index. In contrast, the Australian small caps market is much more diversified. The top 10 companies in the ASX Small Ordinaries Index make up just 14% of the Index.

Portfolio concentration is fine when the dominant companies are performing. In the past several years, investors have benefited from a period of strong returns from the ASX giants. But when these large companies underperform, concentration creates a huge headwind to returns.

We believe investors should be asking the question “how would my portfolio perform in an environment where the top 10 ASX stocks lag the market?” Below, we outline why now is the time for investors to consider improving their equities portfolio diversification with active small caps.

1) Hard to see value in the ASX 10

Today, 49c of every $1 invested in the ASX 200 goes to ten companies. When considering the outlook for the ASX200, the outlook for these ten companies is all that matters.

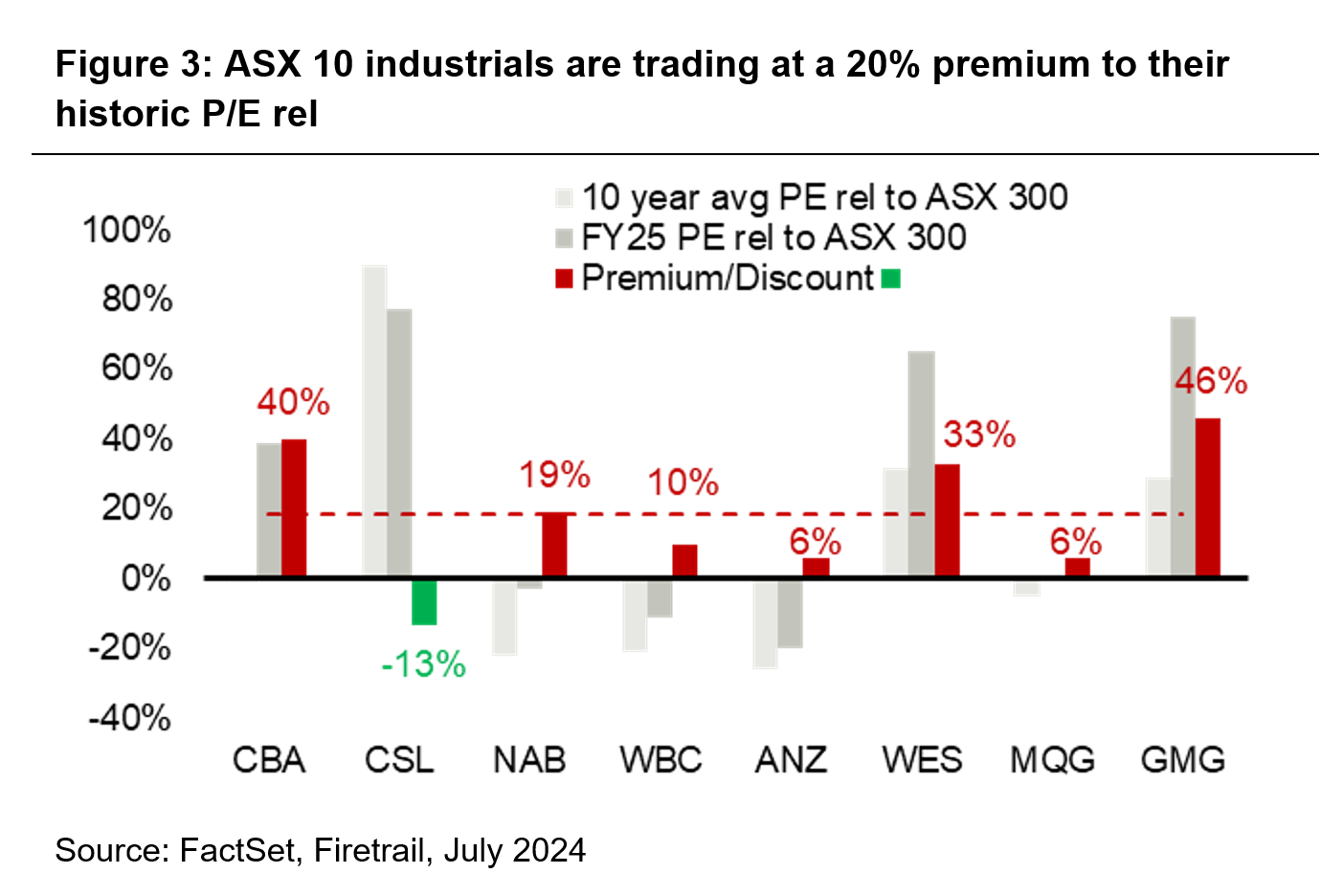

We don’t have a crystal ball, but we believe the best predictor of future investment returns is the price you pay today. Today, the largest companies on the ASX 10 look extremely expensive. On average, the top 10 ASX industrial stocks are trading at a 20% premium to their history. For example, Commonwealth Bank (CBA) has historically traded at a slight discount to the ASX 300. Today it is trading at a 40% premium! All else equal, if CBA was to normalise back to its historical valuation, the stock would fall 29%.

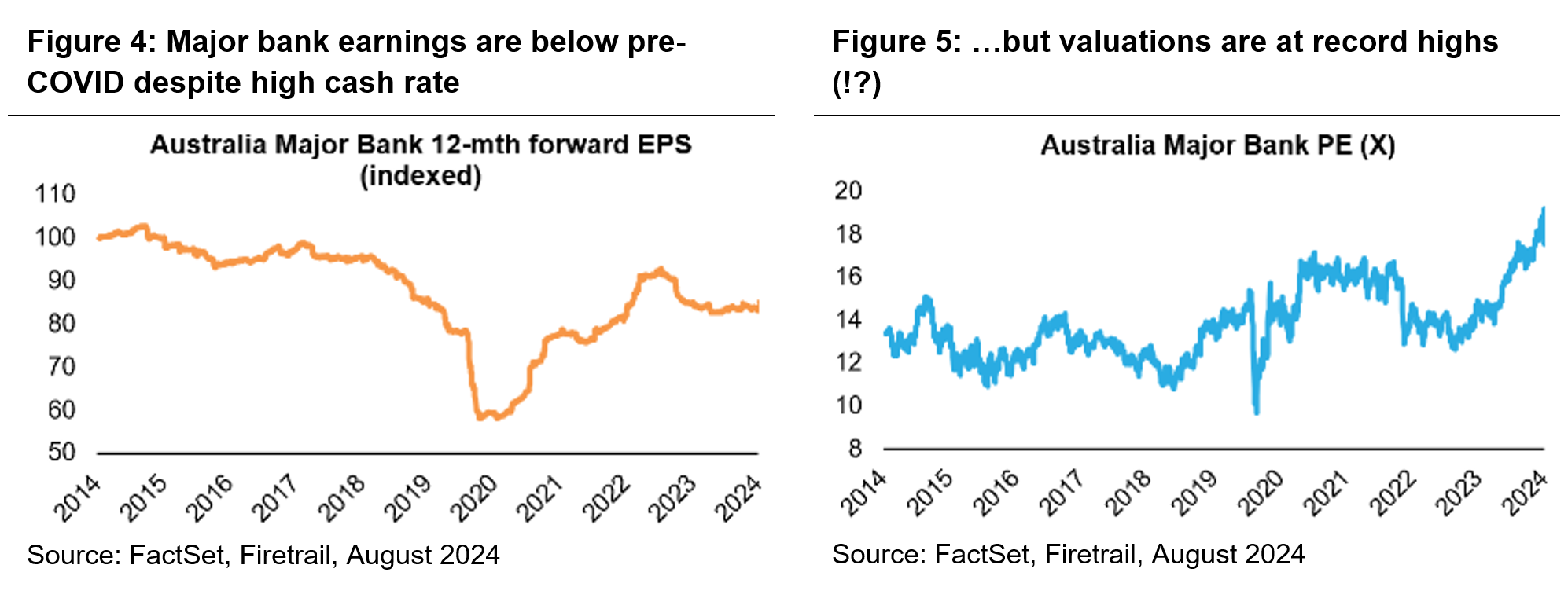

Elevated valuations are justified if there is a robust earnings outlook to support it. Zooming in on the major banks, eye-watering multiples are not backed up by improving earnings. In fact, major bank earnings are below FY19 levels despite the benefit of high interest rates. Its hard to see earnings growth over the next few years with elevated competition and bad debt risks, and interest rates more likely to move down than up.

Even the two resources companies in the ASX 10, BHP and Woodside, have challenging outlooks ahead. Both are facing declining production profiles and increased reinvestment. After a period of uncharacteristic M&A discipline that has been fantastic for returns, M&A is firmly back on the agenda. If history is any guide, we believe this will not be positive for shareholders.

In Firetrail’s large cap fund (Firetrail High Conviction Fund), we are finding much better opportunities outside the ASX 10 and are deeply underweight. Is the ASX 10 where you want to be allocating 49c of every investment $1 for the coming years?

2) Active small companies have delivered when the ASX 10 is underperforming

With ASX 10 fundamentals weak and valuations elevated, now is the time to consider improving your Australian equities portfolio diversification.

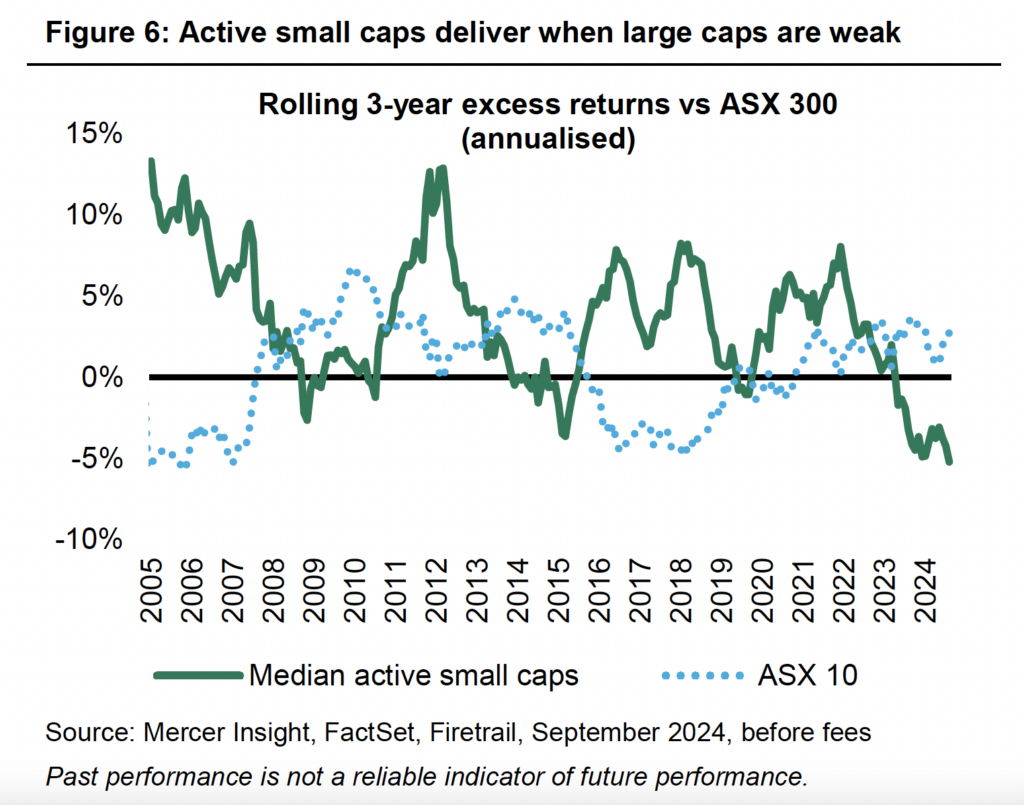

Figure 6 highlights that the ASX 10 goes through cycles of outperformance and underperformance relative to the ASX 300. In periods where the ASX 10 has underperformed, the median small caps manager has delivered 6.2% p.a. (before fees) outperformance over the ASX 300.

For those that don’t believe in market timing (Firetrail included), this data also highlights the value of a long-term buy and hold allocation to active small caps. The median active small caps manager has outperformed the ASX 300 in 82% of rolling 3-year periods, with average outperformance of 3.9% p.a. (before fees).

For those that don’t believe in market timing (Firetrail included), this data also highlights the value of a long-term buy and hold allocation to active small caps. The median active small caps manager has outperformed the ASX 300 in 82% of rolling 3-year periods, with average outperformance of 3.9% p.a. (before fees).

3) Valuations for small caps are extremely attractive

So what is the outlook for Australian small caps? Contrasting the ASX 10, the data indicates the valuation and earnings growth outlook for Australian small caps is very attractive.

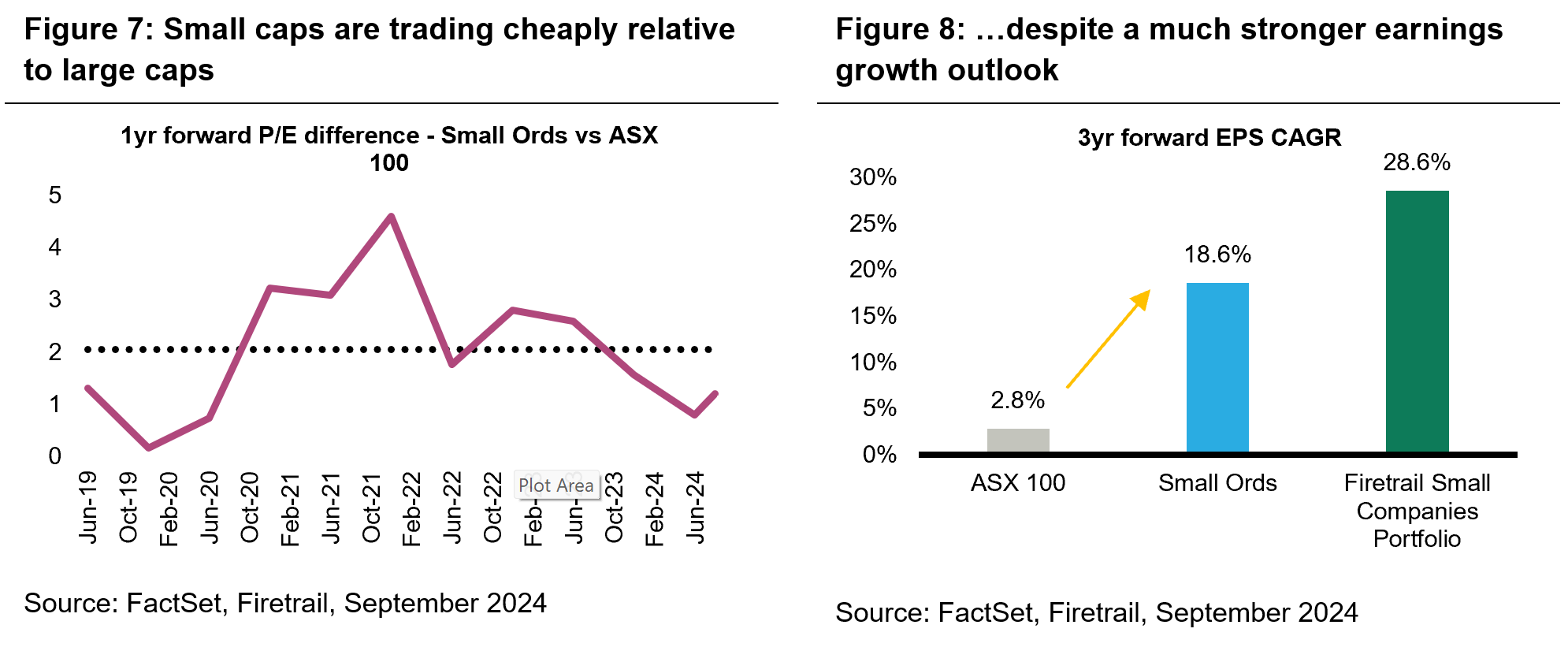

Aussie small caps are trading below their average historical valuation relative to large caps. At the same time, small caps are expected to deliver 18.6% p.a. earnings growth over the next 3 years, versus just 2.8% p.a. from the ASX 100 (weighed down by the anaemic growth outlook for most of the ASX 10).1

Highlighting the big opportunities for active managers in the small cap market, the Firetrail Australian Small Companies Fund portfolio is trading on a lower P/E ratio than the ASX Small Ordinaries index but is expected to grow earnings at double the rate.2

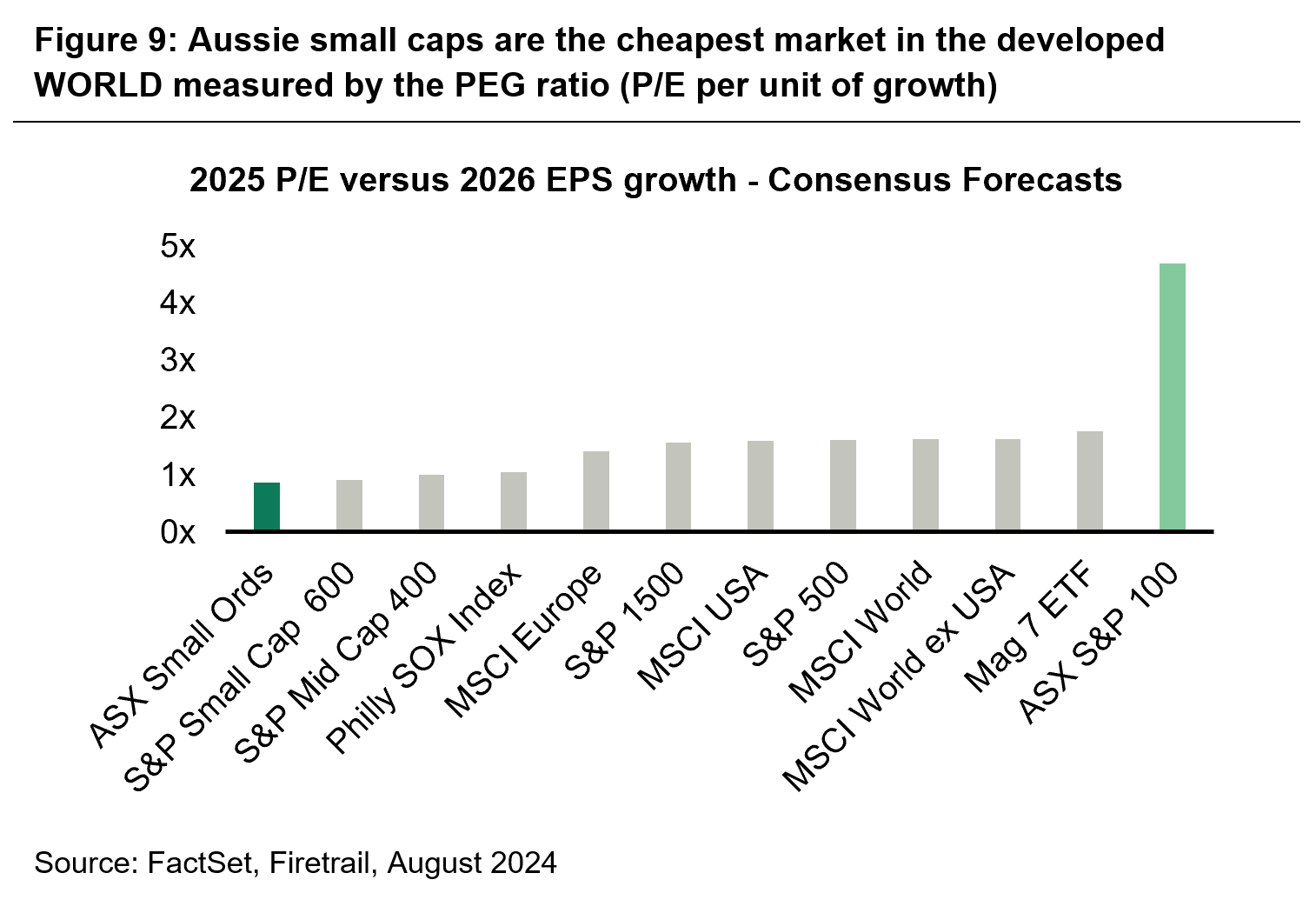

In fact, Aussie small caps are currently offering one of the cheapest price for earnings growth in the developed WORLD (as measured by the PEG ratio). Due to the anaemic growth outlook for the ASX 10, the ASX 100 is among the most expensive indexes in the world on a price-for-growth basis.

Conclusion

The ASX 10 has delivered strong outperformance in recent years greatly benefitting the total returns of the ASX 200. We have seen similar periods of ASX 10 outperformance in the past, with each followed by multi-year periods of ASX 10 underperformance.

In periods of ASX 10 underperformance, active small caps have delivered strong outperformance. Looking forward, ASX 10 valuations are at eye-watering levels and the earnings outlook is challenged. 49c of every $1 invested in the ASX 200 is going to these companies.

On the other hand, Australian small caps have a strong earnings growth outlook, and the price you are paying for this growth is among the cheapest in the developed world! In the Firetrail Australian Small Companies Fund, we are finding an abundance of cheap companies across the small caps market with robust earnings outlooks.

We believe now is the time for investors to consider improving the diversification of their portfolios with active small caps.

1 According to consensus estimates from FactSet, September 2024.

2 According to consensus estimates from FactSet, September 2024.