Why we see significant upside in this Aussie industrial icon

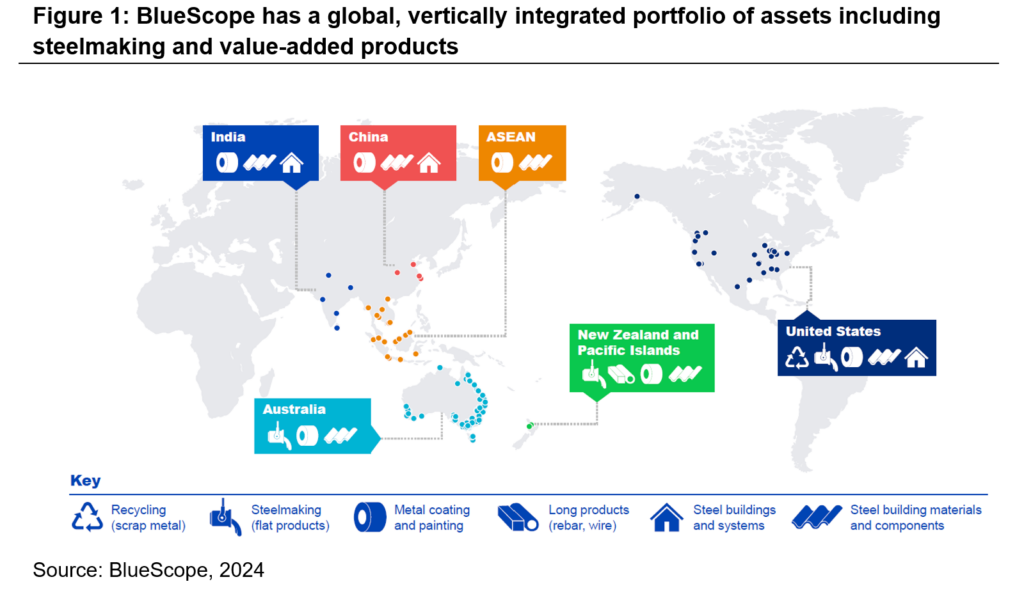

BlueScope Steel is well-known as Australia’s largest steelmaker. The company’s blast furnace at Port Kembla has been operating for over 90 years. Port Kembla Steelworks now sits within a broader, vertically-integrated asset portfolio including steelmaking and value-added steel products targeting the building and construction sectors in Australia, New Zealand, Asia and North America.

Over the past decade, BlueScope’s well-regarded management team have accelerated operating improvements and growth. The company’s steelmaking position in Australia has been secured with a regionally-competitive asset. There has also been a focus on growing downstream products, which has increased BlueScope’s local earnings defensibility and quality. Finally, the business now has a global growth platform led by a major expansion at its North Star steelmaking operations in North America.

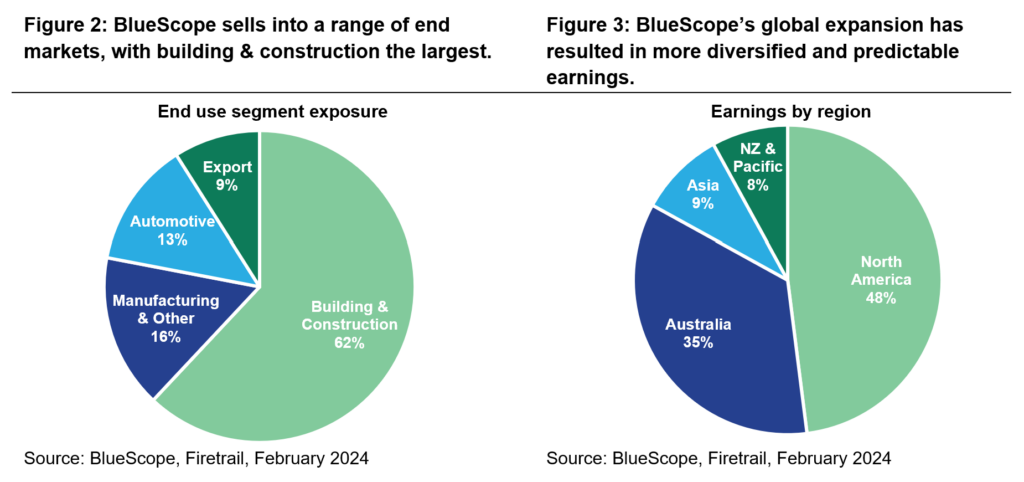

The transformation to more diversified, predictable earnings that are less exposed to cyclical factors has allowed the company to increase shareholder returns over time. We expect this to continue as a period of major capital investment comes to a close.

A regionally-competitive Australian steel producer

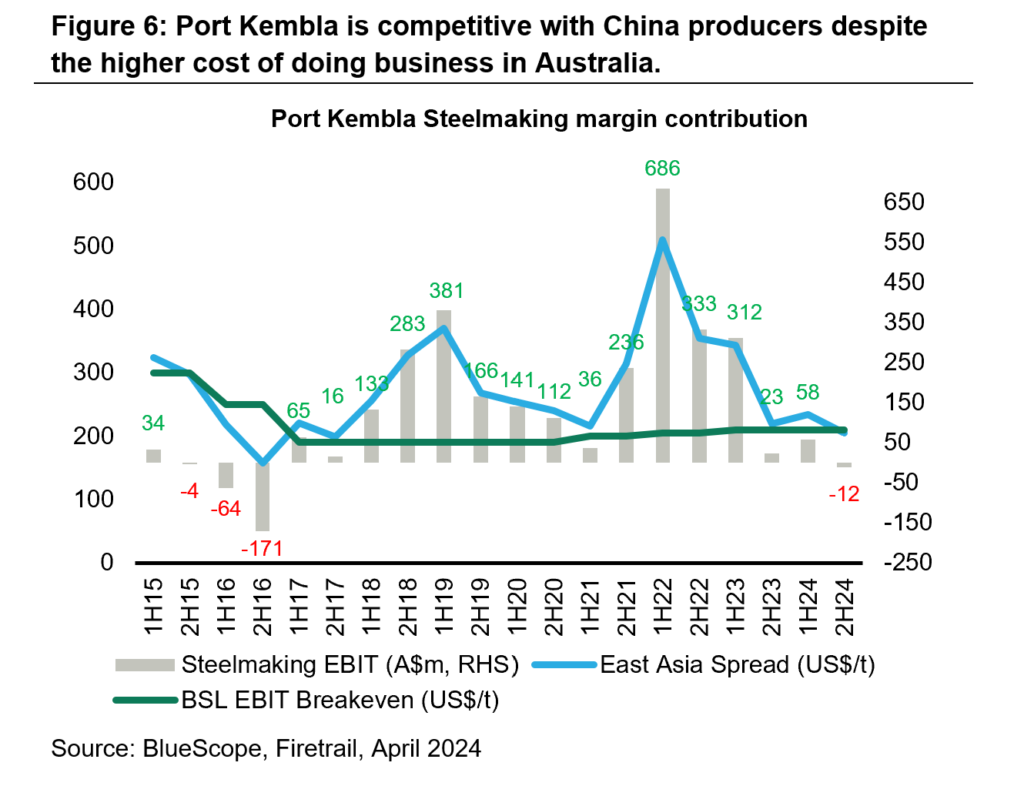

BlueScope’s Australian earnings are highly dependent on the global competitiveness of the Port Kembla steel mill. BlueScope emerged as a more competitive steel producer in 2015 following a major restructuring that resulted in a lower cost base at Port Kembla. While not the lowest cost producer, BlueScope has repositioned itself to successfully compete against low-priced imports, mainly from China and Southeast Asia.

Steelmaking profitability is driven by the steelmaker spread. The spread is the steel price (in this case the Asian Hot Rolled Coil price), less the cost of inputs (iron ore and coal). In other words, the spread is the profit a producer makes on each tonne of steel sold.

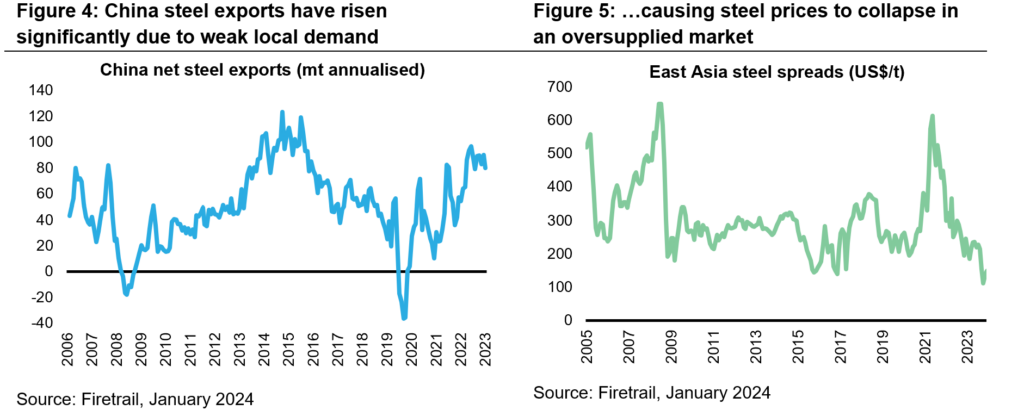

Asian steel spreads have fallen to multi-year lows not seen since 2015-16. In 2015-16, China was exporting a significant amount of steel (100 metric tonnes) before enacting supply side reforms to reduce overcapacity in the following years. We find ourselves in a similar situation in 2024. China steel exports are approaching 100mt as a combination of weak domestic property and infrastructure demand forces local steel mills to the export market. As a result, steel prices (and spreads) have collapsed due to an oversupplied market.

Fortunately, BlueScope now finds itself in a much better position compared with 2015-16. BlueScope has reduced its breakeven cost on a tonne of steel produced at Port Kembla from $300/t to $200/t. Port Kembla is now competitive with Chinese producers despite the higher cost of doing business in Australia. However, both BlueScope and Chinese steelmakers are marginally loss making at current steel prices.

Figure 6 shows Port Kembla’s pure steelmaking profitability at different steelmaker spreads. Given most of the market is lossmaking today, we believe current prices are unsustainable and have to move up.

The shift to downstream

A competitive cost position in steelmaking has allowed BlueScope to focus on taking international market share with its value-added branded products. The most prominent example is Colorbond. Colorbond is pre-painted steel used for roofing, fencing and siding. It competes against traditional tiles, timber and brick in building and construction. Other value-added BlueScope products include Truecore, Zincalume metallic coated steel, and Tru-Spec steel.

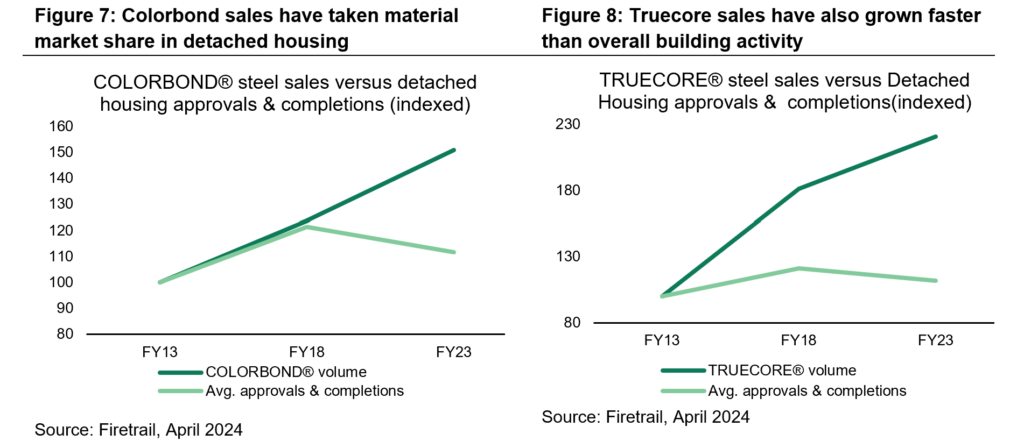

An aggressive growth strategy for value-added products has seen brands such as Colorbond and Truecore take significant share against peers. For example, Colorbond’s share of roofing today sits close to 60%, versus 40% ten years ago. Truecore has moved from less than 5% of the new build framing market to over 15%. Importantly, BlueScope has largely kept competing products out. Colorbond has 90% share of metal roofing today.

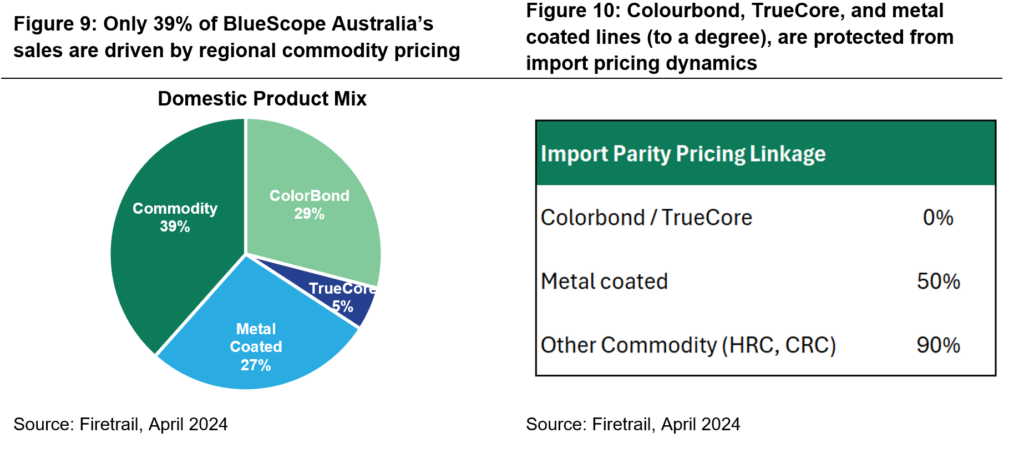

Unlike commodity steel such as hot rolled coil, there is minimal linkage to a global price index for value-added steel. Instead, Colorbond and Truecore sell at a local price which is linked to pricing for competing products such as roof tiles. Figure 9 and 10 illustrate Bluescope’s domestic product mix and the linkage to commodity import parity pricing.

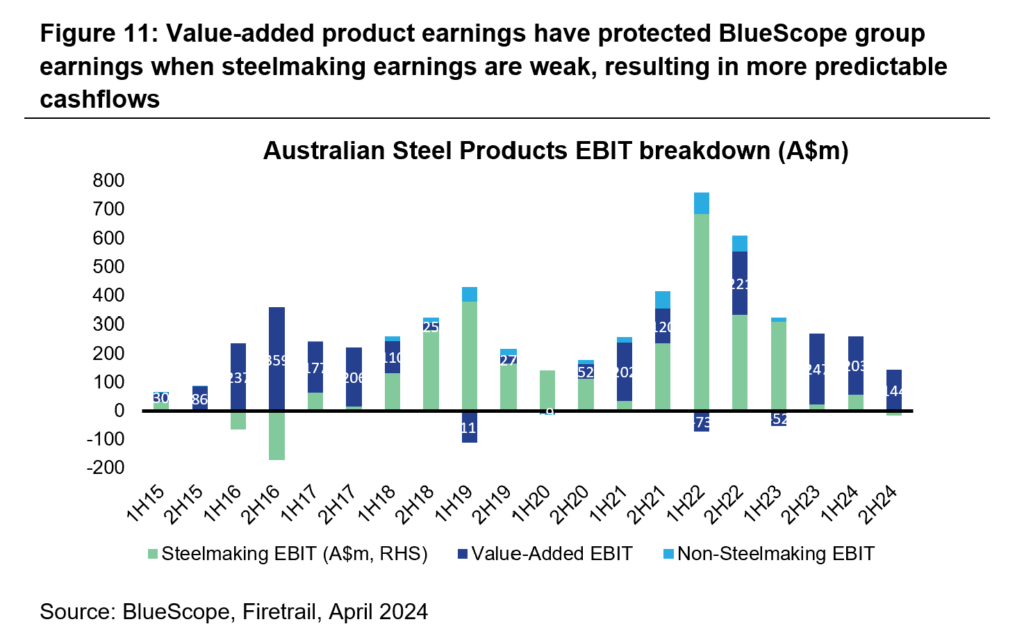

The key benefit of BlueScope’s value-added products is that profitability typically has an inverse relationship to global steel prices and spreads. When global steel spreads are low, Colorbond margins are high. This acts as a stabilizing force on the overall earnings base.

Figure 11 breaks out the Australian Steel Products segment earnings. As steelmaking has become more competitive and value-added product earnings have grown, the overall Australian earnings quality has improved with less volatile cashflows.

Valuation

Despite the share price trading near multi-year highs, we see plenty of value at today’s levels as the downstream growth strategy in Australia continues, and new capital projects ramp-up underpinning a material lift in cashflows over the next few years.

BlueScope is currently trading on a mid-cycle earnings PE of 8.5x, or a 50% discount to the Australian market. This is attractive in our view given BlueScope historically trades close to 11x mid-cycle earnings.

We see strong upside to BlueScope’s current share price. It remains a key holding in the Firetrail Absolute Return Fund.

Companies mentioned are illustrative only and not a recommendation to buy or sell any particular security.