1. Throw away the textbook…

Central banks and governments have shown they are prepared to do whatever it takes, so we have decided to throw away our economics textbooks (Sorry Doyley!). This week the Bank of England said it would buy government bonds to stabilise the UK bond market, following on from the UK Government’s mini-Budget last Friday. It has been mayhem in markets, with the yield on the UK 10-year gilt rising from 3.50% last Thursday to 4.51% over the course of 3 trading days. Sterling was also hit hard, falling to a record low versus the US dollar of 1.07.

UK government bonds are known as ‘gilts’ because, historically, the paper certificates issued with fixed-interest securities had a gilt-edge. By buying bonds, the BoE is seeking to reverse what it sees as “dysfunction” in the bond market. Specifically, the central bank is seeking to address problems facing pension funds, which are very sensitive to sudden drops in long-dated bond prices and in extreme market conditions a vicious cycle of forced sales and further price falls can set in.

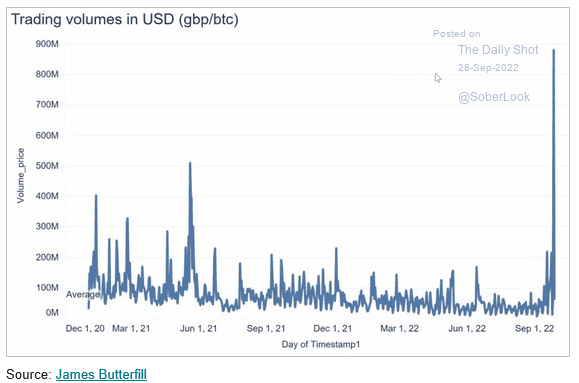

Meanwhile the coping mechanism of choice by the Brits in this uncertainty seems to be buying bitcoin…go figure!

Source: James Butterfill

2. Shopaholics anonymous…

Australia’s nominal retail sales rose for an eighth straight month in August, up +0.6% m/m. Sales in July and August were nearly 2% above the monthly average in Q2. Amongst the contributors, department store sales rose to a new record, while household goods retailing had its largest rise since March. Meanwhile the August CPI reading showed inflation slowing slightly. CPI rose 6.8% in the year through August, from 7% in the prior month, according to the ABS.

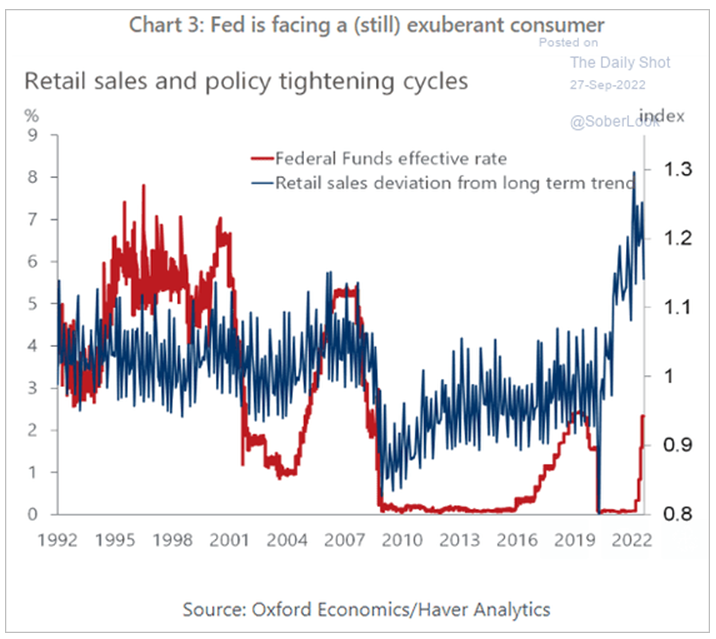

But the shopaholics aren’t isolated to Australia, the Americans enjoy shopping too it seems.

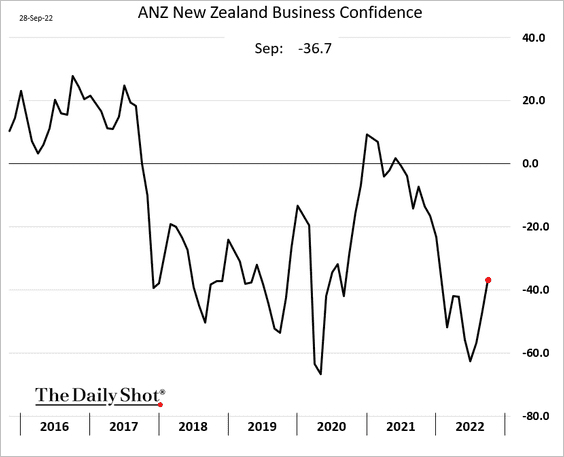

Maybe we can all buy whatever is in the water over in NZ, so our business confidence goes up too!

Source: ABS, Macquarie Macro Strategy

Source: ABS, Macquarie Macro Strategy

Source: Oxford Economics/Haver Analytics

Source: The Daily Shot

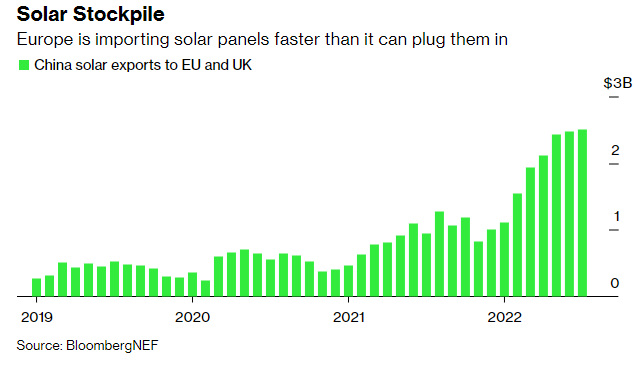

3. The bright spot…

We’ve found a bright spot amongst all the market angst. Europe and UK are importing solar panels at an increasing rate.

Source: BloombergNEF

Source: BloombergNEF